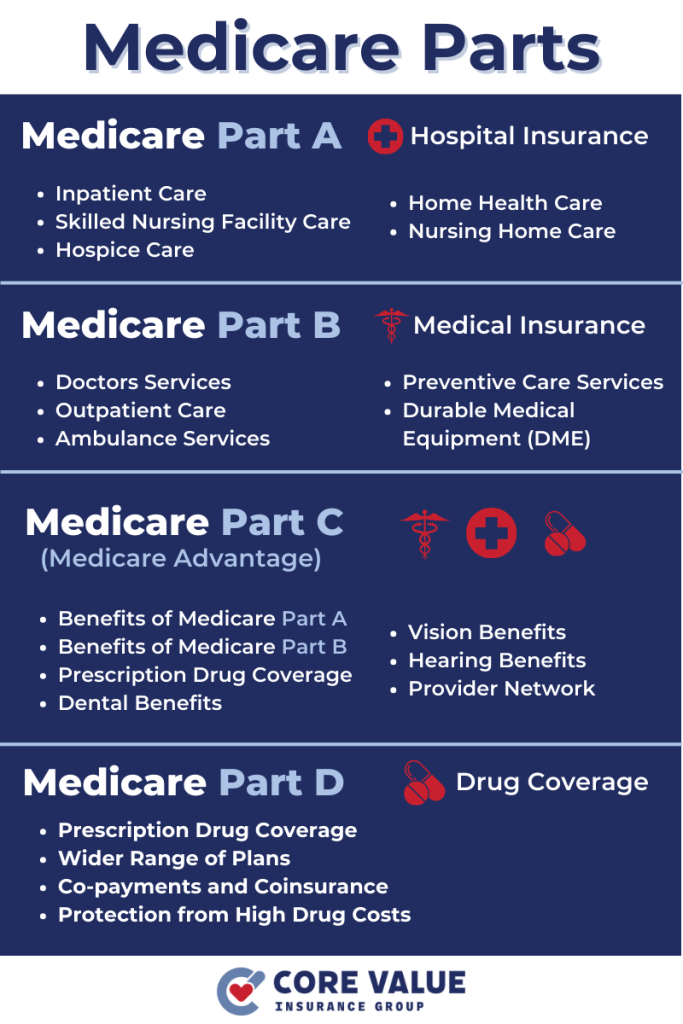

Medicare Part C, also known as Medicare Advantage, is a health insurance coverage option provided by private insurance companies. It offers additional benefits on top of Original Medicare, becoming your primary source of coverage.

Medicare Advantage plans are an alternative to traditional Medicare and are offered by private insurers approved by Medicare.

These plans provide all the benefits of Original Medicare (Part A and Part B) but often include additional coverage options such as:

- Prescription drugs

- Dental

- Vision

- Hearing services

By enrolling in a Medicare Advantage plan, you can enjoy the convenience of having all your healthcare needs covered under one plan.

These plans may also offer extra perks like gym memberships or wellness programs to help you stay healthy.

What is Medicare Advantage?

Medicare Advantage combines the benefits of Original Medicare (Part A and Part B) with additional coverage options.

With Medicare Part C, you receive your healthcare coverage through a private insurer rather than directly from the government.

These plans are required to provide at least the same level of coverage as Original Medicare but often go beyond that by offering additional benefits.

One of the key features of Medicare Advantage is that it operates on a managed care model. This means that you may need to use doctors and hospitals within the plan’s network or obtain referrals from a primary care physician (PCP) for specialist visits.

However, some plans offer out-of-network options for certain services, giving you more flexibility in choosing providers.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

How Does Medicare Part C Differ from Original Medicare?

Medicare Part C replaces Original Medicare as your primary source of coverage.

While Original Medicare is administered by the federal government and provides coverage for hospital stays (Part A) and medical services (Part B), it does not typically include prescription drug coverage or other supplemental benefits.

In contrast, Medicare Advantage plans often include prescription drug coverage (Medicare Part D) as well as additional benefits like:

- Dental care

- Vision exams

- Eyewear

- Hearing aids

- Fitness programs

- Transportation services

These extra benefits can help you save money on healthcare expenses and improve your overall well-being.

Types of Medicare Advantage Plans

HMO (Health Maintenance Organization) Plans

Health Maintenance Organization (HMO) plans are a type of Medicare Part C plan. With an HMO plan, you are required to choose a primary care physician (PCP) who will coordinate your healthcare.

Your PCP will serve as your main point of contact for all your medical needs and will provide referrals if you need to see specialists.

One of the key features of HMO plans is that they typically have a network of doctors, hospitals, and other healthcare providers that you must use in order to receive coverage.

Going out-of-network for non-emergency care may not be covered by the plan, except in certain circumstances.

While HMO plans may have more restrictions on choosing healthcare providers, they often come with lower monthly premiums and out-of-pocket costs compared to other types of Medicare Part C plans.

This can make them an attractive option for individuals who are willing to work within a specific network and prefer predictable costs.

PPO (Preferred Provider Organization) Plans

Preferred Provider Organization (PPO) plans, offer more flexibility when it comes to choosing healthcare providers.

With a PPO plan, you have the freedom to see any doctor or specialist without needing a referral from a primary care physician.

Unlike HMO plans, PPO plans also provide some coverage for out-of-network care.

While the coverage for out-of-network services may be lower than in-network services, it can still help reduce your overall expenses if you need to see providers outside of the plan’s network.

PPO plans generally have higher monthly premiums compared to HMO plans but offer greater flexibility in terms of provider choice.

If you value having the ability to see specialists without referrals and want some coverage for out-of-network care, a PPO plan might be the right fit for you.

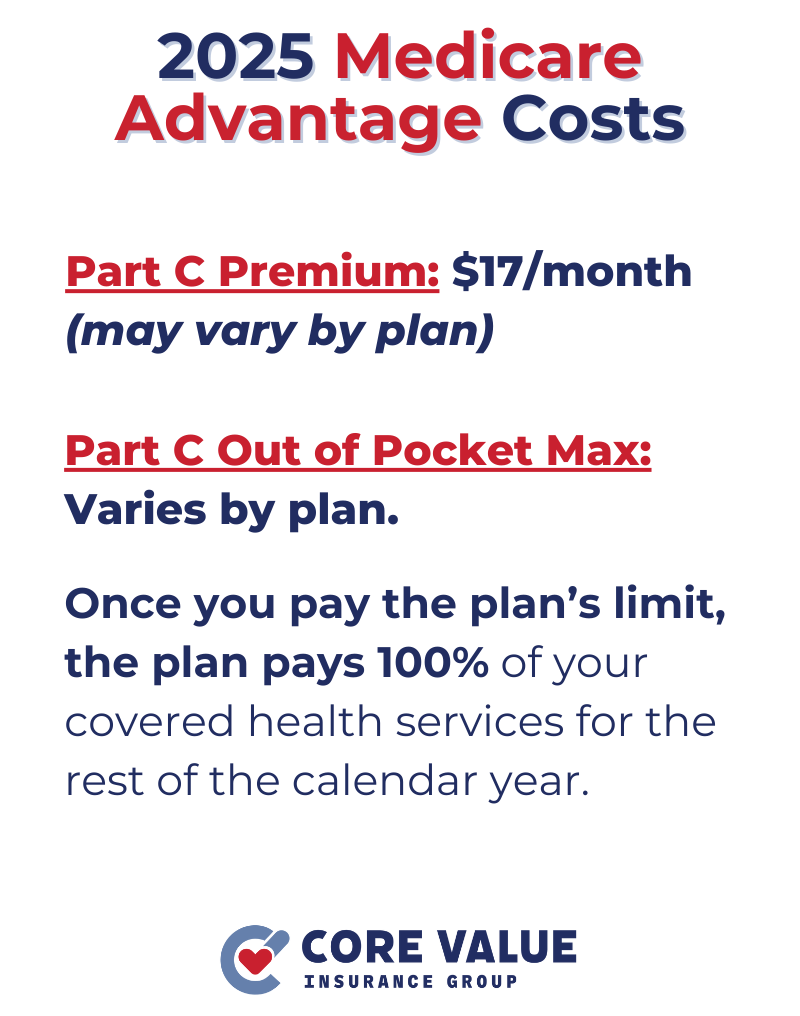

Medicare Advantage Costs

When considering Medicare Part C plans, it’s important to understand the costs associated with these plans.

In addition to the standard Medicare Part B premium, which is paid to the government, Medicare Part C plans may have their own monthly premiums. These premiums can vary depending on the plan and the coverage options it offers.

In addition to monthly premiums, you may also be responsible for copayments, deductibles, and coinsurance for various services.

- Copayments: Fixed amounts that you pay for specific services.

- Deductible: The amount you must pay before your coverage kicks in.

- Coinsurance: The percentage of costs that you are responsible for after meeting your deductible.

It’s essential to carefully review each plan’s cost structure and consider your healthcare needs when choosing a Medicare Part C plan.

Some plans may have lower monthly premiums but higher out-of-pocket costs, while others may have higher premiums but lower copayments or deductibles.

Medicare Advantage Coverage Options

Medicare Part C plans often include prescription drug coverage through Medicare Part D. This can help reduce your out-of-pocket expenses for medications.

It’s important to review each plan’s formulary (list of covered drugs) to ensure that your prescriptions are included.

In addition to prescription drug coverage, many Medicare Part C plans offer additional benefits beyond what Original Medicare provides.

These benefits may include:

- Dental care

- Vision exams

- Eyewear

- Hearing aids

- Wellness programs such as gym memberships

- Preventive health screenings

The coverage options available with each plan can vary, so it’s crucial to carefully review the details of each plan’s benefits package.

Consider your specific healthcare needs and prioritize the coverage options that are most important to you when selecting a Medicare Part C plan.

Choosing the Right Medicare Part C Plan

When selecting a Medicare Part C plan, it’s important to consider your specific healthcare needs.

- Evaluate your current health condition and any ongoing medical treatments or prescription medications you require.

- Make a list of your preferred healthcare providers, specialists, and hospitals that you would like to have in-network coverage for.

- Review the coverage options and benefits offered by different Medicare Part C plans. Consider whether the plans cover your prescription medications, offer the specialist care you need, and provide additional benefits that are important to you, such as dental or vision coverage.

- Take note of any restrictions or requirements imposed by the plans, such as referrals for specialist visits or prior authorization for certain procedures.

By carefully assessing your healthcare needs and comparing them with the coverage options available from various Medicare Part C plans, you can narrow down your choices and find a plan that aligns with your specific requirements.

Compare Medicare Advantage Carriers

Researching popular Medicare Part C carriers is another crucial step in choosing the right plan.

Some well-known carriers include Independence Blue Cross, Jefferson Health Plans, United Healthcare, Humana and many others. Look into each carrier to ensure they will be reliable partners in providing your healthcare coverage.

Compare their plan offerings to see which ones align with your healthcare needs.

Examine their networks of providers to determine if they include your preferred doctors and hospitals.

Additionally, consider customer satisfaction ratings and reviews to gauge how well each carrier serves its members.

Make an informed decision about which carrier offers the best fit for you by thoroughly compare Medicare Advantage carriers based on their:

- Plan offerings

- Provider networks

- Customer satisfaction ratings

- Overall reputation

Choosing a plan that suits your needs

Medicare Advantage offers additional benefits on top of Original Medicare.

By choosing a Medicare Part C plan that suits your healthcare needs, you can receive comprehensive coverage and enjoy the peace of mind that comes with knowing you have access to a wide range of services.

Understanding the different types of Medicare Part C plans and their coverage options is crucial in making an informed decision.

Consider factors such as your healthcare needs, preferred providers, and desired additional benefits like prescription drug coverage or dental care.

By comparing Medicare Part C carriers and their plan offerings, you can find the right combination of coverage and cost that fits your unique situation.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!