To qualify for Medicare Advantage, also known as Medicare Part C, you must meet certain eligibility requirements which we will explore in detail.

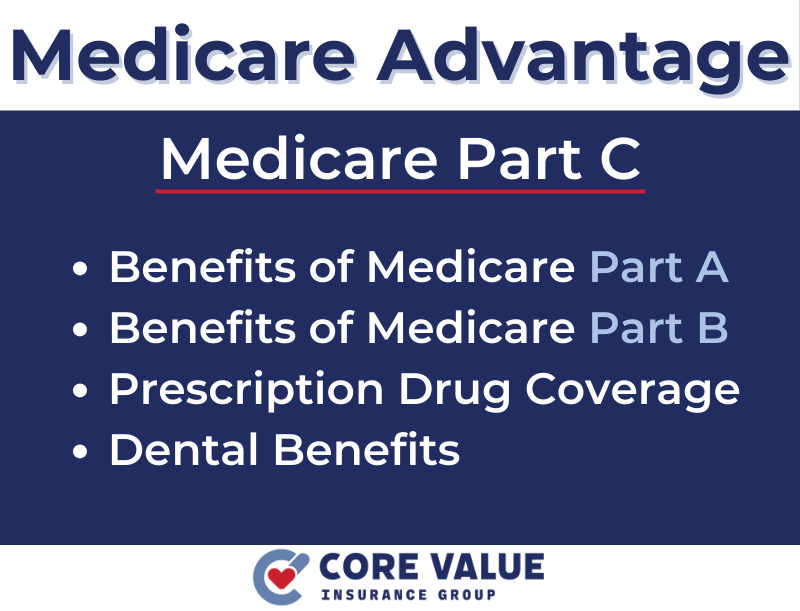

Medicare Advantage is a program that offers additional benefits beyond what is provided by Original Medicare.

It provides an alternative way to receive your healthcare coverage through private insurance companies approved by Medicare.

To qualify for Medicare Advantage, you must meet certain eligibility requirements, which we will explore in detail.

Understanding the benefits of Medicare Part C is essential in making an informed decision about your healthcare coverage.

Who Qualifies for Medicare Advantage?

Medicare Advantage offers additional benefits to those enrolled in Medicare Part A and Medicare Part B. To be eligible for Medicare Advantage, you must meet certain requirements.

Firstly, you need to be enrolled in both Medicare Part A and Medicare Part B. This ensures that you have the basic coverage provided by Original Medicare.

Additionally, you must live in the service area of the specific Medicare Advantage plan you wish to join.

Each plan has its own designated service area, so it’s important to check if your location is covered. It’s worth noting that certain health conditions may affect your eligibility for Medicare Advantage.

Some plans may have restrictions or limitations based on pre-existing conditions or specific medical needs.

However, most plans are open to individuals with various health conditions.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

When it comes to enrollment periods, there are a few key timeframes to keep in mind.

- Initial Enrollment Period (IEP): The IEP occurs when you first become eligible for Medicare, typically around the age of 65. During this period, you can enroll in a Medicare Advantage plan without any penalties or restrictions.

- Annual Enrollment Period (AEP): The AEP takes place from October 15th to December 7th each year. This is an opportunity for individuals already enrolled in Medicare to make changes to their coverage, including switching to a Medicare Advantage plan.

- Special Enrollment Periods (SEP): SEPs are available for specific circumstances such as moving out of your plan’s service area or losing other healthcare coverage. These periods provide flexibility outside of the standard enrollment windows.

Understanding these eligibility requirements and enrollment periods is crucial when considering Medicare Advantage as an option for your healthcare coverage.

The Benefits of Medicare Advantage

One of the key benefits of Medicare Advantage plans is the inclusion of prescription drug coverage.

Many plans offer this coverage as part of their package, saving you from having to enroll in a separate Medicare Part D plan.

In addition to prescription drugs, Medicare Advantage plans may also provide extra benefits like:

- Dental check-ups

- Vision exams

- Hearing coverage or hearing aids

- Fitness and wellness programs

Cost savings are another advantage of Medicare Advantage plans. Compared to Original Medicare, these plans often have lower out-of-pocket costs.

They may have lower deductibles, copayments, and coinsurance amounts for medical services.

Additionally, some Medicare Advantage plans set a maximum limit on annual out-of-pocket expenses, providing financial protection in case of significant healthcare needs.

For eligible individuals with limited financial resources, there are financial assistance programs available that can help reduce the costs associated with Medicare Advantage plans.

These programs aim to make healthcare more affordable and accessible for those who need it most.

Medigap vs. Medicare Advantage

Medigap vs. Medicare Advantage

When it comes to supplemental coverage for Medicare, there are two main options to consider:

- Medigap (Medicare Supplement) plans

- Medicare Advantage (Part C) plans

Understanding the differences between these two can help you make an informed decision about which option is right for you.

Medigap plans, also known as Medicare Supplement plans, are designed to fill the gaps in Original Medicare coverage.

These plans work alongside your existing Medicare Part A and Part B coverage, providing additional benefits such as:

- Copayments

- Deductibles

- Coinsurance

With a Medigap plan, you have the freedom to keep your Original Medicare and use the supplement plan to enhance your coverage.

However, it’s important to note that Medigap plans require a separate premium in addition to your Medicare Part B premium.

On the other hand, Medicare Advantage plans replace Original Medicare entirely. These comprehensive plans are offered by private insurance companies approved by Medicare and often include:

- Prescription drug coverage (Part D)

- Dental coverage

- Vision coverage

- Hearing coverage

With a Medicare Advantage plan, you receive all your healthcare coverage through a single plan rather than having separate parts like with Original Medicare and Medigap.

The choice between Medigap and Medicare Advantage depends on your personal preferences and healthcare needs.

If you prefer more flexibility in choosing healthcare providers and want additional financial protection from out-of-pocket costs, a Medigap plan may be suitable for you.

However, if you prefer a bundled approach with added benefits like prescription drug coverage and wellness programs, a Medicare Advantage plan might be more appealing.

Understanding the differences between Medigap and Medicare Advantage allows you to compare their features and choose the option that aligns best with your healthcare requirements.

Choosing a Medicare Advantage Plan

Choosing the right Medicare Advantage plan requires careful consideration of your healthcare needs and budget.

- Assess your specific requirements: These may be prescription drug coverage, dental or vision benefits, and any other services that are important to you. Take into account your anticipated healthcare expenses and determine what you can comfortably afford.

- Compare Medicare Advantage plans available in your area: Each plan may offer varying levels of coverage, costs, and additional benefits. Consider factors like monthly premiums, deductibles, copayments, and coinsurance amounts. Look for plans that align with your budget while providing the coverage you need.

- Review the plan’s network of doctors and hospitals: Ensure that your preferred healthcare providers are included in the plan’s network to avoid any unexpected out-of-network costs. Check if there are any restrictions on seeing specialists or obtaining referrals for certain services.

Familiarize yourself with the plan’s coverage rules and restrictions to ensure you receive appropriate care without surprises. Be aware of any prior authorization requirements for certain procedures or medications.

Additionally, some plans may have limitations on out-of-network care, so it’s important to know what options are available if you require care outside of the network.

Conclusion

Understanding the eligibility requirements and benefits of Medicare Advantage is crucial for making informed decisions about your healthcare coverage.

By comparing Medigap and Medicare Advantage, you can assess which option aligns best with your needs.

Take the time to navigate through the available Medicare Advantage plans in your area, considering factors such as coverage, costs, and network providers.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!