Navigating the complexities of Medicare can be challenging, especially when it comes to making the most of your coverage options. One crucial aspect of this journey is understanding the Medicare Annual Enrollment Period (AEP).

This period is a key time each year when Medicare beneficiaries can review and make changes to their plans. In this blog, we’ll discuss the following:

- What the AEP entails

- Important enrollment dates

- The choices available during this period

- Strategies to make informed decisions

Whether you’re a new enrollee or a long-time beneficiary, this guide aims to demystify the AEP and help you optimize your healthcare coverage.

Overview of Medicare

As a quick refresher, Medicare is the federal health insurance program for people aged 65 or older, as well as for younger individuals with certain disabilities or diseases.

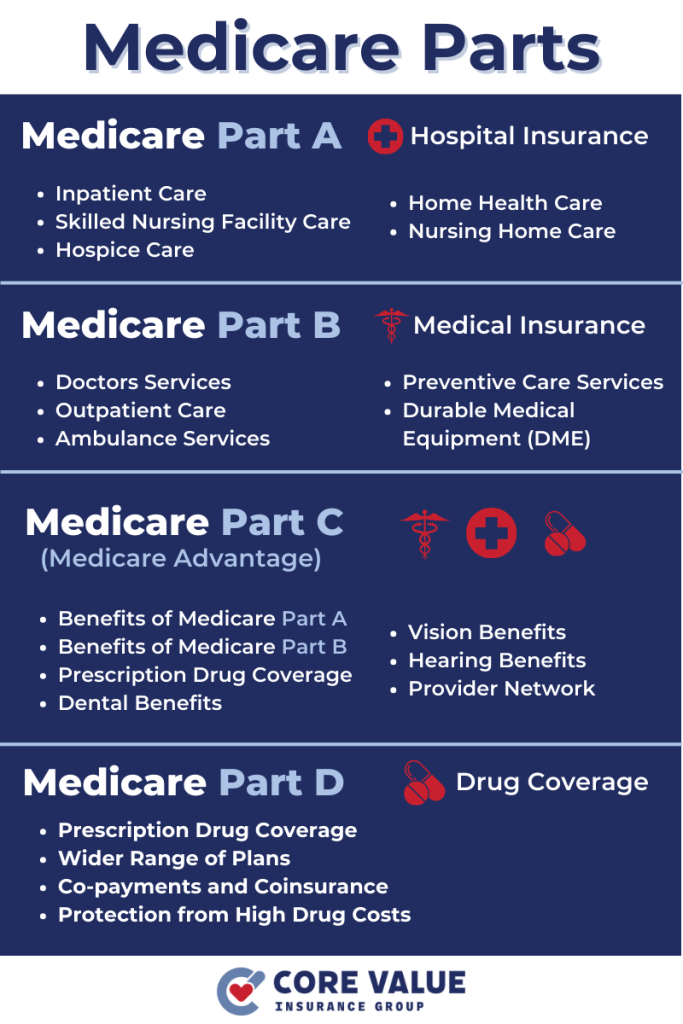

- Part A (Hospital Insurance)

- Part B (Medical Insurance)

- Part C (Medicare Advantage Plans)

- Part D (Prescription Drug Coverage)

Each part serves different healthcare needs, which becomes particularly relevant during the Annual Enrollment Period.

What is the Annual Enrollment Period (AEP)?

The Annual Enrollment Period runs from October 15 to December 7 each year. During this time, current Medicare beneficiaries can make changes to their Medicare health plans and prescription drug coverage for the next year.

This period is essential as it allows you to adjust your coverage based on changes in health needs, financial status, or plan performance.

It’s a time to evaluate your current plan’s benefits, costs, and coverage and see if there’s a better fit for your situation.

Key Dates and Timeline of the AEP

The AEP has a set timeline:

- October 15 to December 7: The window for making changes to your Medicare plans.

- Changes made during AEP take effect on January 1 of the following year.

It’s crucial to mark these dates in your calendar to avoid missing the opportunity to revise your Medicare coverage.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Choices and Changes Allowed During AEP

During the Annual Enrollment Period, you can:

- Switch from Original Medicare to a Medicare Advantage plan and vice versa.

- Change from one Medicare Advantage plan to another, whether or not the plan includes drug coverage.

- Join a Medicare Prescription Drug Plan, change from one Medicare drug plan to another, or drop your drug coverage completely.

This period is your annual opportunity to tailor your healthcare coverage to better suit your specific healthcare needs and budget.

Strategies for Making the Most of the AEP

To effectively navigate the AEP, consider these strategies:

- Review Your Current Plan: Assess if your current plan still meets your health needs and financial capabilities.

- Compare Other Plans: Look at other available plans to ensure you’re not missing out on better coverage or lower costs.

- Check for Changes in Current Plan: Plans can change benefits and costs each year, so it’s important to review any changes to your current plan.

Common Misconceptions About AEP

- “I can enroll in Medicare Part B during AEP”: This is not the case. The AEP is for changing existing coverage, not for initial enrollment in Part B.

- “All changes made will take effect immediately”: Changes made during the AEP take effect on January 1 of the following year.

Understanding these nuances can help you navigate the AEP more effectively.

Conclusion

The Medicare Annual Enrollment Period is a vital time for beneficiaries to reassess and adjust their healthcare plans.

By staying informed and proactive, you can make choices that best align with your health needs and financial situation.

Remember, this period is your chance to optimize your Medicare coverage for the coming year. Use this opportunity wisely to ensure your health insurance works best for you.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!