Medicare does in fact cover Ozempic if you have a Medicare Part D plan, but only for managing diabetes, not for weight loss. When it comes to managing type 2 diabetes, having Medicare coverage is essential.

Medicare Part D provides coverage for prescription drugs, including medications like Ozempic. This coverage ensures that beneficiaries have access to the medications they need to manage their condition effectively.

However, it’s important to be aware of the requirements associated with Medicare coverage.

By exploring the various Medicare coverage options for Ozempic, you can determine which plan best suits your needs and budget.

Medicare Part D Coverage for Ozempic

Medicare Part D is a prescription drug coverage program offered by the federal government. It is designed to help Medicare beneficiaries access the medications they need to manage their health conditions, including Ozempic for type 2 diabetes.

Medicare Part D works through private insurance companies that are approved by Medicare. These insurance plans provide coverage for a wide range of prescription drugs, including Ozempic.

Beneficiaries pay a monthly premium and may also have copayments or coinsurance for their medications.

Part D Enrollment and Eligibility

To be eligible for Medicare Part D coverage, you must be enrolled in either Medicare Part A or Medicare Part B. Most people become eligible for Medicare when they turn 65, but individuals with certain disabilities may also qualify.

Enrolling in Medicare Part D can be done during your Initial Enrollment Period (IEP) when you first become eligible for Medicare.

In addition to the IEP, you can also enroll during the Annual Enrollment Period (AEP) which runs from October 15th to December 7th each year.

It’s important to note that if you delay enrolling in Medicare Part D without having other creditable coverage, you may face a late enrollment penalty.

Determining Medical Necessity of Ozempic

Determining the medical necessity of Ozempic for Medicare coverage involves evaluating various factors. These factors typically include:

- The severity of your condition

- Previous treatment options tried

- The potential benefits of using Ozempic to manage your type 2 diabetes

To establish medical necessity for Medicare coverage, your healthcare provider will assess your specific situation and determine if it’s medically necessary.

Prescription Requirements

Medicare has specific prescription requirements that must be met in order to receive coverage for Ozempic. Your prescription should come from a licensed healthcare provider who can prescribe medications under Medicare.

Additionally, the prescription should clearly indicate the medical necessity of managing your type 2 diabetes.

Your healthcare provider can help you document medical necessity effectively and ensure that all required information is included in the prescription.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Savings Options for Ozempic

Medicare beneficiaries can take advantage of discounts and cost-saving programs to help reduce their out-of-pocket expenses.

One option is to utilize coupons and savings cards provided by the manufacturer of. These programs can offer significant discounts on the medication, making it more affordable for individuals with Medicare coverage.

It’s important to check if you are eligible for these savings options and understand any restrictions or limitations that may apply.

Medicare Advantage and Supplement Plans

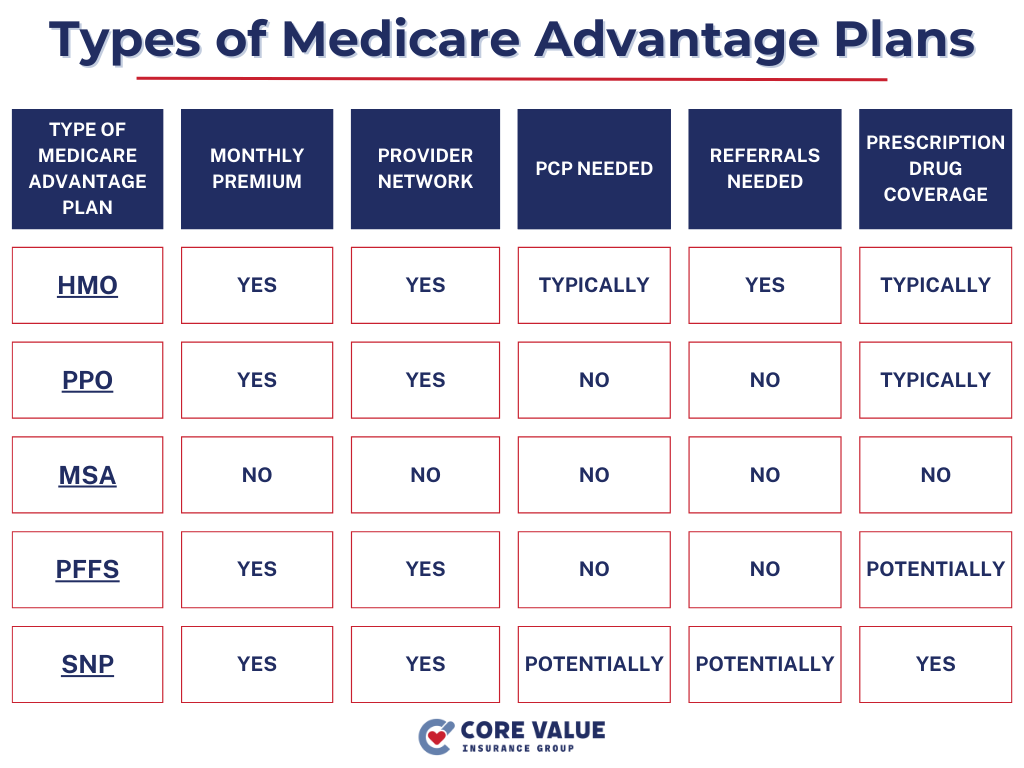

In addition to Medicare Part D coverage, beneficiaries may have the option to obtain additional coverage for Ozempic through Medicare Advantage plans or Medicare Supplement plans.

Medicare Advantage plans, also known as Part C, are offered by private insurance companies approved by Medicare. These plans often include prescription drug coverage along with other benefits not provided by Original Medicare.

Some Medicare Advantage plans may provide coverage, but it’s essential to review the plan details and formulary to ensure the medication is included.

On the other hand, Medicare Supplement (Medigap) can help fill gaps in Original Medicare coverage and may provide financial assistance with other healthcare costs related to type 2 diabetes.

Managing Costs for Ozempic

Managing the costs of Ozempic under Medicare is crucial for individuals with type 2 diabetes. Here are some strategies to help you effectively manage the expenses:

- Review your Medicare Part D plan: Ensure that your current plan covers Ozempic. Compare premiums, deductibles, copayments, and coinsurance.

- Utilize generic alternatives: Talk to your healthcare provider about generic alternatives to Ozempic.

- Explore patient assistance programs: Check if there are any assistance programs available.

- Consult with a licensed Medicare agent: A licensed Medicare agent can help you navigate through different plans and find cost-effective options tailored to your needs.

Choosing the Right Medicare Coverage

When selecting Medicare coverage for Ozempic, consider the following factors:

- Formulary coverage: Ensure that the plan’s formulary includes Ozempic as a covered medication.

- Cost-sharing structure: Evaluate the plan’s premiums, deductibles, copayments, and coinsurance to determine how much you will need to pay out-of-pocket for Ozempic.

- Network pharmacies: Check if your preferred pharmacy is in-network with the plan to maximize convenience and potential savings.

- Overall coverage needs: Consider other healthcare services and medications you require in addition to Ozempic when choosing a comprehensive plan that meets all your needs.

The Medicare Part D Formulary

The Medicare Part D formulary is a list of covered prescription drugs, including Ozempic.

Changes to the formulary can include prior authorization requirements or quantity limits. These changes may impact your access to Ozempic or require additional steps for coverage approval.

To stay updated on formulary changes and their impact on Ozempic coverage, you can:

- Review plan documents: Read through your plan’s Annual Notice of Change (ANOC) and Evidence of Coverage (EOC). These materials provide information about any upcoming changes to the formulary.

- Contact your plan provider: Reach out to your Medicare Part D plan provider directly and inquire about any recent or upcoming changes related to Ozempic coverage.

- Consult with a licensed Medicare agent: A licensed Medicare agent at CVIG can help you understand how recent formulary changes may affect your specific situation.

Plan Comparison for Ozempic coverage

When comparing different Medicare plans for Ozempic coverage, it’s essential to have access to reliable resources.

Here are some tools and websites that can assist you in making an informed decision:

- Medicare.gov: The official website of the Centers for Medicare & Medicaid Services (CMS) provides a Plan Finder tool to compare different plans based on factors like cost, coverage, and pharmacy networks.

- State Health Insurance Assistance Programs (SHIPs): SHIPs offer free counseling services and personalized assistance in understanding and comparing various Medicare plans available in your state.

Choosing Medicare Coverage for Ozempic

Consider factors such as cost, coverage, and prescription requirements when selecting a plan. Evaluate different Medicare plans based on their formulary coverage, cost-sharing structure, and network pharmacies to find the right fit for your needs.

Additionally, staying updated on changes to the Medicare Part D formulary that may impact Ozempic coverage. Utilize plan comparison resources and licensed insurance agents to make well-informed decisions about your Medicare coverage.

By utilizing these resources and considering important factors, you can ensure that you choose the right Medicare plan for Ozempic and effectively manage your type 2 diabetes.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!