Retirement marks a thrilling phase of life, especially for those with a desire to explore the world.

Whether it’s visiting national parks, discovering new cities, or reconnecting with old friends, travel can significantly enrich your golden years.

However, your adventures hinge on more than just your itinerary; the right health coverage is pivotal.

With various Medicare plans available, understanding the difference between Preferred Provider Organizations (PPO) and Health Maintenance Organizations (HMO) is crucial.

Let’s dive deeper into why selecting a suitable Medicare Advantage plan is essential for travel-minded retirees.

Our goal is to empower you with the knowledge to choose the best health coverage that aligns with your vision of retirement travel.

PPO vs. HMO

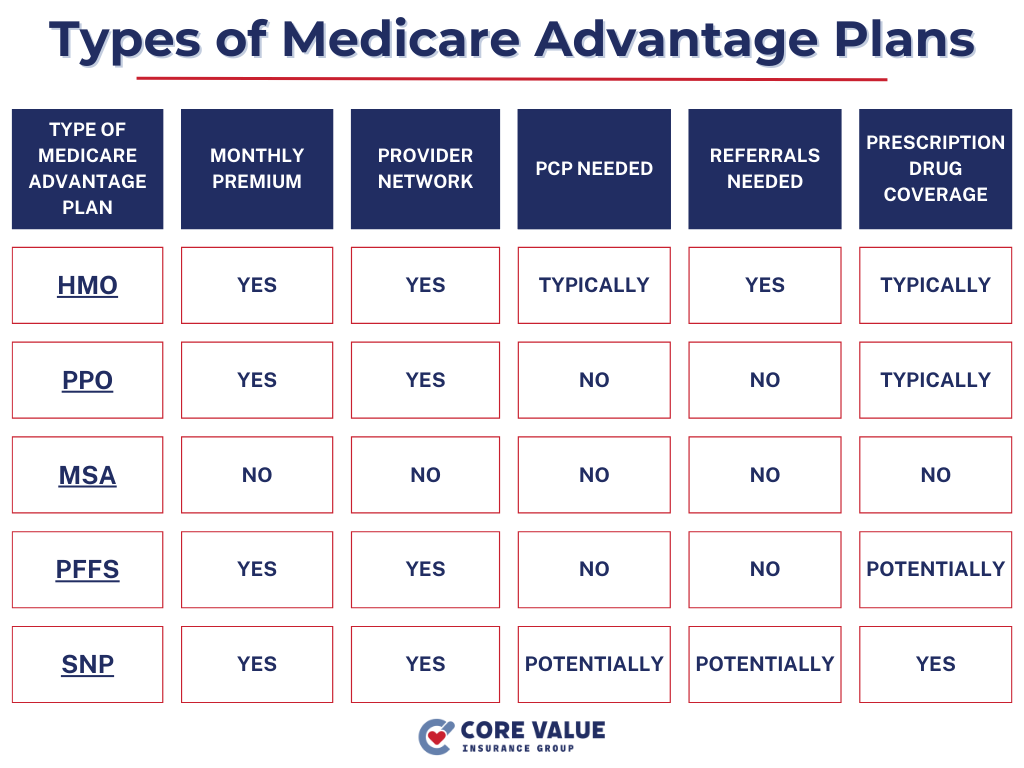

Medicare Advantage plans, or Part C, provide an alternative to Original Medicare, with additional benefits offered through private insurers.

The two predominant types of Medicare Advantage plans are Preferred Provider Organizations (PPOs) and Health Maintenance Organizations (HMOs), each with distinct features:

PPO Plans: Designed for Flexibility

- Network Flexibility: Allows you to visit any doctor that accepts Medicare, crucial for travelers.

- Referral Requirements: No referrals needed to see specialists, providing immediate access to necessary care.

- Out-of-Network Coverage: Offers partial coverage for out-of-network services, which is vital for those traveling outside their home network.

HMO Plans: Structured for Localized Care

- Network Restrictions: Requires you to use network providers, limiting access when away from home.

- Referral Requirements: Must obtain referrals to see specialists, potentially delaying care when traveling.

- Out-of-Network Coverage: Typically, does not cover non-emergency out-of-network care, posing a risk for travelers.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Advantages of PPO Plans for Travelers

For retirees planning extensive travel, PPO plans are often preferable due to their flexibility:

- Broad Network Access: Essential for accessing care nationwide without concerns about network restrictions.

- Direct Specialist Access: Facilitates immediate care by allowing visits to specialists without prior referrals.

- Emergency and Out-of-Network Coverage: Ensures that emergencies are covered everywhere in the U.S., with partial coverage for other out-of-network care.

Limitations of HMO Plans for Traveling

Travelers on HMO plans may encounter significant challenges:

- Strict Network Limitations: Makes finding eligible care providers difficult when traveling.

- Dependence on Referrals: Adds steps to the care process, potentially delaying necessary treatment.

- Coverage Restrictions: Non-emergency out-of-network care is typically not covered, leading to high out-of-pocket costs in unfamiliar locations.

How to Choose the Right Plan for Travel

Selecting the right Medicare plan involves considering your health needs, travel plans, and financial situation:

- Assess Your Health and Travel Needs: Analyze your health status and how often you plan to travel.

- Compare Plan Benefits: Look at the coverage, costs, and flexibility of PPO versus HMO plans.

- Consult Experts: Speak with healthcare advisors to understand the best options based on your individual circumstances.

Conclusion

As you embark on your retirement journey, the right Medicare plan acts as your safety net, ensuring you can enjoy your travels without worrying about healthcare coverage.

A PPO plan, with its nationwide network and flexible care options, is often the best choice for those who want to explore freely.

Remember, annual plan evaluations are crucial as your health needs and travel plans evolve.

With the right plan in place, you are all set for a retirement filled with adventure and peace of mind.

Safe travels!

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!