Medicare Part D costs can have a significant impact on individuals’ medication expenses. It is crucial to understand these costs to make informed decisions about prescription drug coverage.

This guide aims to provide a clear understanding of Medicare Part D costs, including:

- Premiums

- Deductibles

- Coverage phases

- Out-of-pocket thresholds

By unraveling the complexities of Medicare Part D costs, individuals can better manage their prescription drug coverage expenses and ensure they have the necessary financial resources for their medications.

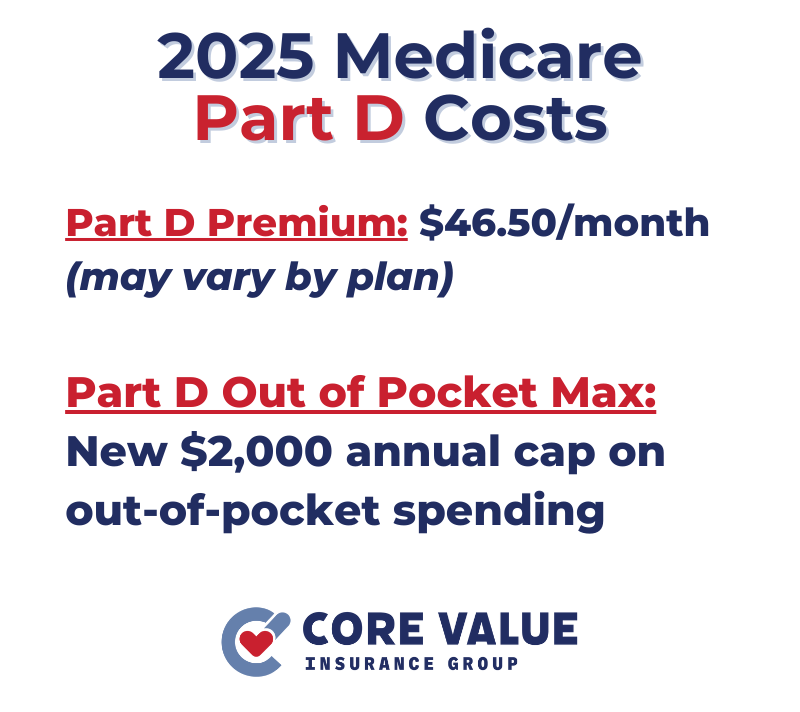

Medicare Part D Premiums

Medicare Part D premiums play a crucial role in determining the cost of prescription drug coverage.

These premiums can vary based on factors such as income and the chosen plan.

Individuals with higher incomes may have higher premiums, while those with lower incomes may qualify for income-based premium adjustments, making Medicare Part D coverage more affordable.

Factors Affecting Medicare Part D Premiums

Several factors can influence the cost of Medicare Part D premiums. Income is one significant factor, as individuals with higher incomes may be subject to higher premium amounts.

The chosen plan also plays a role, as different plans offer varying levels of coverage and associated costs.

It’s important to carefully consider these factors when selecting a Medicare Part D plan to ensure it aligns with both budgetary constraints and medication needs.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Managing Medicare Part D Premiums

Managing Medicare Part D premiums effectively can help individuals find the most cost-effective options for their prescription drug coverage.

One essential tip is to compare different plans and their premiums before making a decision. This allows individuals to assess which plan offers the best value for their specific medication needs.

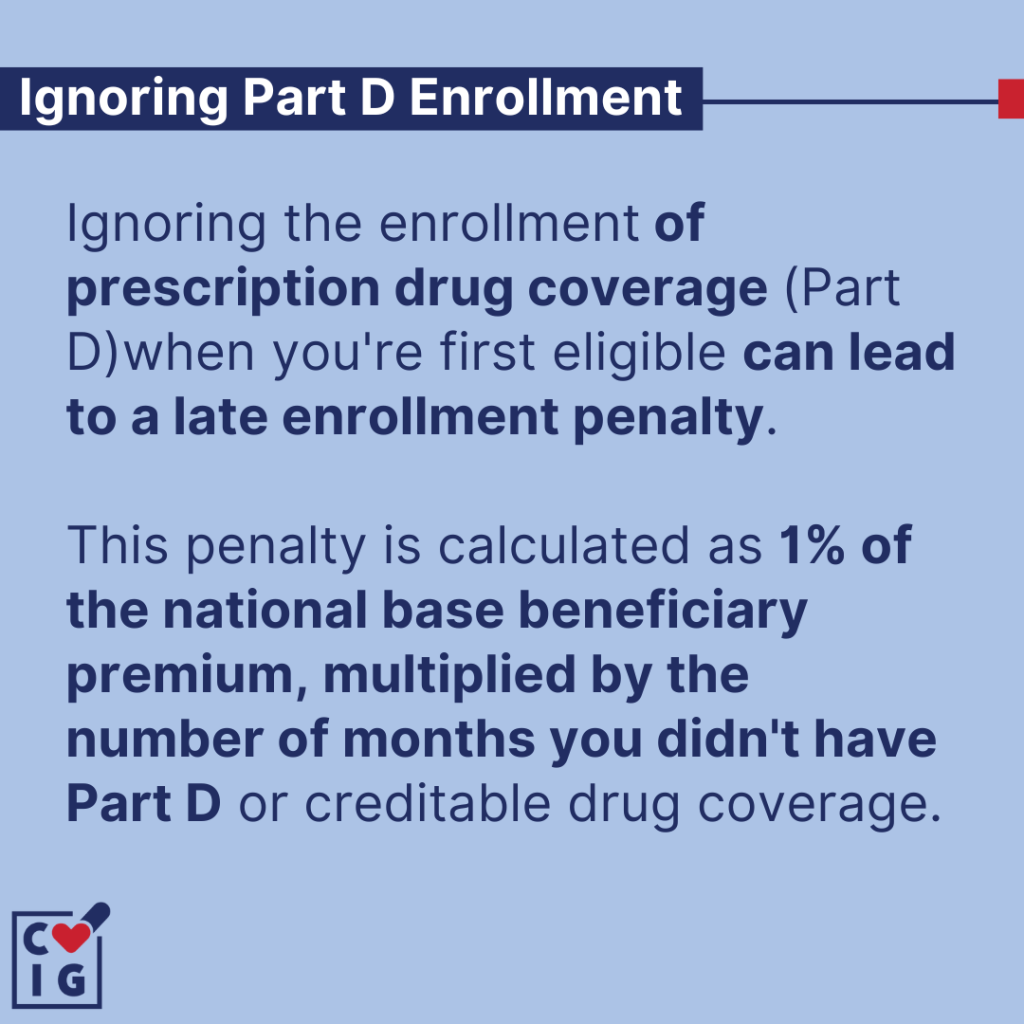

Enrolling during the Initial Enrollment Period (IEP) is another crucial step in managing Medicare Part D premiums.

By enrolling during this period, individuals can avoid late enrollment penalties and potentially higher premiums in the future.

Coverage Phases and Out-of-Pocket Thresholds

Understanding the coverage phases and out-of-pocket thresholds of Medicare Part D is essential for individuals to effectively manage their prescription drug expenses.

Medicare Part D coverage consists of different phases, including:

- Initial coverage phase

- Coverage gap (“Donut Hole”)

- Catastrophic coverage

Each phase has its own cost-sharing requirements and levels of coverage.

During the initial coverage phase, individuals pay a portion of their medication costs through copayments or coinsurance. Once total drug costs reach a certain threshold, individuals enter the coverage gap (Donut Hole).

In this phase, they are responsible for a higher percentage of their medication costs until they reach the out-of-pocket threshold.

Out-of-pocket thresholds determine when individuals transition between coverage phases. Once an individual’s out-of-pocket spending reaches a specific limit, they move into catastrophic coverage.

During this phase, individuals pay significantly less for their medications.

Understanding these coverage phases and out-of-pocket thresholds can help individuals plan for their medication expenses.

By knowing when they may enter the coverage gap or reach expense limits, individuals can budget accordingly and explore cost-saving strategies to manage their prescription drug costs effectively.

How to Manage Medicare Part D Costs

Managing Medicare Part D costs is essential for individuals seeking affordable prescription drug coverage.

Here are two effective strategies to help individuals reduce their medication expenses:

Generic and Preferred Brand Medications

Opting for generic and preferred brand medications can significantly lower medication costs. Generic drugs are equivalent to their brand-name counterparts but come at a fraction of the cost.

Preferred brand medications, on the other hand, may have lower copayments or coinsurance rates compared to non-preferred brands.

Understanding the formulary of the chosen Medicare Part D plan is crucial in selecting cost-effective medications.

The formulary is a list of covered drugs and their associated costs under the plan, allowing individuals to make informed decisions about their prescriptions.

Medication Assistance Programs

Medication assistance programs provide financial support for individuals who struggle with high medication costs.

These programs can help eligible individuals access affordable medications through discounts or patient assistance programs.

Researching and applying for these programs can be beneficial in reducing out-of-pocket expenses for prescription drugs.

By utilizing generic and preferred brand medications and exploring medication assistance programs, individuals can effectively manage their Medicare Part D costs and ensure access to necessary medications without breaking the bank.

Affordable Medicare Part D Coverage

Understanding Medicare Part D costs is crucial for individuals to ensure affordable prescription drug coverage.

Consider factors such as premiums, coverage phases, and cost-saving strategies, individuals can effectively manage their Part D costs and make informed decisions about their prescription drug coverage.

By taking proactive steps and staying informed about Medicare Part D costs, individuals can ensure they have the necessary coverage without incurring excessive expenses.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!