Medicare Part B is a crucial component of medical insurance for individuals eligible for Medicare.

Understanding the importance of Medicare Part B coverage is essential to ensure comprehensive healthcare coverage.

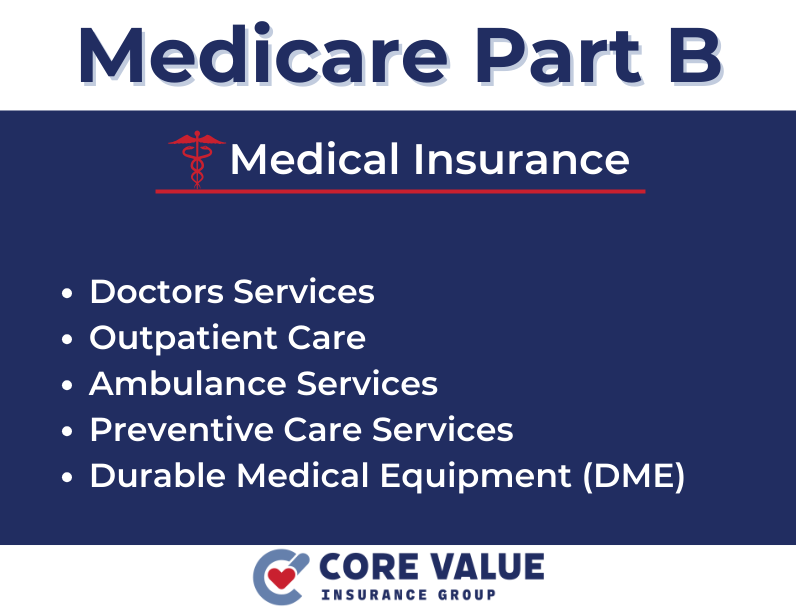

Medicare Part B provides outpatient coverage, including medically necessary services and supplies.

It covers a wide range of healthcare services such as doctor visits, preventive screenings, and durable medical equipment. This plays a vital role in ensuring access to necessary healthcare services outside of a hospital setting.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

By exploring Medicare Part B coverage, individuals can gain a better understanding of their healthcare options and make informed decisions about their medical needs.

Whether you are a caregiver, a senior, or someone eligible for Medicare, understanding the benefits and scope of Medicare Part B is crucial for maintaining your health and well-being.

What is Medicare Part B?

Medicare Part B is a vital component of Original Medicare, providing outpatient coverage for medically necessary services and supplies.

It helps individuals access essential healthcare services outside of a hospital setting.

The purpose of Medicare Part B is to ensure that individuals have access to necessary medical care, including doctor visits, preventive screenings, and durable medical equipment.

It covers a wide range of outpatient services that are deemed medically necessary. When comparing Medicare Part A and Part B, it’s important to note the key differences.

While Medicare Part A primarily covers inpatient hospital stays and limited skilled nursing facility care, Medicare Part B focuses on outpatient coverage.

Together, these two parts make up the basic coverage provided by Original Medicare.

How does Medicare Part B work?

Medicare Part B works by providing coverage for medically necessary outpatient services and supplies. This includes services such as:

- Doctor visits

- Lab test

- Preventive screenings

- Vaccinations

- Durable medical equipment like wheelchairs or walkers.

To access these services, beneficiaries may need to pay certain costs out-of-pocket. This includes cost-sharing in the form of deductibles and coinsurance.

Additionally, there is a monthly premium associated with Medicare Part B coverage.

The premiums for Medicare Part B are typically based on income levels. Most beneficiaries pay the standard premium amount set by the government each year.

However, higher-income individuals may be subject to an income-related adjustment that increases their premium.

Medicare Part B Eligibility

To qualify for Medicare Part B, individuals must meet certain eligibility requirements. The primary requirements include age and citizenship.

Generally, individuals who are 65 years or older and either U.S. citizens or legal residents who have lived in the country for at least five consecutive years are eligible for Medicare Part B.

In addition to the standard eligibility criteria, there are Special Enrollment Periods that allow individuals to sign up for Medicare Part B outside of their Initial Enrollment Period.

These special enrollment periods may apply to those who have delayed enrolling in Medicare due to having employer-sponsored health coverage or other circumstances.

How to apply for Medicare Part B

Applying for Medicare Part B is a straightforward process. Most individuals can apply online through the Social Security Administration’s website.

The online application allows applicants to complete the necessary forms and submit them electronically.

When applying for Medicare Part B, it’s important to have certain documents ready, such as proof of age and citizenship or residency status.

It’s also crucial to be aware of the deadlines associated with enrollment. Missing these deadlines may result in delays in coverage or penalties.

By understanding the eligibility requirements and knowing how to apply for Medicare Part B, individuals can ensure they receive timely access to outpatient coverage and comprehensive healthcare benefits.

Medicare Part B Coverage

Medicare Part B provides coverage for a wide range of medically necessary outpatient services.

These services are essential for maintaining good health and managing various medical conditions.

Under Medicare Part B, beneficiaries have access to treatments, tests, and procedures that are deemed medically necessary by healthcare professionals.

In addition to covering medically necessary outpatient services, Medicare Part B also includes coverage for preventive services and screenings.

These preventive services aim to detect potential health issues early on and help prevent the development of more serious conditions.

Examples of preventive services covered under Medicare Part B include:

- Vaccinations

- Cancer screenings

- Cardiovascular screenings.

Commonly covered services and benefits

Among the commonly covered services and benefits under Medicare Part B are doctor visits and consultations.

Beneficiaries can visit their primary care physician or specialists for routine check-ups, evaluations, or consultations regarding specific health concerns.

Another important category of covered services is durable medical equipment (DME). This includes items such as:

- Wheelchairs

- Walkers

- Oxygen equipment

- Other supplies that are prescribed by a healthcare provider

By understanding the scope of covered services under Medicare Part B, beneficiaries can make informed decisions about their healthcare needs.

It’s important to review the specific coverage details provided by Medicare to ensure that the required treatments or procedures are eligible for reimbursement.

Part B Costs and Premiums

When considering Medicare Part B, it’s important to understand the costs and premiums associated with this coverage.

Beneficiaries are required to pay a monthly premium for Medicare Part B, which is typically deducted from their Social Security benefits.

The amount of the premium may vary each year and is based on income levels.

In addition to the monthly premium, there are other cost-sharing components to be aware of. Medicare Part B has an annual deductible that beneficiaries must meet before coverage begins.

After meeting the deductible, there is a coinsurance requirement, where beneficiaries typically pay 20% of the Medicare-approved amount for covered services.

Additional coverage options

While Medicare Part B provides essential outpatient coverage, it’s important to note that there are additional coverage options available.

One such option is Medicare Advantage (Part C) plans, which are offered by private insurance companies approved by Medicare.

These plans provide all the benefits of Original Medicare (Part A and Part B) and often include additional benefits such as prescription drug coverage or dental services.

Another option is Medigap, also known as Medicare Supplement Insurance.

These policies help fill in the gaps left by Original Medicare, including deductibles, coinsurance, and other out-of-pocket costs.

Medigap policies are sold by private insurance companies and can provide added financial protection for those enrolled in Original Medicare.

Considering these additional coverage options alongside Medicare Part B can help individuals make informed decisions about their healthcare needs.

It’s important to review each option carefully and assess which one aligns best with personal circumstances and preferences.

Choosing Medicare Part B

Understanding the eligibility and enrollment process for Medicare Part B, as well as exploring the covered services and benefits, is crucial for making informed decisions about healthcare coverage.

By familiarizing oneself with the details of Medicare Part B, individuals can ensure they have the necessary outpatient coverage to meet their medical needs.

Medicare Part B provides essential protection and peace of mind by offering coverage for medically necessary services and supplies.

It plays a vital role in ensuring access to quality healthcare outside of a hospital setting.

By understanding the benefits and scope of Medicare Part B, individuals can make informed choices that align with their healthcare needs and preferences.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!