Conclusion: The monthly cost for Medicare Advantage plans can vary widely depending on the plan, provider, and location. Some plans may have $0 premiums, while others charge a monthly fee in addition to the Part B premium.

When it comes to Medicare, navigating the various options and understanding their costs can be daunting.

Medicare Advantage, also known as Part C, offers an alternative to Original Medicare with additional benefits, but what does it cost?

This introduction sets the stage for a deep dive into the monthly costs associated with Medicare Advantage plans, aiming to demystify these expenses for those considering their healthcare options.

Breakdown of Medicare Advantage Monthly Premiums

Medicare Advantage plans bundle hospital, medical, and often prescription drug coverage.

While some plans boast $0 monthly premiums, it’s important to understand the full picture.

These costs include the Medicare Part B premium that all Medicare beneficiaries pay, the plan’s own premium, and potentially additional premiums for extra benefits.

The Reality of $0 Monthly Premium Medicare Advantage Plans

A $0 monthly premium can be appealing, but it doesn’t mean the plan is free.

Out-of-pocket costs like deductibles, copayments, and coinsurance still apply, and these can vary significantly from plan to plan.

Understanding these costs is crucial for making an informed choice.

Key Factors Affecting Medicare Advantage Premiums

Your location can significantly influence the cost of Medicare Advantage plans.

Factors such as the cost of living and local healthcare expenses affect plan premiums, meaning costs can vary widely from one region to another.

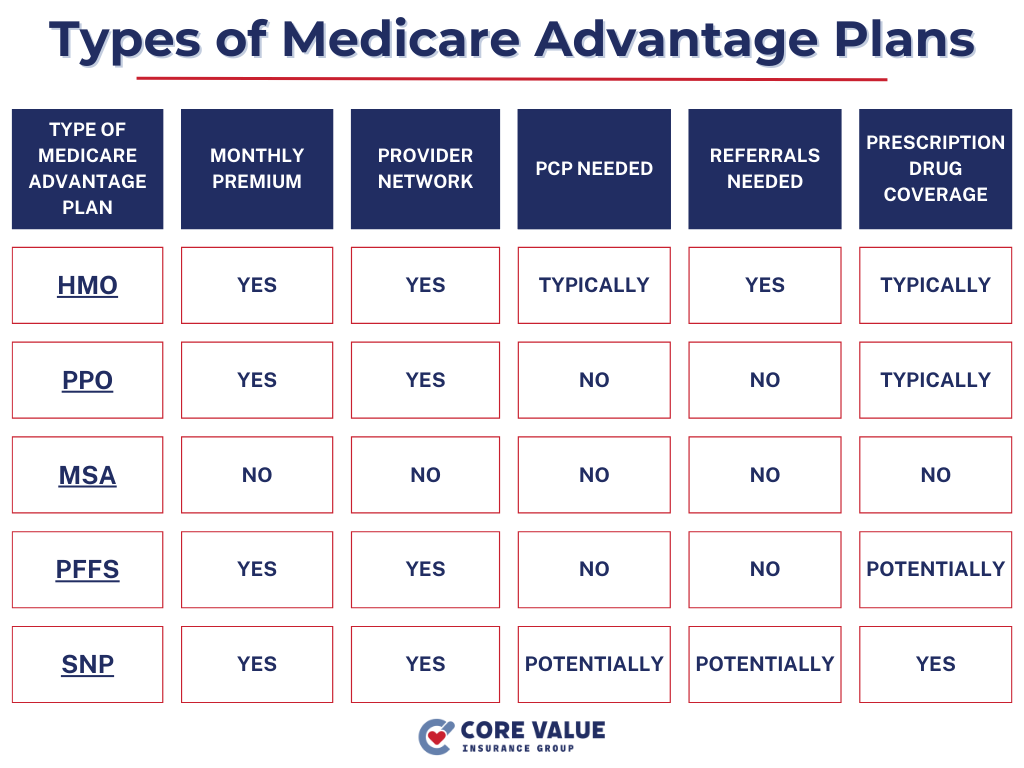

Choosing Between HMO and PPO

The type of Medicare Advantage plan you choose, whether an HMO or a PPO, can also affect your costs.

HMOs often have lower premiums but require care to be coordinated within a network. PPOs offer more flexibility in provider choice but often come with higher premiums.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Deductibles and Copayments in Medicare Advantage Plans

Beyond monthly premiums, Medicare Advantage plans often include deductibles and copayments.

These out-of-pocket costs can add up, especially for frequent healthcare services or expensive treatments.

The Significance of Out-of-Pocket Maximums

One advantage of Medicare Advantage plans is the out-of-pocket maximum, which caps the amount you’ll spend on healthcare services in a year.

This feature provides a safety net, potentially saving you money in the event of unexpected healthcare needs.

How to Evaluate Medicare Advantage Plans Effectively

When comparing Medicare Advantage plans, look beyond the monthly premium.

Consider the plan’s network, the out-of-pocket costs, and the benefits covered.

This approach ensures you find a plan that offers the best value for your healthcare needs and budget.

Using the Medicare Plan Finder for Cost Comparison

The Medicare Plan Finder tool on Medicare.gov is an invaluable resource for comparing plan costs and benefits side by side.

This tool can help you navigate the complexities of Medicare Advantage options, making it easier to choose the right plan.

Conclusion

Understanding the monthly costs of Medicare Advantage plans is just the beginning.

By considering all potential expenses and comparing plans thoroughly, you can make an informed decision that aligns with your healthcare needs and financial situation.

Remember, the best plan for you is one that offers the coverage you need at a cost you can afford.

Take the time to research and compare your options to ensure your healthcare coverage meets your expectations both in benefits and in cost.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!