The Medicare Part D Donut Hole, also known as the Coverage Gap, is a temporary limit in prescription drug coverage.

It is an important aspect of Medicare Part D plans that beneficiaries need to understand.

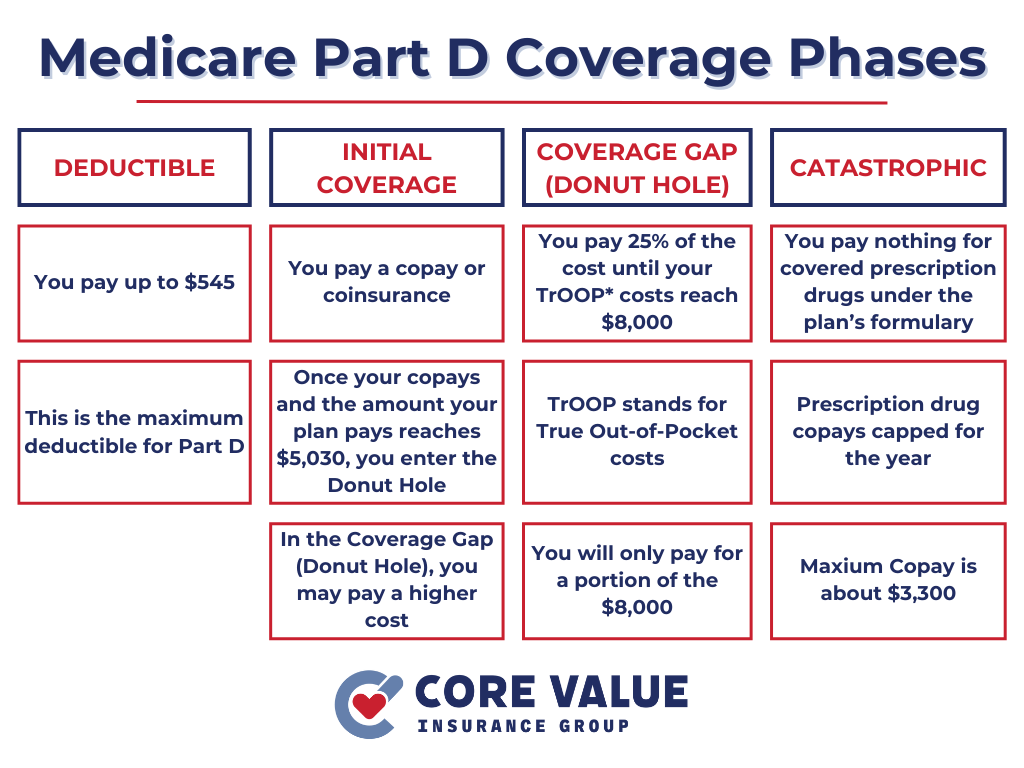

The donut hole consists of different phases that impact how much beneficiaries have to pay for their medications.

By gaining a clear understanding of these phases and how they affect prescription drug coverage, individuals with Medicare Part D plans can make informed decisions to avoid falling into the donut hole.

What is the Medicare Part D Donut Hole?

The Donut Hole occurs after the initial coverage period and ends when the beneficiary reaches catastrophic coverage.

It is a phase where beneficiaries have to bear a greater share of their prescription drug costs.

This means they will be responsible for paying more for their medications until they reach catastrophic coverage.

Why does the Donut Hole exist?

The Donut Hole exists to help control the costs of the Medicare Part D program. It was designed as a way to share the cost burden between beneficiaries, drug manufacturers, and the government.

By requiring beneficiaries to pay a higher percentage of their drug costs during this phase, it helps offset some of the expenses associated with providing prescription drug coverage.

During this phase, beneficiaries are responsible for covering a larger portion of their medication expenses until they reach catastrophic coverage.

Once they reach catastrophic coverage, their out-of-pocket costs decrease significantly.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Understanding the Coverage Phases

The Medicare Part D prescription drug coverage consists of different phases that beneficiaries should be aware of.

These phases include the Initial Coverage Period and the Coverage Gap, also known as the Medicare Part D Donut Hole.

Initial Coverage Period

The Initial Coverage Period is the first phase of Medicare Part D prescription drug coverage. During this period, beneficiaries pay a monthly premium and a portion of their drug costs.

The insurance provider covers the remaining cost until the total drug spending reaches a certain threshold.

This means that beneficiaries will have some out-of-pocket expenses during this phase, but they are typically lower compared to the Coverage Gap.

Donut Hole

The Coverage Gap, or the Donut Hole, is the second phase of prescription drug coverage. During this phase, beneficiaries are responsible for a higher percentage of their drug costs.

They may have to pay a certain percentage for both brand-name and generic drugs until they reach the out-of-pocket threshold.

It’s important to note that not all medications will count towards reaching this threshold, so it’s essential to understand which drugs are included in calculating your out-of-pocket spending.

Avoiding and Managing the Donut Hole

When it comes to the Donut Hole, there are steps you can take to avoid falling into it and effectively manage your prescription drug costs.

Tips to Avoid the Donut Hole

To prevent entering the Coverage Gap, consider the following tips:

Review your Medicare Part D plan’s formulary:

Make sure that your medications are covered by your plan.

If any of your prescriptions are not included, you may want to explore other plans or discuss alternatives with your healthcare provider.

Consider using generic drugs or lower-cost alternatives:

Generic drugs often have the same active ingredients as brand-name medications but at a lower cost. Talk to your doctor about whether generic options are available for your prescriptions.

Utilize prescription assistance programs:

There are various programs available that can help reduce out-of-pocket costs for prescription drugs.

Look into prescription assistance programs or patient assistance programs offered by pharmaceutical companies or nonprofit organizations.

Managing the Donut Hole

If you find yourself in the Donut Hole, here are some strategies for managing it:

- Keep track of your drug spending: Monitor your drug expenses throughout the year to know when you are approaching the Coverage Gap. This awareness can help you plan and budget accordingly.

- Discuss medication options with your healthcare provider: Your doctor may be able to suggest more affordable alternatives or recommend therapeutic equivalents that can provide similar benefits at a lower cost.

- Explore Medicare Savings Programs or Extra Help: These programs offer financial assistance for individuals with limited income and resources.

By implementing these tips and strategies, you can minimize the risk of falling into the donut hole and effectively manage your prescription drug expenses.

Escaping the Donut Hole

If you find yourself in the Medicare Part D Donut Hole, there are ways to escape and minimize the impact on your finances.

Reaching Catastrophic Coverage

Once you reach the out-of-pocket threshold, you enter the Catastrophic Coverage phase. During this phase, your drug costs decrease significantly, providing relief from the financial burden of the Coverage Gap.

You will only be responsible for a small copayment or coinsurance for your medications.

This phase offers additional financial protection for beneficiaries with high drug expenses.

Assistance Programs

In addition to reaching Catastrophic Coverage, there are other assistance programs that can help you navigate and escape the Coverage Gap:

- State pharmaceutical assistance programs: Some states offer programs that provide additional support for prescription drug costs. These programs vary by state, so it’s important to research what options are available in your area.

- Consider enrolling in a Medicare Advantage plan: Medicare Advantage plans often offer additional coverage for the Coverage Gap. These plans may have different formularies and cost-sharing structures that can help reduce your out-of-pocket expenses during this phase.

- Consult with a Medicare Insurance Agent: Seeking personalized guidance from a Medicare Insurance Agent can provide valuable insights into escaping the Coverage Gap. They can review your specific situation and recommend strategies tailored to your needs.

Key Takeaways

Understanding the Medicare Part D Donut Hole is crucial for Medicare beneficiaries and individuals with Medicare Part D plans.

This temporary limit in prescription drug coverage requires beneficiaries to pay a higher percentage of their drug costs.

By following tips to avoid falling into the donut hole and exploring assistance programs, beneficiaries can navigate and manage the Coverage Gap effectively.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!