Medicare HMO-POS plans, also known as Health Maintenance Organization Point-of-Service Option plans, are designed to provide added flexibility and benefits to seniors.

These plans offer coverage for services that are not provided by Original Medicare, giving you access to a wider range of options.

With HMO-POS plans, you have the freedom to choose from a network of doctors and hospitals, ensuring that you receive the care you need.

It’s important to compare rates and options with licensed Medicare agents to find the right plan that suits your specific healthcare needs.

By enrolling in a Medicare HMO-POS plan, you can enjoy comprehensive senior healthcare coverage and peace of mind.

What are Medicare HMO-POS Plans?

Medicare HMO-POS plans are a type of Medicare Advantage plan that provides additional coverage and benefits to seniors.

These plans function as an alternative to Original Medicare, offering a comprehensive package that includes hospital insurance (Part A) and medical insurance (Part B), along with benefits not covered by Original Medicare.

Understanding the Basics

HMO-POS plans are designed to provide seniors with access to a network of doctors and hospitals.

The primary difference between these plans and Original Medicare is the emphasis on managed care.

With HMO-POS plans, you must choose a primary care physician (PCP) from within the plan’s network. Your PCP will coordinate your healthcare services and refer you to specialists when necessary.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

One of the key benefits of Medicare HMO-POS plans is the coverage for services not provided by Original Medicare. These can include:

- Prescription drug coverage (Part D)

- Vision care

- Dental care

- Hearing aids

- Wellness programs

By enrolling in a Medicare HMO-POS plan, you can enjoy comprehensive senior healthcare coverage tailored to your specific needs.

Key Features and Flexibility

Medicare HMO-POS plans offer several key features that provide flexibility in managing your healthcare:

- Choosing from a network of doctors and hospitals: With HMO-POS plans, you have access to a network of healthcare providers who have agreed to provide services at negotiated rates. This allows you to receive care from specialists within the network without needing referrals from your PCP.

- Out-of-network coverage and associated costs: While most services should be obtained within the plan’s network, there may be situations where you need care outside of the network. HMO-POS plans typically offer some level of out-of-network coverage; however, it’s important to note that costs for out-of-network care may be higher.

- Prescription drug coverage: HMO-POS plans often include prescription drug coverage through Medicare Part D. This means you can have your medications covered under the same plan, providing convenience and potentially cost savings.

By understanding these key features and the flexibility they offer, you can make an informed decision about enrolling in a Medicare HMO-POS plan that aligns with your healthcare needs.

Comparing Medicare HMO-POS and PPO Plans

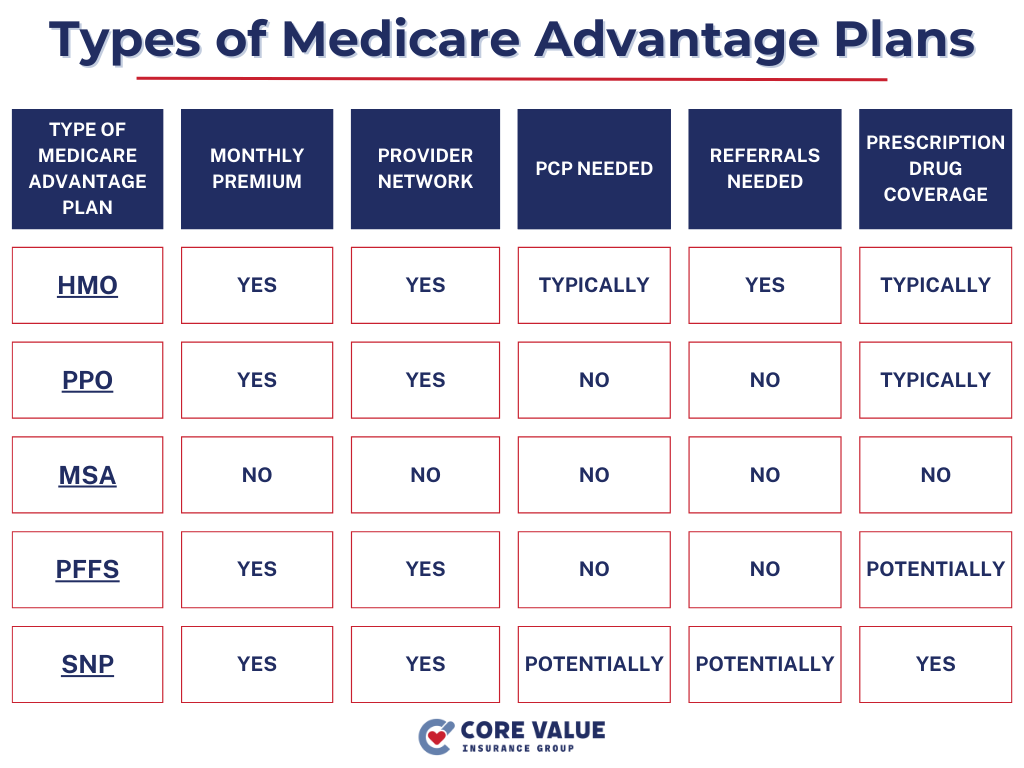

Medicare offers different types of Advantage plans, including HMO-POS plans and Preferred Provider Organization (PPO) plans.

Understanding the differences between these two options can help you make an informed decision about your senior healthcare coverage.

Medicare PPO plans

PPO plans are another type of Medicare Advantage plan that allows you to choose any healthcare provider, whether they are in-network or out-of-network.

This means you have more flexibility in selecting doctors and hospitals compared to HMO-POS plans.

Network restrictions and flexibility

HMO-POS plans typically require you to choose a primary care physician (PCP) from within the plan’s network.

Your PCP will coordinate your care and provide referrals to specialists within the network.

On the other hand, PPO plans allow you to see any doctor or specialist without needing a referral, giving you greater freedom in choosing healthcare providers.

Cost considerations and coverage options

Both HMO-POS and PPO plans have their own cost structures:

- HMO-POS Plans: Often have lower monthly premiums but may require higher copayments for certain services.

- PPO Plans: Generally have higher monthly premiums but offer more flexibility in terms of out-of-network coverage.

When comparing these two types of plans, it’s important to consider factors such as your budget, anticipated healthcare needs, preferred doctors or hospitals, and prescription drug coverage.

Choosing the Right Plan

When deciding between Medicare HMO-POS and PPO plans, it’s essential to assess your healthcare needs and preferences.

Consider factors like:

- Cost

- Network coverage

- Out-of-network options

- Prescription drug coverage

- Any specific medical conditions or treatments you may require

Consulting with licensed Medicare agents, like those at CVIG, can provide personalized guidance and help you navigate the complexities of Medicare Advantage plans.

They can assist in comparing rates, coverage options, and network availability to find the plan that best suits your needs.

The HMO-POS Enrollment Process

Enrolling in a Medicare Health Maintenance Organization Point-of-Service Option plan is an important step in securing your senior healthcare coverage.

Understanding the enrollment process and available options can help you make informed decisions about your healthcare.

Enrollment Periods

There are several enrollment periods to be aware of when considering Medicare HMO-POS plans:

- Initial Enrollment Period (IEP): The IEP is the initial period when you first become eligible for Medicare.

- Annual Enrollment Period (AEP): The AEP occurs annually from October 15th to December 7th, during which you can make changes to your Medicare Advantage plan.

- Special Enrollment Periods (SEP): SEPs allow individuals to enroll in or switch Medicare Advantage plans outside of the IEP or AEP.

Qualifying circumstances may include moving out of your plan’s service area, losing employer coverage, or qualifying for Medicaid.

It’s crucial to understand these enrollment periods and their associated deadlines to ensure timely enrollment in a Medicare HMO-POS plan.

Enrollment Options and Resources

When it comes to enrolling in Medicare HMO-POS plans, there are various options and resources available:

- Enrolling through the Medicare website or by phone: You can visit the official Medicare website or call their toll-free number to enroll in a plan. The online enrollment process is straightforward, allowing you to compare different plans based on your location and specific needs.

- Working with licensed Medicare agents for personalized assistance: Licensed Medicare agents can provide valuable guidance throughout the enrollment process. They have expertise in navigating the complexities of Medicare Advantage plans and can help you find a suitable HMO-POS plan that aligns with your healthcare needs.

By utilizing these enrollment options and resources, you can ensure a smooth and hassle-free process when enrolling in Medicare HMO-POS plans.

Choosing the Best Plan for Your Needs

When it comes to selecting a Medicare HMO-POS plan, it’s important to consider your unique healthcare needs, budget, and preferences.

Take the following steps to make an informed decision:

- Consider your healthcare needs: Assess your current health conditions, medications, and any specific treatments or services you may require. This will help you determine which plan offers the most comprehensive coverage for your individual needs.

- Compare rates, coverage options, and network availability: Research different Medicare HMO-POS plans and compare their rates, coverage options, and network availability. Look for plans that align with your budget while offering the necessary benefits and access to preferred doctors or hospitals.

- Consult with licensed Medicare agents: Licensed Medicare agents, like those at Core Value Insurance Group, can provide personalized guidance and assistance throughout the selection process.

By considering these factors and seeking professional advice when needed, you can choose the best Medicare HMO-POS plan that provides comprehensive senior healthcare coverage tailored to your specific needs.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!