Medicare Supplement Plan C, also known as Medigap Plan C, offers extensive coverage for Medicare-approved expenses.

This plan is crucial for Medicare beneficiaries and individuals approaching Medicare eligibility.

By enrolling in Plan C, you can reduce out-of-pocket costs associated with deductibles, copays, and coinsurance.

It provides peace of mind and financial protection against unexpected medical expenses.

To ensure you find the best fit for your healthcare needs and budget, it’s important to compare premiums from top-rated carriers offering Medicare Supplement Plan C.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Coverage for Medicare-Approved Expenses

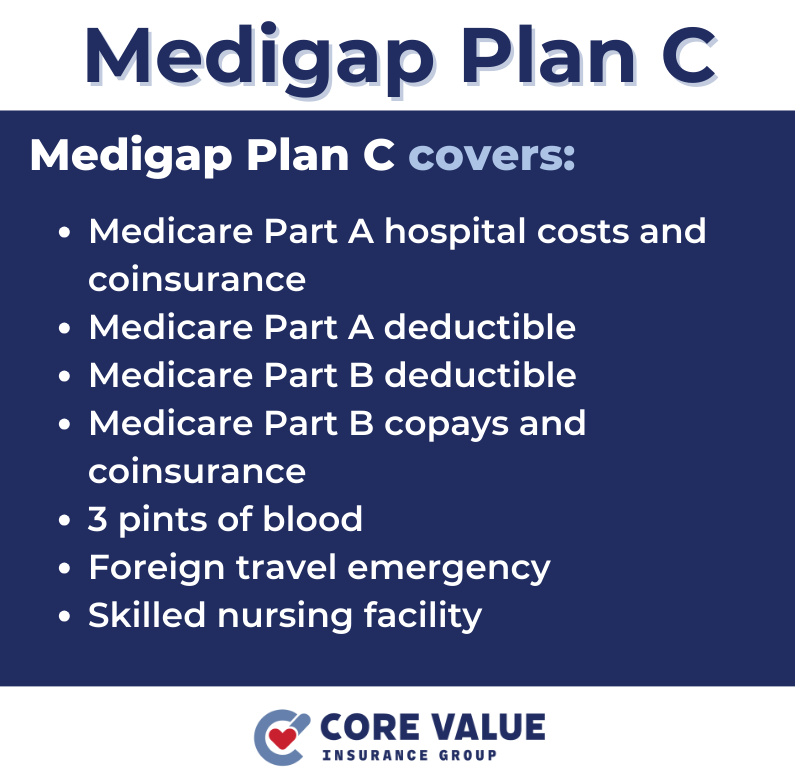

Medicare Supplement Plan C provides comprehensive coverage for a wide range of Medicare-approved expenses.

This includes coverage for deductibles, copays, and coinsurance, which can significantly reduce your out-of-pocket expenses.

One of the key benefits of Plan C is its suitability for individuals who frequently visit doctors or healthcare providers.

With this plan, you can have peace of mind knowing that a significant portion of your medical costs will be covered.

If you reside in a state that doesn’t allow excess charges, Plan C can be particularly beneficial as it covers those charges.

Another advantage of comprehensive coverage is that it extends to medical expenses incurred while traveling overseas.

This means that if you require medical attention while abroad, your Plan C coverage can help alleviate the financial burden.

Who Can Enroll in Medicare Supplement Plan C?

Medicare beneficiaries who were eligible for Medicare Supplement Plan C before January 1, 2020, can still enroll in this plan.

However, it’s important to note that new Medicare enrollees are not eligible for Plan C.

Understanding the eligibility criteria is crucial to determine if you qualify for this coverage option.

Considerations for Enrollment

Before enrolling in Medicare Supplement Plan C, it’s essential to evaluate your healthcare needs and compare them with the coverage offered by this plan.

Consider factors such as:

- Frequency of doctor visits

- State regulations on excess charges

- International travel plans

By assessing your specific requirements, you can determine if Plan C aligns with your healthcare needs.

To make an informed decision about enrollment, consulting with a Medicare Insurance Agent, like those at Core Value Insurance Group, is highly recommended.

CVIG can provide personalized guidance based on your individual circumstances and help you understand if Medicare Supplement Plan C is the right choice for you.

Understanding the Cost of Medicare Supplement Part C

The average monthly cost of Medigap Plan C can vary based on several factors, including:

- Age

- Gender

- Location

Insurance carriers offering Plan C may also have different premium rates.

It is important to have a clear understanding of the cost structure to effectively budget and make an informed decision.

Factors Affecting Monthly Costs

Age and gender are two significant factors that can impact the monthly premium for Medigap Plan C.

Generally, older individuals may have higher premiums compared to younger ones.

Additionally, some insurance carriers may consider gender as a factor when determining the cost.

Location plays a role in determining the monthly costs of Medigap Plan C due to regional pricing differences.

Premiums can vary from one geographic area to another, so it’s important to consider your specific location when estimating costs.

To find the most cost-effective option for Medigap Plan C, it is crucial to compare premiums from multiple insurance carriers.

By doing so, you can identify potential savings and choose a plan that best fits your budget while providing comprehensive coverage.

Choosing a Carrier for Medicare Supplement Plan C

When selecting a carrier for your Medicare Supplement Plan C, it’s important to research and compare ratings and reviews of insurance carriers offering this plan.

Look for carriers with high customer satisfaction ratings, as this indicates their commitment to providing quality service.

Additionally, consider the carrier’s financial stability and reputation in the industry. Choosing a top-rated carrier ensures reliable coverage and access to quality customer service when you need it.

Evaluating Carrier Networks

Another crucial aspect to consider is the carrier’s network of healthcare providers.

Check if the carrier has a wide network of doctors, hospitals, and specialists in your area.

It’s essential to ensure that your preferred healthcare providers accept coverage from the carrier you choose.

Access to a robust network ensures that you can receive seamless healthcare services without any disruptions or limitations.

By thoroughly researching carriers and evaluating their networks, you can make an informed decision about which carrier is the right fit for your Medicare Supplement Plan C.

Medicare Supplement Plan C Recap

Understanding the coverage, eligibility, and costs associated with Medicare Supplement Plan C is crucial for individuals considering this option.

By comparing premiums from top-rated carriers, you can find the best fit for your healthcare needs and budget.

It’s also beneficial to consult with us to provide personalized guidance based on your specific circumstances.

With their expertise, you can make an informed decision about whether Medicare Supplement Plan C is the right choice for you.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!