Private Fee for Service (PFFS) Medicare Advantage Plans provide comprehensive coverage and offer the flexibility to choose any Medicare-approved healthcare provider.

These plans are an alternative to Original Medicare and give beneficiaries the freedom to receive care from a wide network of providers.

Whether you’re a Medicare beneficiary or someone seeking Medicare Advantage plans, this information will help you make informed decisions about Private Fee for Service plans.

What is a PFFS Plan?

A Private Fee for Service (PFFS) plan provides beneficiaries with comprehensive coverage and additional benefits beyond what Original Medicare offers.

One of the key features of PFFS plans is that beneficiaries are not required to choose a primary care physician or obtain referrals before seeking specialized care.

This flexibility allows individuals more control over their healthcare decisions and access the services they need without restrictions.

PFFS Plan Flexibility

PFFS Medicare Advantage plans offer beneficiaries the freedom to visit any Medicare-approved healthcare provider, including:

- Doctors

- Hospitals

- Specialists

However, it’s important to note that providers must agree to accept the plan’s payment terms and conditions.

Before receiving services, it is crucial for beneficiaries to verify if their chosen providers accept the specific plan they are enrolled in.

This step ensures that there are no unexpected out-of-pocket expenses or complications when seeking medical care.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

PFFS plans allow you the freedom to choose your healthcare providers without being limited by network restrictions or referral requirements.

Benefits of PFFS Plans

PFFS plans offer Medicare beneficiaries comprehensive coverage for their healthcare needs.

These plans typically include coverage for:

- Hospital stays

- Doctor visits

- Prescription drugs

- Dental coverage

- Vision coverage

This comprehensive coverage ensures that beneficiaries have peace of mind knowing that their healthcare needs are taken care of under one plan.

Having all healthcare needs covered by a single plan simplifies the process for beneficiaries.

Instead of managing multiple insurance policies or paying out-of-pocket for services, PFFS plans provide healthcare coverage into one comprehensive package.

Freedom to Choose Healthcare Providers

One of the significant advantages of PFFS plans is the freedom to choose any Medicare-approved healthcare provider.

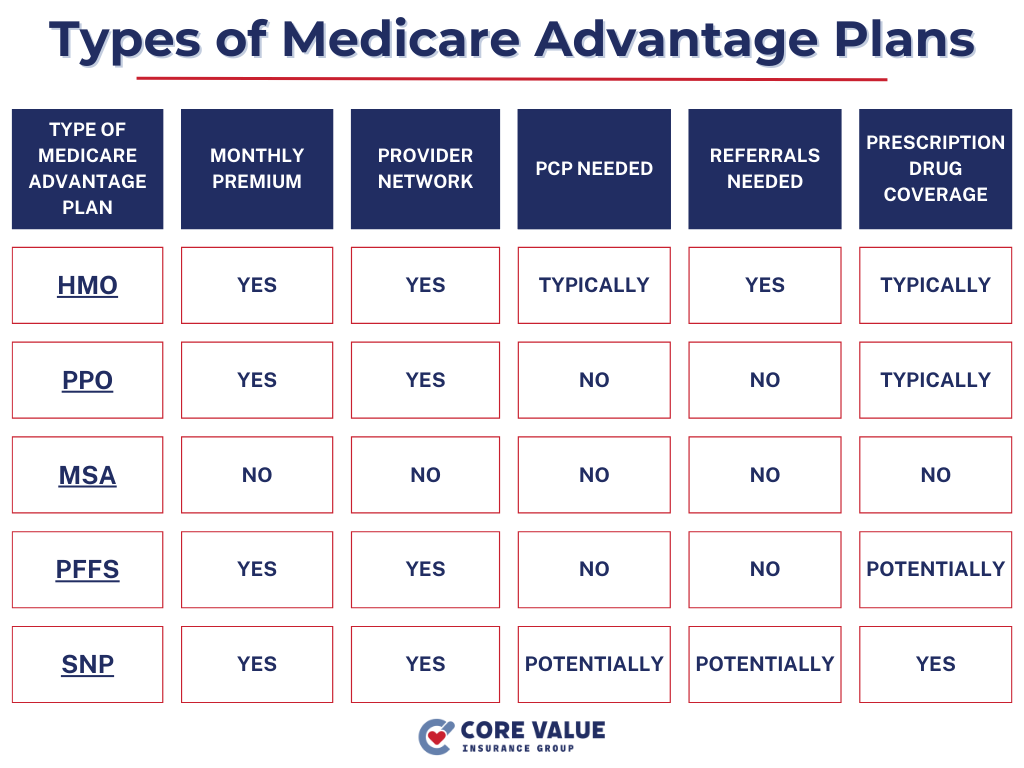

Unlike other Medicare Advantage plans that often require beneficiaries to stay within a specific network or obtain referrals, PFFS plans allow individuals to see the doctors and specialists they prefer without restrictions.

This flexibility in provider choice gives beneficiaries greater control over their healthcare decisions.

Whether you have established relationships with specific doctors or require specialized care from particular specialists, PFFS plans enable you to access the providers who best meet your individual needs.

With no network restrictions or referral requirements, PFFS plans empower beneficiaries to make informed choices about their healthcare providers based on personal preferences and specialized requirements.

Eligibility for PFFS Plans

To be eligible for a Private Fee for Service (PFFS) plan, you must be enrolled in both Medicare Part A and Medicare Part B.

These are the basic requirements to qualify for any Medicare Advantage plan, including PFFS plans.

Additionally, you must reside in the service area of the specific PFFS plan you wish to enroll in.

Individuals with end-stage renal disease (ESRD) generally cannot enroll in PFFS plans. There may be exceptions or alternative options available for those with ESRD.

It’s recommended to consult with a Medicare representative or an insurance agent specializing in Medicare plans to explore suitable alternatives.

Enrolling in a PFFS Plan

Enrollment in a PFFS plan can typically be done during two main periods:

The IEP is a seven-month period that begins three months before your 65th birthday month and ends three months after.

During this time, you have the opportunity to sign up for a PFFS plan without facing any penalties or restrictions.

The AEP occurs annually from October 15th to December 7th. It allows individuals who are already enrolled in Medicare to make changes to their coverage, including enrolling in or switching to a PFFS plan.

In addition to these enrollment periods, some individuals may qualify for Special Enrollment Periods (SEPs).

SEPs are triggered by certain life events such as moving out of your current plan’s service area or losing other healthcare coverage.

When considering enrolling in a PFFS plan, it is essential to compare different plans and evaluate the following:

- Benefits

- Costs

- Provider networks

- Additional features

This comparison will help you choose the PFFS plan that best suits your individual needs and preferences.

Key Takeaways

In summary, Private Fee for Service (PFFS) plans offer Medicare beneficiaries comprehensive coverage and the flexibility to choose any Medicare-approved healthcare provider.

Beneficiaries have the freedom to see the doctors and specialists they prefer without network restrictions or the need for referrals.

When considering PFFS plans, understand the enrollment process and compare different options to find the plan that best suits your healthcare needs.

By enrolling in a PFFS plan, individuals can enjoy the convenience of accessing a wide network of providers while maintaining control over their healthcare decisions.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!