Medigap Plan A, also known as Medicare Supplement Plan A, is a comprehensive insurance plan that provides coverage for the out-of-pocket expenses of Original Medicare.

Let’s cover the core benefits, coverage, and cost factors associated with Medigap Plan A.

By understanding the intricacies of this plan, you can make an informed choice regarding your healthcare coverage.

Additionally, we will compare different carriers offering Medigap Plan A to help you find the one that best suits your needs.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Plan A Benefits and Coverage

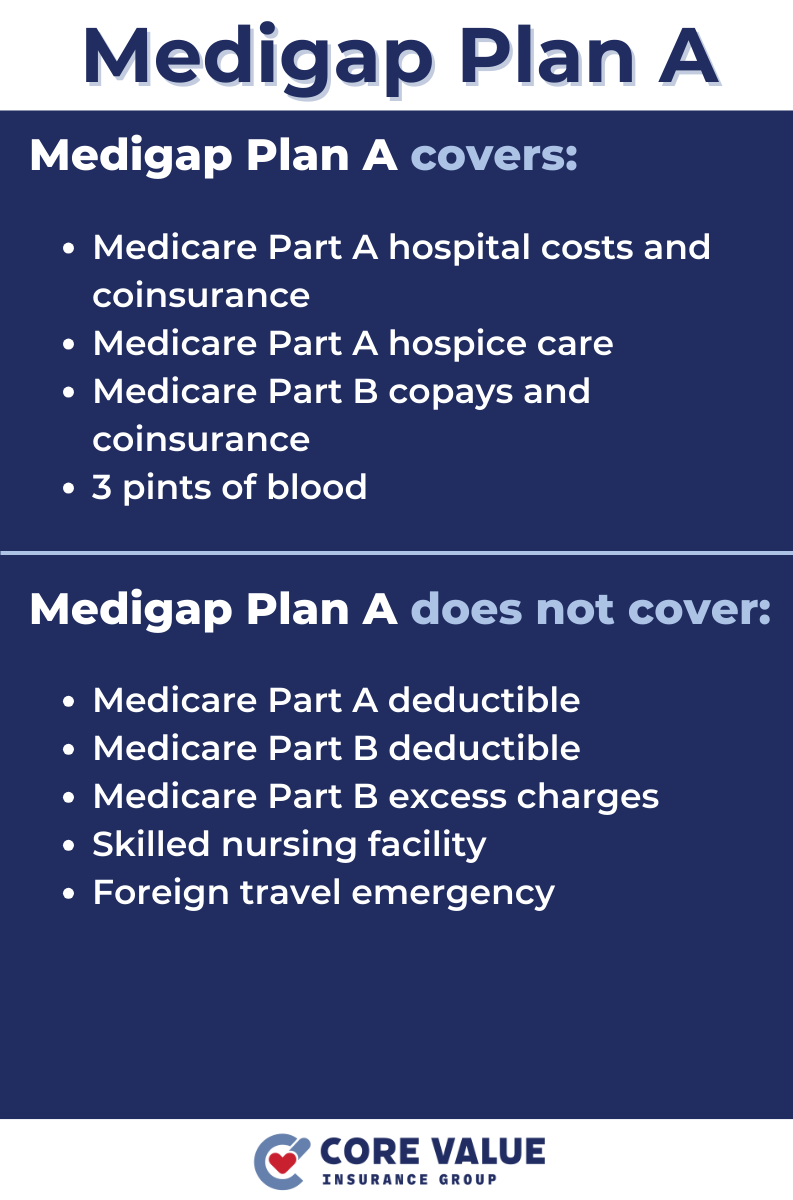

Medicare Supplement Plan A offers comprehensive coverage for various out-of-pocket expenses that are not covered by Original Medicare.

By enrolling in Medigap Plan A, you can alleviate the financial burden of deductibles, coinsurance, and copayments associated with your medical care.

Plan A coverage ensures that you receive the necessary treatment without worrying about excessive costs.

This plan includes coverage for the first three pints of blood needed for a medical procedure. This benefit can be particularly valuable in emergency situations or for individuals who require regular blood transfusions.

One of the significant advantages of Medicare Supplement Plan A is its nationwide coverage.

Regardless of where you are in the United States, you can access healthcare services without any geographical restrictions.

Additionally, this plan allows you to choose any healthcare provider who accepts Medicare patients.

You have the freedom to consult with specialists without obtaining referrals from primary care physicians.

Advantages and Disadvantages

When considering Medigap Plan A, it’s essential to weigh its advantages and disadvantages to make an informed decision about your healthcare coverage.

Advantages of Medigap Plan A

One of the significant advantages of Plan A is that it provides basic coverage at a lower premium compared to other plans.

This can be beneficial if you’re looking for a more affordable option while still receiving essential coverage for your medical expenses.

Plan A offers predictable out-of-pocket costs, making budgeting for healthcare easier. You’ll have a clear understanding of your financial responsibility without unexpected surprises.

Another advantage is that with Medigap Plan A, you are not restricted by network limitations.

You have the freedom to choose any healthcare provider who accepts Medicare patients.

This flexibility allows you to receive care from providers you trust or prefer, ensuring that you have access to quality healthcare services.

Disadvantages of Medicare Supplement Plan A

It’s important to note that Medicare Supplement Plan A has limited coverage and may not cover all your healthcare needs.

For example, it does not include coverage for prescription drugs, dental care, vision care, or hearing aids.

If these services are crucial for you, you may need to explore other Medigap plans or alternative insurance options that provide more comprehensive coverage.

Additionally, premiums for Medigap Plan A may increase over time. It’s important to consider this potential cost escalation when budgeting for your healthcare expenses in the long run.

Furthermore, Medigap Plan A does not include additional benefits like fitness programs or wellness incentives that some other plans offer.

Monthly Premiums and Cost Factors

When considering Medigap Plan A, it’s crucial to evaluate the monthly premiums and various cost factors that can impact your overall expenses.

Monthly Premiums

Several factors can influence the monthly premium of Medigap Plan A:

- Where you live

- Age

- Gender

- Tobacco use

Younger individuals may have higher premiums compared to older beneficiaries due to their potentially longer coverage period.

It’s essential to compare prices among different insurance carriers offering Medigap Plan A.

Premiums may vary between carriers based on their pricing strategies and other factors.

Average Monthly Premiums for Medigap Plan A

The average monthly premium for Medigap Plan A typically ranges from $100 to $200.

However, it’s important to note that individual premiums may vary based on specific circumstances and factors mentioned earlier.

Generally, younger beneficiaries tend to have higher premiums compared to older individuals who may benefit from lower rates.

Insurance carriers may offer discounts or incentives that can affect the premium cost as well.

It’s advisable to explore these options and consider any potential savings or benefits offered by different carriers before making a decision.

Choosing Carriers and Making an Informed Choice

When it comes to choosing a carrier for Medicare Supplement Plan A, it’s important to analyze and compare the options available to make an informed decision.

Comparing Carriers Offering Medigap Plan A

Start by conducting thorough research and comparing different insurance carriers that offer Medigap Plan A.

Consider factors such as:

- Reputation

- Customer service

- Financial stability

Look for carriers with a strong track record of providing reliable coverage and excellent customer support.

Reading reviews from other policyholders can also provide valuable insights into the experiences of others.

Carrier Networks and Accessibility

As you evaluate carriers, it’s crucial to check if your preferred healthcare providers are in the network of each carrier.

Ensure that the carrier provides coverage for the doctors, hospitals, and specialists you trust or prefer.

Consider the accessibility of providers within each carrier’s network and assess how easy it is to find in-network doctors near your location.

Additionally, verify that the carrier offers coverage in your desired geographic area. Some carriers may have limitations on coverage based on specific regions or states.

It’s essential to confirm that the carrier operates in your area before making a decision.

By carefully analyzing different carriers offering Medigap Plan A and considering factors like reputation, customer service, network accessibility, and geographic coverage, you can make an informed choice that aligns with your healthcare needs.

Making the Right Decision

In conclusion, Medigap Plan A offers valuable coverage for the out-of-pocket expenses of Original Medicare.

Before choosing this plan, it’s important to carefully consider its advantages, disadvantages, and cost factors.

Assess your healthcare needs and budget to determine if Medigap Plan A aligns with your requirements.

Comparing different carriers offering Medigap Plan A is crucial in finding the one that best suits your healthcare needs.

Consider factors such as reputation, customer service, and network accessibility when making your decision.

By taking these factors into account and making an informed choice, you can ensure that you have the right coverage in place to protect yourself from unexpected medical expenses.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!