Medicare Part D eligibility and coverage play a crucial role in ensuring that beneficiaries and individuals approaching eligibility have access to affordable prescription medications.

By understanding Medicare Part D penalties and learning tips for selecting the right plan, individuals can make informed decisions about their healthcare needs.

Eligibility for Medicare Part D Enrollment

To be eligible for Medicare Part D, individuals must first be eligible for Original Medicare, which includes Medicare Part A and/or Medicare Part B coverage. This serves as the foundation for enrolling in a Medicare Part D plan.

In addition to being eligible for Original Medicare, individuals must also reside in the service area of the specific Medicare Part D plan they wish to enroll in.

Each plan has its own designated service area, and individuals must ensure that they live within that area to be eligible for enrollment.

There are different combinations of Medicare plans that can make individuals eligible for Medicare Part D coverage:

- Prescription Drug Plan (PDP): One option is having a standalone Prescription Drug Plan (PDP), which provides coverage exclusively for prescription medications.

- Medicare Advantage (MAPD) Plan: Another option is through a Medicare Advantage plan with drug coverage (MA-PD). These plans combine medical and prescription drug coverage into one comprehensive package.

It’s important to note that Medicare Supplement plans (Medigap) do not include Part D coverage.

Therefore, beneficiaries who have Medigap plans need to separately enroll in a standalone PDP to ensure access to prescription drug benefits.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

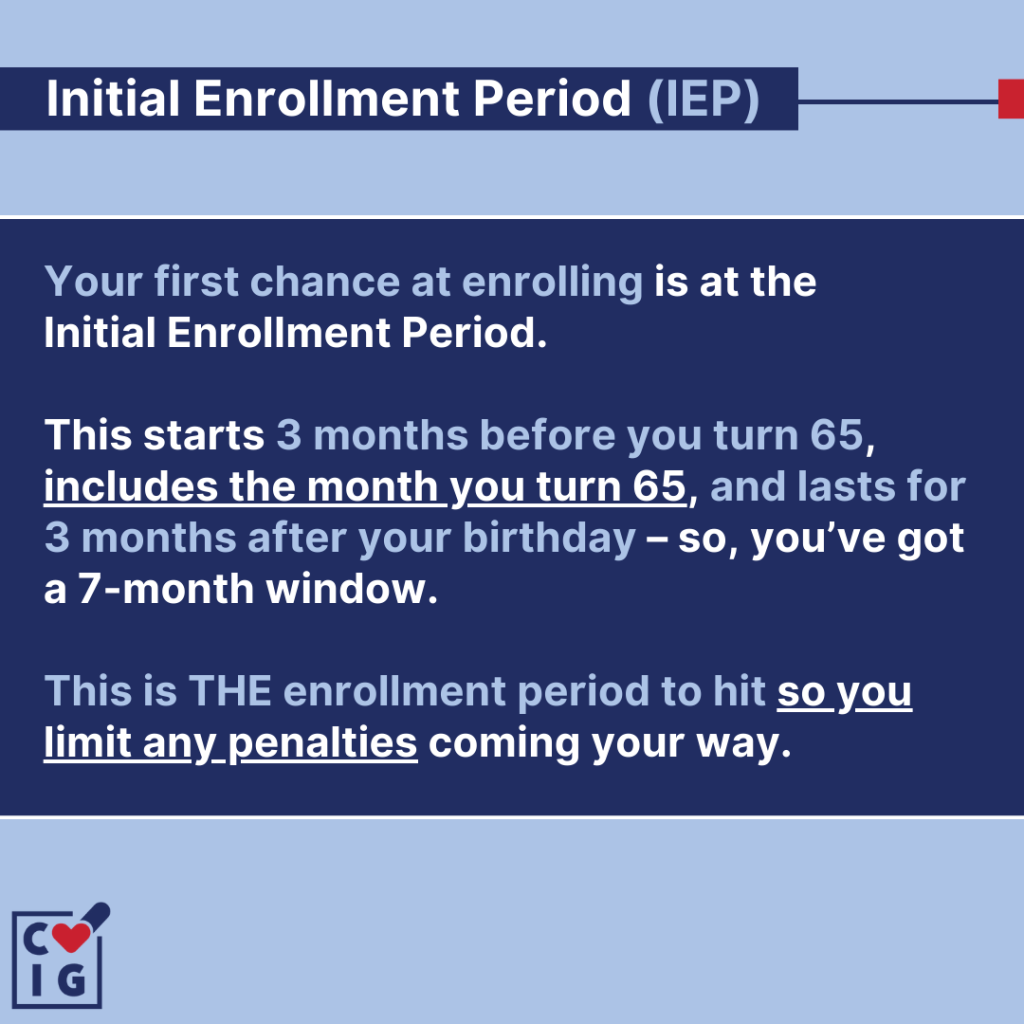

The Initial Enrollment Period and Penalties

The Initial Enrollment Period (IEP) is a critical time for individuals to enroll in a Medicare Part D plan.

It is the first opportunity to sign up for coverage and ensure that prescription drug needs are met without any penalties or late enrollment fees.

Enrolling during the IEP is highly encouraged to avoid potential financial penalties. Delaying enrollment in Medicare Part D can result in a late enrollment penalty.

This penalty is calculated based on the number of months an individual goes without creditable prescription drug coverage. The longer the delay, the higher the penalty may be.

To avoid these penalties, it’s important to understand the significance of enrolling during the IEP and selecting the right Medicare Part D plan.

By enrolling on time, individuals can ensure seamless access to necessary medications while avoiding unnecessary financial burdens.

Choosing the Best Medicare Part D Plan

When it comes to selecting the best Medicare Part D plan, there are important factors to consider that can help individuals make an informed decision.

Prescription Drug Needs

Evaluate your current prescriptions and ensure that they are covered by the Part D plan you are considering.

Each plan has its own formulary, which is a list of covered drugs. It’s essential to check if your medications are included in the formulary.

Tier Structure

Consider the tier structure and cost-sharing requirements of different plans.

Some medications may have higher copayments or require prior authorization, so it’s important to understand these details before making a decision.

Plan Costs and Coverage

Another factor to compare when selecting a Medicare Part D plan is the costs and coverage offered by different plans.

Compare monthly premiums, deductibles, copayments, and coinsurance across various plans.

Donut Hole

It’s also important to consider the coverage gap, commonly known as the “Donut Hole,” which is a temporary limit on what the Part D plan will cover for prescription drugs.

Additionally, look into catastrophic coverage limits, which provide additional protection once out-of-pocket spending reaches a certain threshold.

Medicare Prescription Drug Plans

Understanding the intricacies of Medicare prescription drug plans is essential when navigating the world of Medicare Part D. Two important aspects to consider are:

- Formularies

- Drug coverage

Formularies

Formularies are lists of covered drugs, and each Medicare Part D plan has its own formulary. It’s crucial to review the formulary of different plans to ensure that your necessary medications are included.

Additionally, it’s important to note that different drugs may be placed in different tiers within a formulary. These tiers can affect the cost-sharing requirements, such as: copayments or coinsurance, for specific medications.

Understanding how your medications are categorized within a plan’s formulary will help you anticipate potential out-of-pocket expenses.

Drug Coverage

In addition to drug coverage, some Medicare prescription drug plans offer additional benefits.

These benefits can include services like mail-order pharmacy options or preferred pharmacy networks, which may provide convenience and potential cost savings for beneficiaries.

Furthermore, there are Extra Help programs available for individuals with limited income and resources. These programs provide financial assistance to help cover prescription drug costs.

It’s important to explore these programs and determine if you qualify for any additional support.

Medicare Part D Eligibility Recap

By enrolling during the Initial Enrollment Period and selecting the right plan, individuals can avoid penalties and reduce out-of-pocket costs.

It’s important to explore the world of Medicare Part D coverage, considering factors such as formularies, drug coverage tiers, plan costs, and additional benefits.

By making informed decisions about your healthcare needs, you can ensure that you have access to the necessary medications while minimizing financial burdens.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!