Conclusion: Yes, you can switch back to Original Medicare during the Medicare Advantage Open Enrollment Period or during the Annual Election Period.

For many, Medicare Advantage (Part C) offers an attractive bundle of benefits, combining Parts A, B, and often D into one plan.

However, personal needs and preferences evolve, leading some to ponder: Is it possible to switch back to Original Medicare?

This post delves into why you might consider such a change, the process involved, and crucial considerations to ensure you make an informed decision tailored to your healthcare needs.

Why Switch Back to Original Medicare?

Individuals consider returning to Original Medicare for various reasons, including:

- Wider choice of healthcare providers

- Dissatisfaction with network restrictions

- Changing health needs that are better served

Whatever the reason, it’s important to understand that switching is an option, but timing and eligibility criteria must align with Medicare’s specified enrollment periods.

Eligibility and Timing for Switching

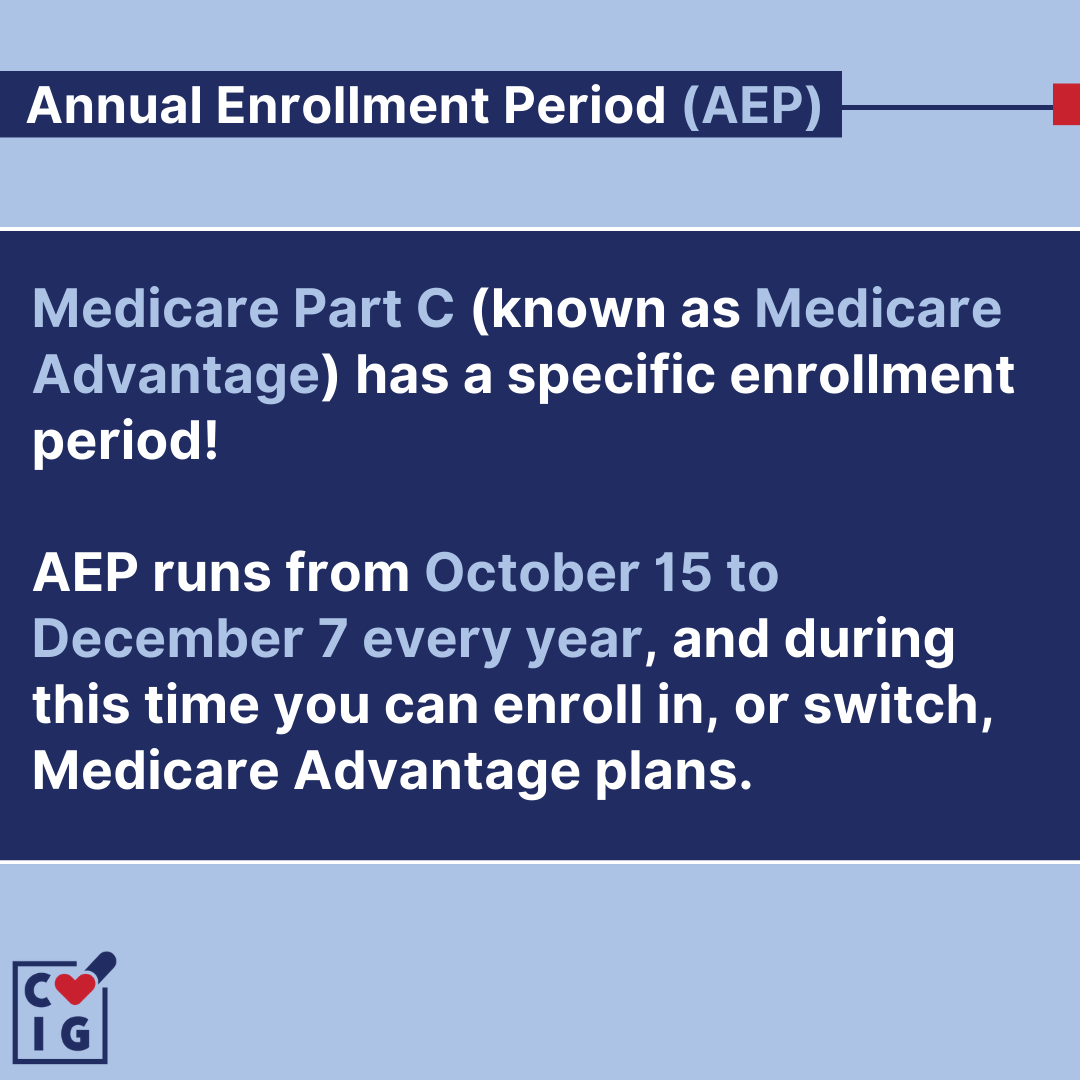

The primary window for switching from Medicare Advantage to Original Medicare is during the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31 each year.

Additionally, certain life events may qualify you for a Special Enrollment Period, allowing for plan changes outside the standard timelines.

How to Drop Your Medicare Advantage Plan

To revert to Original Medicare, you’ll need to contact your Medicare Advantage plan provider directly.

The process may involve filling out specific forms or simply providing your intent to disenroll over the phone.

It’s crucial to initiate this change during an eligible enrollment period to avoid any lapses in coverage.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Enrolling in Part D After Switching

Leaving Medicare Advantage might mean losing prescription drug coverage if your plan included Part D.

To maintain comprehensive coverage, you’ll need to enroll in a standalone Part D plan.

Timing is critical to avoid any gaps in your prescription drug coverage.

Supplement Your Original Medicare Coverage

Switching back to Original Medicare might expose you to out-of-pocket costs not covered by Parts A and B.

A Medigap policy can help fill these gaps, but eligibility and the best time to buy can be nuanced, especially if you’re leaving a Medicare Advantage plan.

Understanding Medigap rights and enrollment windows is essential.

Impact on Existing Coverage

Transitioning plans can temporarily affect your healthcare coverage, particularly if you switch outside of designated enrollment periods.

Carefully plan the switch to minimize disruption to your access to healthcare services and medications.

Evaluating Your Healthcare Needs and Costs

Analyze your current and anticipated healthcare needs, considering the flexibility, costs, and coverage that Original Medicare and Medigap can offer.

This evaluation is pivotal in determining if switching aligns with your healthcare priorities and budget.

Consulting with a Medicare Advisor

Decisions about Medicare coverage can be complex. Consulting with a Medicare advisor or exploring resources on Medicare.gov can provide personalized guidance, helping you navigate your options with confidence.

Conclusion

The decision to switch from Medicare Advantage to Original Medicare is significant and personal.

It requires a thorough understanding of your healthcare needs, careful timing, and consideration of additional coverage options like Medigap.

By educating yourself and seeking advice when necessary, you can ensure that your Medicare coverage optimally supports your health and financial well-being.

Remember, the goal is to secure the coverage that best suits your individual situation, allowing for peace of mind and focus on what truly matters—your health.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!