Conclusion: Yes, “Senior Advantage” is often used as another term for Medicare Advantage. These plans provide Medicare benefits to seniors, combining Part A (hospital insurance) and Part B (medical insurance), and sometimes Part D (prescription drug) coverage, in one plan.

Navigating Medicare options can often feel like trying to understand a new language, especially with the variety of plans and terms encountered during the process.

Among these, “Medicare Advantage” and “Senior Advantage” are terms that frequently cause confusion.

Understanding the distinctions between these terms is crucial for making informed decisions about healthcare coverage.

What is Medicare Advantage?

Medicare Advantage, also known as Part C, is a popular alternative to Original Medicare (Parts A and B), offering beneficiaries comprehensive health coverage.

These plans are offered by private insurance companies approved by Medicare and bundle hospital, medical, and often prescription drug coverage.

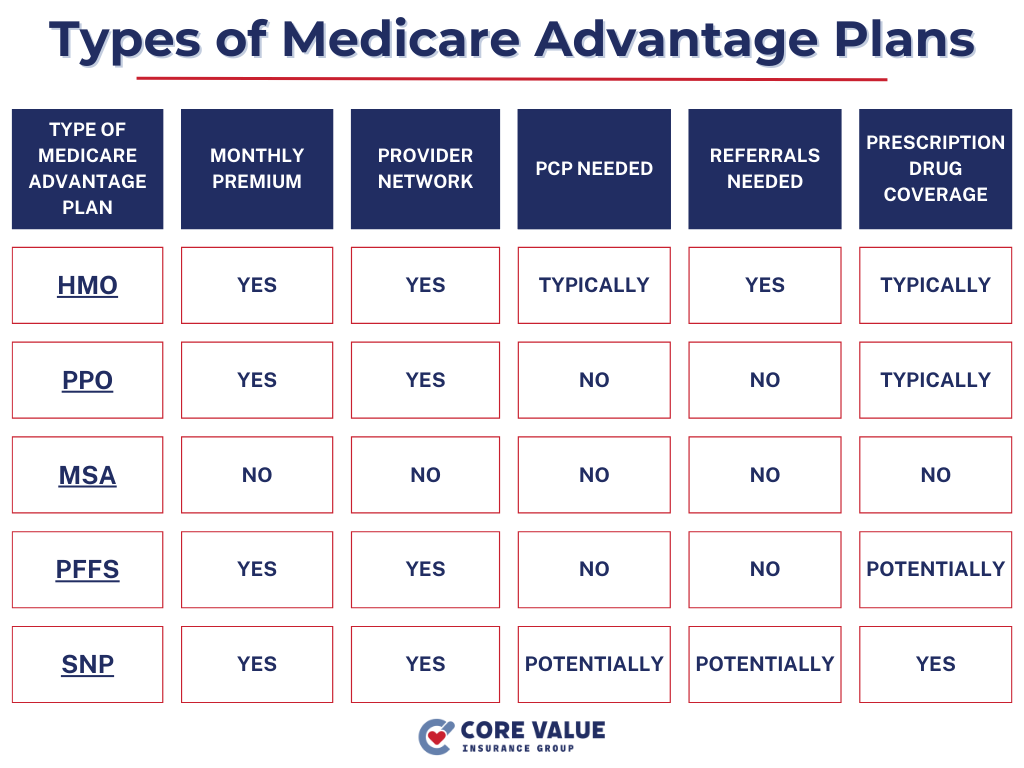

Medicare Advantage plans come in several forms, including:

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Private Fee-for-Service (PFFS) plans

- Special Needs Plans (SNPs)

- Medicare Medical Savings Account (MSA) plans

Each type offers different benefits and network rules, providing a range of options to fit various healthcare needs and preferences.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

What is ‘Senior Advantage’?

The term “Senior Advantage” is less standardized and can lead to confusion.

It is not a specific Medicare program but rather a marketing term that some organizations use to describe their Medicare Advantage plans or services geared towards seniors.

These might be special offerings or packages designed with the needs of older adults in mind, but they do not represent a separate category of Medicare plans.

It’s important for consumers to understand that “Senior Advantage” plans are essentially Medicare Advantage plans under a different name, possibly with marketing or benefits tailored to appeal to a senior demographic.

Key Differences Between Medicare Advantage and Senior Advantage Plans

The primary difference between Medicare Advantage and what is marketed as “Senior Advantage” may lie in branding rather than in substantive plan features.

Both refer to Medicare Part C plans, offering a bundled approach to Medicare coverage.

However, plans marketed as “Senior Advantage” might highlight specific benefits or services that appeal to seniors, such as wellness programs or preventive care services, though these are also available through standard Medicare Advantage plans.

The essential step is to look beyond the name and evaluate each plan based on its coverage, costs, and network to ensure it meets your healthcare needs.

How to Choose the Right Plan

Choosing the right Medicare plan requires a careful evaluation of your healthcare needs, preferences, and financial situation.

Here are some tips to help you compare Medicare Advantage plans effectively:

- Assess Your Healthcare Needs: Consider your current health status, regular medications, and preferred healthcare providers.

- Check Plan Networks: Ensure your doctors and hospitals are within the plan’s network if you’re considering an HMO or PPO.

- Consider Out-of-Pocket Costs: Look at premiums, deductibles, copayments, and out-of-pocket maximums to understand the potential costs.

- Review Additional Benefits: Some plans offer extra benefits like dental, vision, and hearing coverage. Determine if these are important to you.

- Seek Advice: If you’re unsure, consider consulting with a Medicare advisor or using resources like Medicare.gov to compare plans.

Conclusion

While “Senior Advantage” may sound like a distinct category from Medicare Advantage, it’s important to recognize that both terms refer to Medicare Part C.

By understanding what these terms truly represent, you can better navigate the landscape of Medicare options available to you.

Always prioritize your healthcare needs and financial capacity when evaluating plans, and don’t hesitate to seek professional advice to make the most informed decision possible.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!