Medicare Supplement Plan B, also known as Medigap Plan B, is designed to provide additional coverage for costs that are not covered by Original Medicare.

While Original Medicare covers many healthcare expenses, there are still gaps in coverage that can leave beneficiaries responsible for out-of-pocket costs.

Plan B aims to bridge these gaps by offering coverage for the Medicare Part A hospital deductible and the 20% coinsurance for Medicare Part B services.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

What is Medigap Plan B?

Medigap Plan B is a supplemental insurance plan that helps fill the gaps in coverage left by Original Medicare.

The Medicare Part A hospital deductible is an annual amount that beneficiaries pay before their Part A coverage kicks in.

With Plan B, this deductible is covered, saving you from significant out-of-pocket expenses.

Medigap Plan B covers the 20% coinsurance for Medicare Part B services.

This means that instead of paying the full 20% of your medical services out of pocket, Plan B will cover this portion.

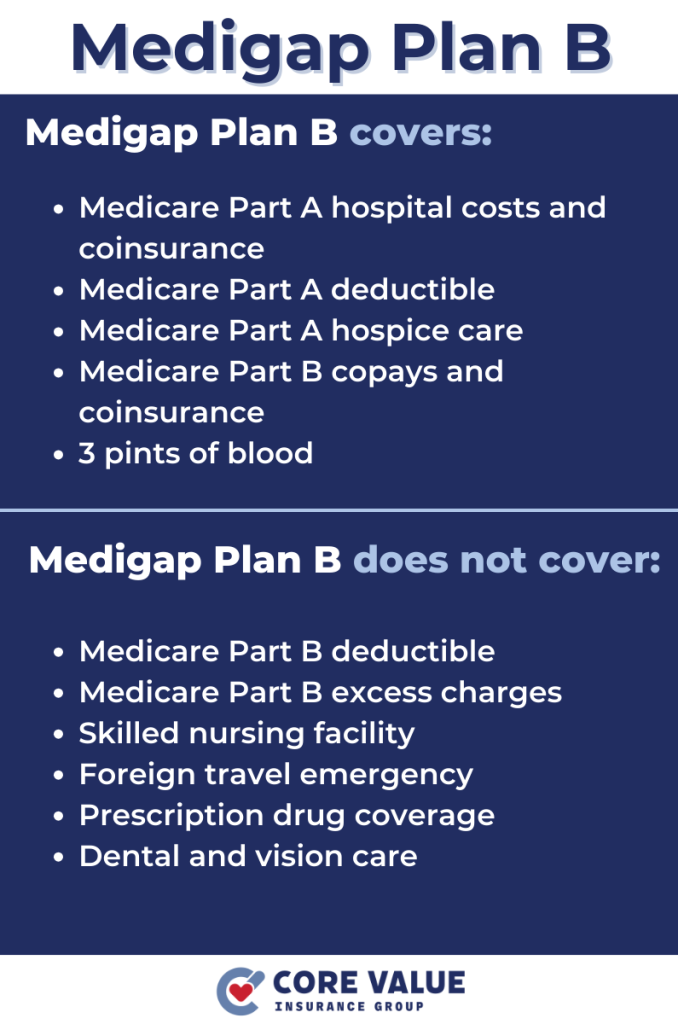

Coverage and Benefits

Medicare Supplement Plan B offers valuable coverage and benefits to enhance your healthcare coverage.

With Plan B, you can have confidence knowing that your hospital deductible under Medicare Part A will be taken care of.

This can save you a significant amount of money if you require hospitalization.

Having coverage for the 20% coinsurance ensures that you won’t face excessive out-of-pocket costs when receiving medical care.

Medigap Plan B Benefits

One of the key benefits is that it covers the Medicare Part A hospital deductible.

This deductible is an annual amount that beneficiaries must pay before their Medicare Part A coverage kicks in.

By having Plan B, you can save significant out-of-pocket expenses by having this deductible covered.

Another important benefit of Medigap Plan B is its coverage for the 20% coinsurance for Medicare Part B services.

Original Medicare typically covers 80% of the approved amount for medical services, leaving beneficiaries responsible for the remaining 20%.

With this plan, cost-sharing for Medicare Part B is taken care of, providing you with financial protection and reducing your healthcare costs.

Costs of Medigap Plan B

The costs associated with Medicare Supplement Plan B can vary depending on factors such as age, location, and insurance company.

One cost to consider is the monthly premium, as insurance companies set their own premiums for these plans.

Therefore, it’s essential to shop around and find a plan that offers competitive pricing while still providing the coverage you need.

While this plan covers many expenses not covered by Original Medicare, there may still be certain costs that you are responsible for paying.

How to Enroll in Medigap Plan B

To enroll in Medicare Supplement Plan B, you must first be enrolled in both Medicare Part A and Part B.

Once you have these two parts of Medicare coverage, you can apply for Medigap Plan B through private insurance companies that offer it in your state.

When to Enroll

The best time to enroll in Medigap Plan B is during your Medigap Open Enrollment Period.

This period starts on the first day of the month when you’re 65 years old or older and enrolled in Medicare Part B.

During this period, insurance companies cannot deny you coverage or charge you higher premiums based on your health status.

It’s crucial to take advantage of this open enrollment period because once it ends, insurance companies may impose medical underwriting and can consider pre-existing conditions when determining your eligibility for coverage.

If you miss this window, there is no guarantee that you will be able to enroll in Medigap Plan B at a later date without facing potential limitations or higher costs.

By understanding how and when to enroll in Medicare Supplement Plan B, you can ensure a smooth enrollment process and secure the additional coverage provided by this plan.

Healthcare Coverage with Medigap Plan B

Medicare Supplement Plan B plays a crucial role in enhancing your healthcare coverage by providing additional coverage for costs not covered by Original Medicare.

By understanding the benefits, costs, and enrollment process of Medicare Supplement Plan B, you can make informed decisions about your healthcare coverage.

With Plan B, you can bridge the gaps in Original Medicare and ensure that you have the necessary coverage to meet your healthcare needs.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!