Understanding Medicare Part D enrollment periods is crucial for Medicare beneficiaries and those approaching Medicare eligibility.

These enrollment periods refer to specific time frames during which individuals can enroll in a Medicare prescription drug plan.

Being aware of the different Medicare Part D enrollment periods is essential to ensure timely access to prescription drug coverage.

These time frames play a vital role in ensuring that individuals have access to affordable medications and necessary healthcare services.

What are Medicare Part D Enrollment Periods?

Medicare Part D enrollment periods are specific time frames during which individuals can enroll in a Medicare prescription drug plan.

These enrollment periods are designed to ensure that beneficiaries have access to prescription drug coverage.

They provide opportunities for individuals to sign up for a suitable plan based on their needs and preferences.

The Three Part D Enrollment Periods

There are three main Medicare Part D enrollment periods:

Each period has its own qualifications and enrollment windows, allowing beneficiaries to make informed decisions about their prescription drug coverage.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

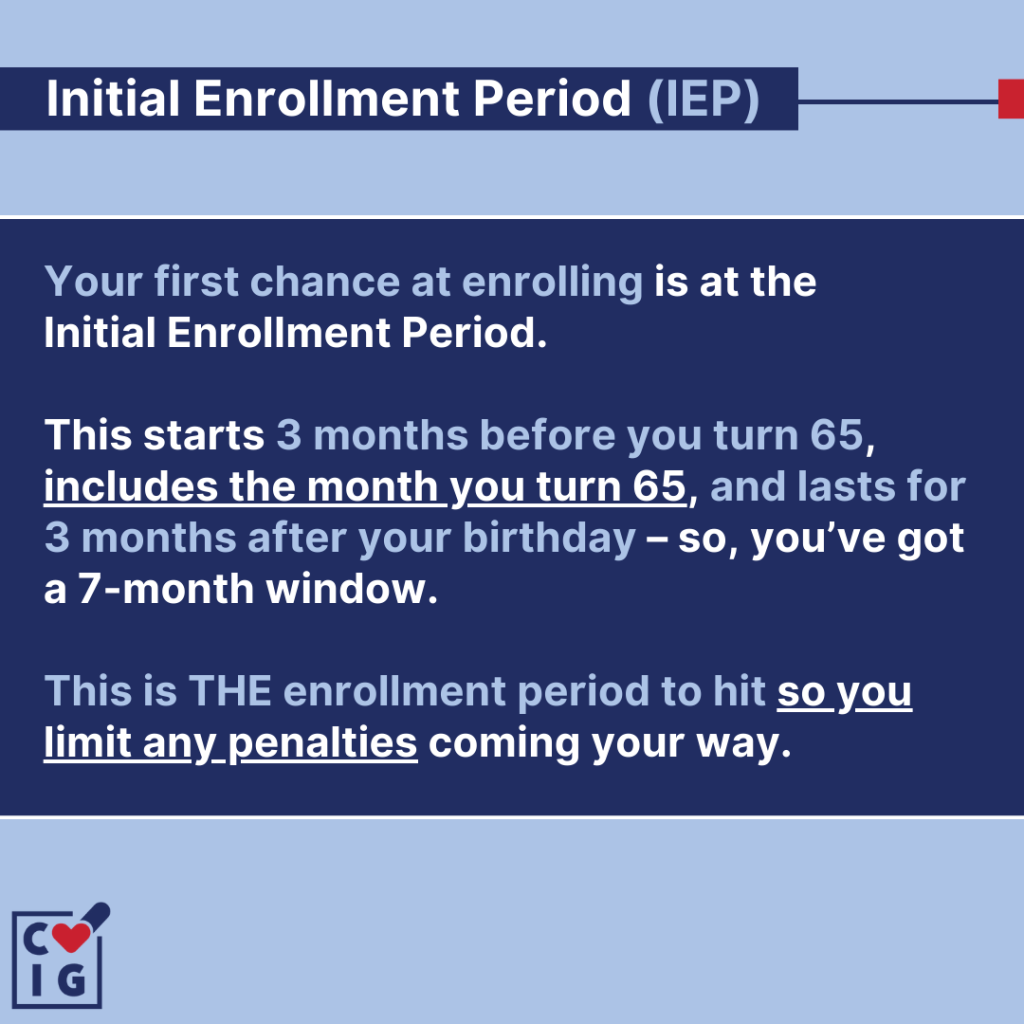

Initial Enrollment Period (IEP): The IEP is the first opportunity for most people to enroll in a Medicare Part D plan.

It typically starts three months before the month of your 65th birthday and ends three months after your birthday month.

This seven-month window ensures that individuals have ample time to explore their options and choose the most suitable plan.

Special Enrollment Period (SEP): SEPs are granted based on certain qualifying events that occur outside of the Initial Enrollment Period. Examples of qualifying events include:

- Losing prescription drug coverage

- Moving out of your plan’s service area

- Qualifying for Extra Help

Individuals typically have a limited time frame to enroll in a Part D plan once a qualifying event occurs.

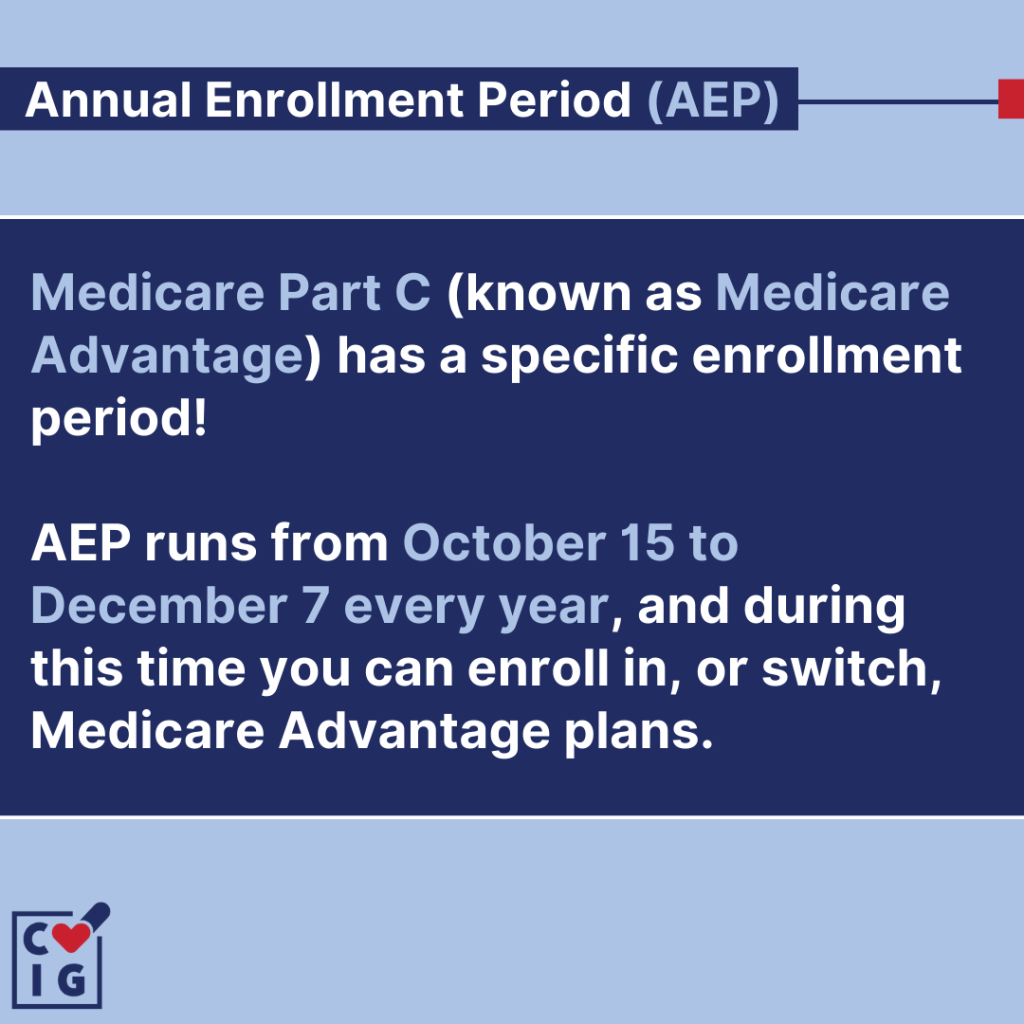

Annual Enrollment Period (AEP): The AEP is the time when you can make changes to your Medicare Part D coverage. It typically runs from October 15th to December 7th each year, allowing beneficiaries to:

- Switch plans

- Enroll in new plans

- Drop their current plans

This annual opportunity ensures that individuals can review their current coverage and make any necessary adjustments for the upcoming year.

Understanding these three enrollment periods is essential for navigating Medicare Part D enrollment.

It allows individuals to take advantage of the appropriate time frames to enroll in a plan that best meets their prescription drug needs.

Initial Enrollment Period (IEP)

The Initial Enrollment Period (IEP) is the first opportunity for most people to enroll in a Medicare Part D plan. It is specifically designed for individuals who are new to Medicare or turning 65 years old.

During this period, you have the chance to sign up for a Medicare prescription drug plan that best suits your needs.

It’s important to take advantage of this enrollment window as missing it may result in late enrollment penalties and gaps in prescription drug coverage.

During the Initial Enrollment Period, it’s crucial to carefully evaluate different plans, considering factors such as:

- Premiums

- Deductibles

- Copayments

- Formularies

By comparing these aspects, you can make an informed decision and choose a plan that provides adequate coverage for your prescription medications.

Special Enrollment Period (SEP)

A Special Enrollment Period (SEP) is a designated time outside of the Initial Enrollment Period when you can sign up for a Medicare Part D plan.

SEPs are granted based on certain qualifying events that occur in your life. These events may make you eligible for enrollment outside of the standard enrollment periods.

Qualifying for a Special Enrollment Period

There are various qualifying events that can make you eligible for a Special Enrollment Period in Medicare Part D.

Some examples include:

- Losing Creditable Prescription Drug Coverage: If you lose your existing prescription drug coverage and it is considered creditable coverage, you may qualify to enroll in a Medicare Part D plan.

- Moving Out of Your Plan’s Service Area: If you move out of the service area covered by your current Medicare Part D plan, you may be eligible for an SEP to select a new plan that covers your new location.

- Qualifying for Extra Help: Individuals who qualify for Extra Help, also known as the Low-Income Subsidy (LIS) program, can enroll in or switch plans at any time throughout the year using an SEP.

It’s important to note that once a qualifying event occurs, you typically have a limited time frame to take advantage of the SEP and enroll in a Medicare Part D plan.

Therefore, it’s essential to be aware of these events and promptly explore your options to ensure uninterrupted access to prescription drug coverage.

Annual Enrollment Period (AEP)

The Annual Enrollment Period (AEP) is a crucial time when you can make changes to your Medicare Part D coverage.

It typically runs from October 15th to December 7th each year.

During this period, beneficiaries have the opportunity to review their current coverage and explore different options for the upcoming year.

Making Changes during the Annual Enrollment Period

The AEP allows you to make several changes to your Medicare Part D plan:

- Switching Plans: If you are currently enrolled in a Part D plan and wish to explore other options, the AEP is the perfect time to do so. You can switch plans and choose one that better suits your prescription drug needs.

- Joining a New Plan: If you don’t currently have prescription drug coverage through Medicare, the AEP provides an opportunity to enroll in a Part D plan for the first time.

- Dropping Your Current Plan: In some cases, you may find that your current plan no longer meets your needs or is no longer cost-effective. During the AEP, you have the option to drop your current plan altogether.

To make informed decisions during the AEP, it’s important to review your current coverage and compare different plans.

Consider factors such as monthly premiums, deductible amounts, copayments, and formularies (the list of covered medications).

Remember that once the AEP ends on December 7th, any changes made will generally take effect on January 1st of the following year.

Medicare Part D Late Enrollment Penalty

To avoid the Medicare Part D late enrollment penalty, it’s crucial to enroll in a Part D plan as soon as you become eligible or have creditable prescription drug coverage.

The late enrollment penalty is a permanent increase in your premium that is added if you go without creditable prescription drug coverage for 63 days or more after your Initial Enrollment Period ends.

By enrolling in a Medicare Part D plan during your Initial Enrollment Period or a Special Enrollment Period, you can avoid this penalty and ensure that you have continuous access to affordable prescription medications.

Enrolling in Medicare Part D

Understanding Medicare Part D enrollment periods is essential, whether you’re new to Medicare or looking to optimize your coverage.

By understanding the qualifications and options for enrolling in Part D, you can make informed decisions and avoid penalties.

Navigating the enrollment process may seem overwhelming at first, but with the knowledge gained from this guide, you can approach it with confidence.

Take advantage of the enrollment periods to ensure you have the prescription drug coverage that best meets your needs.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!