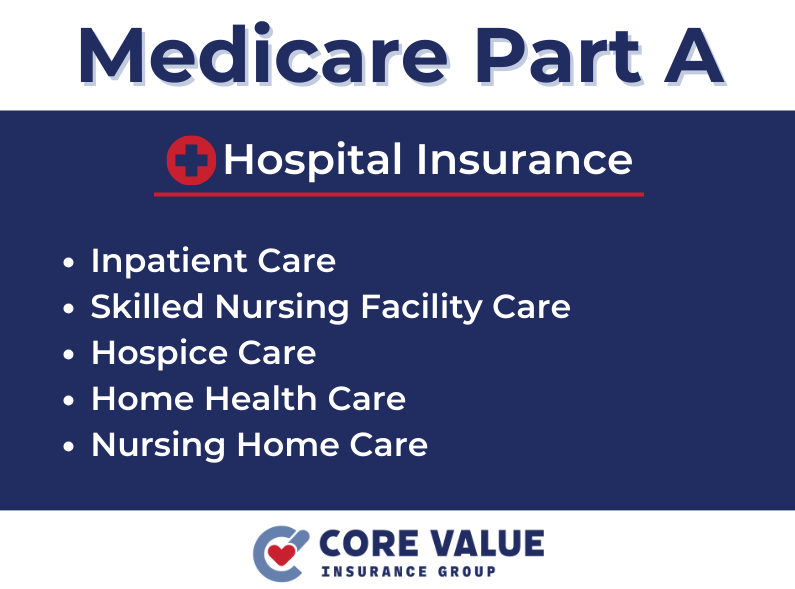

Medicare Part A is a crucial component of Original Medicare, providing coverage for hospital inpatient care, skilled nursing facilities, hospice, and home health care.

This comprehensive coverage ensures that seniors and individuals approaching retirement age have access to the necessary medical services they may require.

By understanding the eligibility criteria for Medicare Part A, individuals can determine if they qualify for this essential coverage.

Additionally, knowing the details of what is covered under Medicare Part A allows individuals to make informed decisions about their healthcare needs.

Let’s explore the benefits, eligibility requirements and coverage benefits of Medicare Part A.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Part A Eligibility

Medicare Part A provides essential coverage for hospital inpatient care, but understanding the eligibility criteria is crucial to determine if you qualify for this coverage.

The primary requirement for Medicare Part A eligibility is age. Individuals must be 65 years or older to be eligible.

However, there are exceptions where individuals under 65 may qualify if they have certain disabilities or end-stage renal disease (ESRD).

In addition to age, work history also plays a role in determining eligibility for Medicare Part A. Most people qualify for premium-free Part A if they or their spouse paid Medicare taxes for at least 10 years.

This work history requirement ensures that individuals who have contributed to the Medicare system receive the benefits they deserve without paying additional premiums.

However, if you don’t meet the work history requirement, you may still be eligible for Medicare Part A by paying a premium.

This means that even if you haven’t worked long enough to earn premium-free coverage, you can still access hospitalization coverage by paying a monthly premium.

Benefits of Medicare Part A

Part A offers comprehensive coverage for various healthcare services, ensuring that individuals have access to the care they need.

Hospital Stays and Inpatient Services

Medicare Part A covers hospital stays, including semi-private rooms, meals, and necessary hospital services.

This coverage extends to a wide range of inpatient hospital services, such as:

- Surgeries

- Diagnostic tests

- Medications administered during hospital stay

- Skilled nursing care

Whether you require emergency treatment or scheduled procedures, Part A ensures that you receive the necessary care without facing significant financial burdens.

Hospice and Home Health Care

In addition to hospitalization coverage, Medicare Part A also provides coverage for hospice care and home health care services.

Hospice care includes pain relief management, counseling services, and support for individuals with terminal illnesses.

This compassionate coverage aims to enhance quality of life during end-of-life stages.

Part A covers home health care services for individuals who require skilled nursing care or therapy at home. This can include:

- Physical therapy sessions

- Occupational therapy sessions

- Speech-language pathology services

- Medical equipment like wheelchairs or walkers

- Other necessary supplies

By knowing what is covered under this program, individuals can make informed decisions about their healthcare needs and ensure they receive the benefits they deserve.

Medicare Enrollment Process

Enrolling in Medicare Part A is an important step to ensure you have access to hospitalization coverage and other benefits.

Initial Enrollment Period (IEP)

For most individuals, enrollment in Medicare Part A is automatic when they turn 65 years old.

If you’re already receiving Social Security or Railroad Retirement Board benefits, you will be enrolled in Medicare Part A automatically.

However, if you’re not automatically enrolled, you can sign up during your Initial Enrollment Period (IEP), which begins three months before your 65th birthday and ends three months after.

During your IEP, it’s crucial to understand the eligibility criteria and gather the necessary documents to complete the enrollment process smoothly.

This includes proof of age and citizenship or legal residency status.

Special Enrollment Periods (SEP)

If you missed your Initial Enrollment Period (IEP) or didn’t qualify for automatic enrollment, you may still have opportunities to enroll in Medicare Part A through Special Enrollment Periods (SEPs).

SEPs are available for certain life events that may affect your healthcare coverage.

Some common examples of qualifying life events include losing employer coverage, moving out of the coverage area, or experiencing changes in marital status.

It’s essential to be aware of these special circumstances that may make you eligible for a SEP so that you can take advantage of them and sign up for Medicare Part A when needed.

Ensure you’re Eligible

Understanding the eligibility criteria for Medicare Part A is crucial for seniors and individuals approaching retirement age.

By meeting the requirements, you can gain access to valuable coverage for hospital inpatient care, skilled nursing facilities, hospice, and home health care.

It’s important to be aware of the enrollment process and important deadlines to ensure you are covered and receive the benefits you deserve.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!