As you approach the milestone of your 65th birthday in Bucks County, there’s an important aspect of your health and future to consider: How to plan for Medicare.

This federal health insurance program plays a pivotal role in ensuring your medical needs are covered during your golden years.

Understanding Medicare’s ins and outs is crucial to making informed decisions that best suit your health and financial wellbeing.

This guide aims to demystify Medicare for Bucks County residents, highlighting key dates, plan options, and steps to ensure you’re well-prepared and enrolled on time.

Understanding Medicare: The Basics

Medicare is a health insurance program provided by the federal government for people aged 65 and older, certain younger people with disabilities, and individuals with End-Stage Renal Disease (ESRD).

It consists of four main parts:

- Part A (Hospital Insurance): Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care in Bucks County.

- Part B (Medical Insurance): Covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Medicare Advantage Plans (Part C): Offered by private companies that contract with Medicare to provide Part A and Part B benefits.

- Prescription Drug Coverage (Part D): Adds prescription drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private-Fee-for-Service Plans, and Medicare Medical Savings Account Plans.

How To Plan For Medicare

You’re automatically eligible for Medicare Part A and Part B starting the first day of the month you turn 65, provided you’re a U.S. citizen or a permanent legal resident who has lived in the U.S. for at least five continuous years.

You can receive Medicare Part A for free if you or your spouse paid Medicare taxes for a certain amount of time while working.

For Medicare Part B, most people pay a monthly premium.

Bucks County residents should ensure they understand these eligibility requirements.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Key Dates and Enrollment Periods

Understanding your Medicare enrollment periods in Bucks County is critical to avoid late penalties and ensure your coverage starts when you need it.

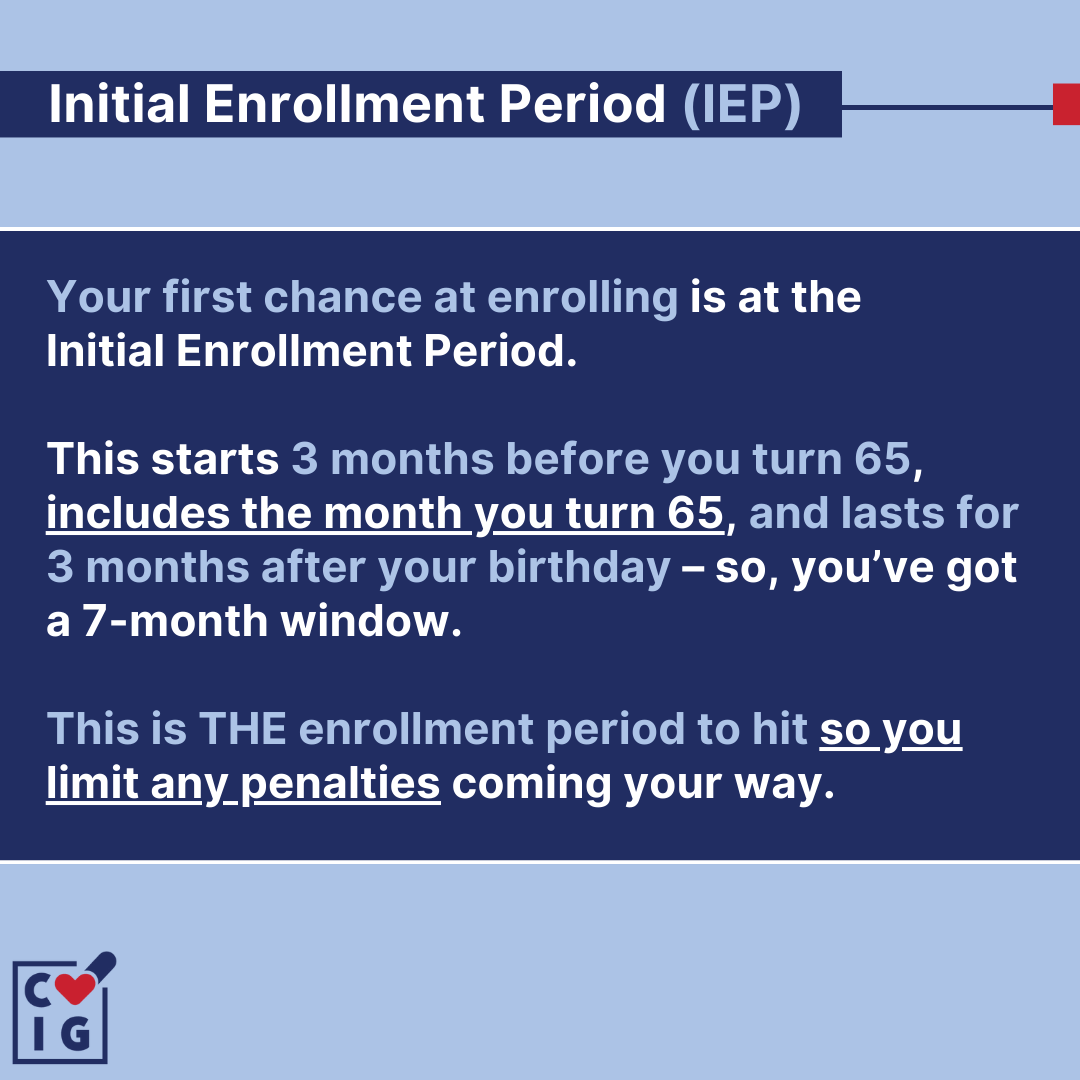

Initial Enrollment Period (IEP)

Your IEP is a 7-month period that begins three months before the month you turn 65, includes the month of your 65th birthday, and ends three months after.

Enrolling during this period ensures that your coverage starts without delay.

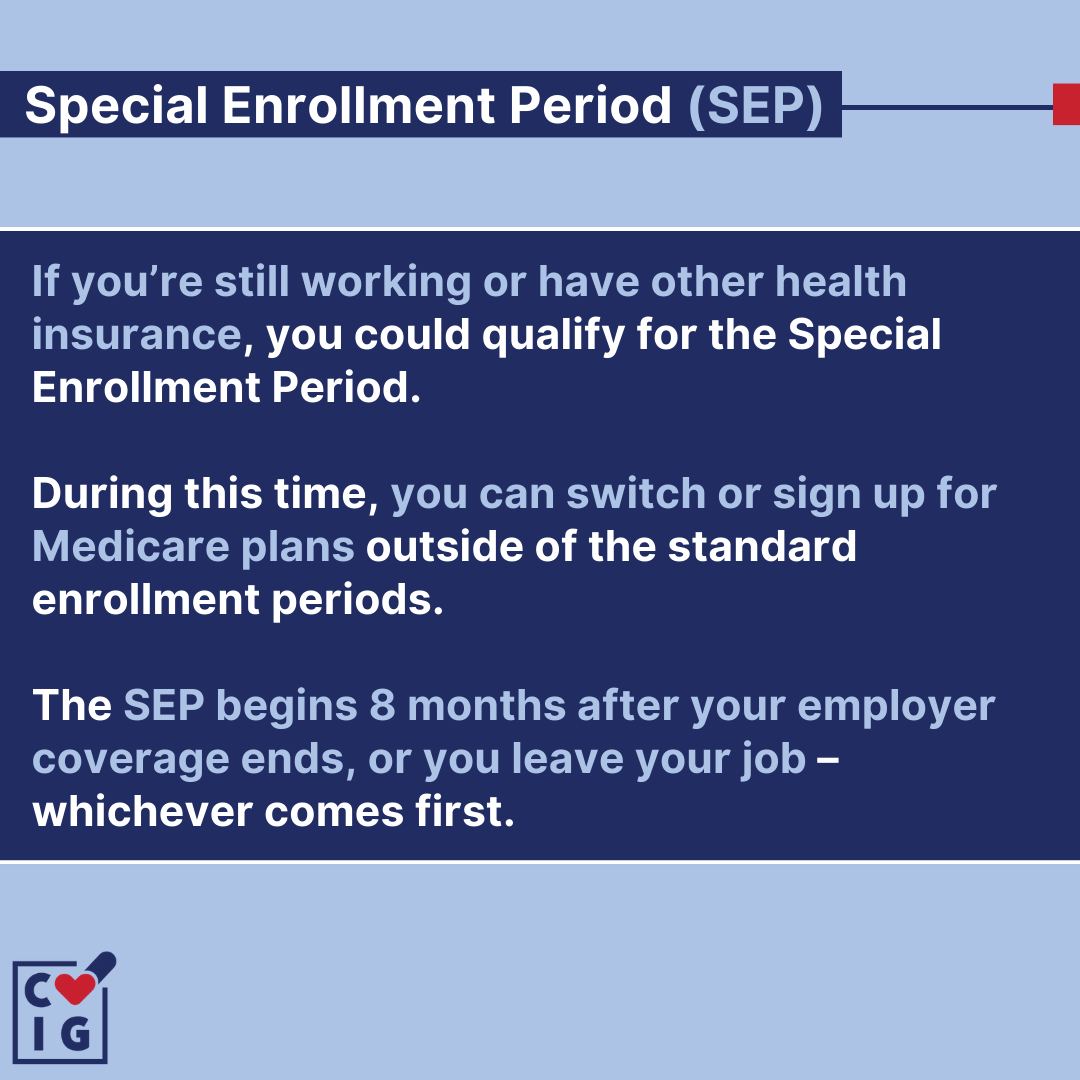

Special Enrollment Periods (SEP)

If you or your spouse are still working and you’re covered by a group health plan through employment, you can sign up for Part A and/or Part B during a SEP without facing late enrollment penalties.

Medicare Plan Options

Choosing the right Medicare plan depends on your health needs, financial situation, and personal preferences.

Original Medicare (Part A and Part B)

Original Medicare covers hospital and medical costs but doesn’t cover all expenses, like prescription drugs, dental, vision, and hearing aids.

It’s best for those who prefer flexibility in choosing healthcare providers, including those in Bucks County.

Medicare Advantage (Part C)

Medicare Advantage plans are an alternative to Original Medicare, offering additional benefits like dental, vision, and hearing.

These plans may have lower out-of-pocket costs but come with network restrictions.

Medicare Prescription Drug Plans (Part D)

Part D plans add prescription drug coverage.

Choosing the right plan requires comparing costs, coverage, and the drug formulary to ensure your medications are covered.

Medigap (Medicare Supplement)

Medigap helps cover some of the remaining healthcare costs not covered by Original Medicare, like copayments, coinsurance, and deductibles.

It’s suitable for those seeking more comprehensive coverage in the Bucks County area.

Preparing for Medicare: A Checklist for Turning 65

Before Your 65th Birthday:

- Gather personal documents (e.g., birth certificate, proof of U.S. citizenship or legal residency).

- Start researching Medicare plans specific to Bucks County and decide between Original Medicare and Medicare Advantage.

During Your IEP:

- Enroll in Medicare Part A and Part B through the Social Security Administration.

- Consider whether you need additional coverage (Part D or Medigap).

After Enrollment:

- Confirm your coverage and understand your benefits.

- Mark your calendar for the Annual Enrollment Period (AEP) to make any plan changes.

Frequently Asked Questions (FAQ)

When should I start thinking about Medicare?

- Start researching at least 3 to 6 months before you turn 65 to understand your options and enrollment periods.

Can I delay Medicare Part B or Part D enrollment?

- Yes, if you have coverage through an employer or union, you might delay Part B or Part D without a penalty.

Conclusion

Approaching your 65th birthday brings the important task of enrolling in a Medicare plan specific to your Bucks County zip code.

By understanding the basics, key dates, and plan options, and following the provided checklist, you can ensure a seamless transition to Medicare coverage that meets your needs.

Take action early, and empower yourself with the knowledge to make informed healthcare decisions as you enter this new chapter of life.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!