Medicare Supplement Plan M, also known as Medigap Plan M, offers a range of advantages for seniors and Medicare beneficiaries.

This comprehensive plan provides coverage for:

- Copayments

- Coinsurance

- Foreign travel emergency care

- First three pints of blood

By unlocking the benefits of Plan M, individuals can enjoy peace of mind knowing that their out-of-pocket expenses are minimized.

Whether you require medical services within the United States or during international travel, Medigap Plan M ensures that you have access to quality healthcare coverage.

Let’s dive deeper into the details of this plan and discover how it can benefit you.

The Benefits of Medicare Supplement Plan M

Plan M offers a range of benefits that provide individuals with comprehensive healthcare coverage.

Let’s explore two key benefits of this plan:

- Coverage for copayments and coinsurance

- Foreign travel emergency care

Copayments and Coinsurance Coverage

Medigap Plan M covers copayments and coinsurance, which are common out-of-pocket expenses that can add up quickly.

With this coverage, individuals can enjoy financial peace of mind knowing that these expenses are taken care of.

Whether it’s a doctor’s visit or a hospital stay, Medigap Plan M ensures that you won’t have to worry about paying copayments or coinsurance fees.

This allows you to focus on your health without the added stress of unexpected medical bills.

Foreign Travel Emergency Care

One of the standout features of Plan M is its coverage for foreign travel emergency care.

If you’re planning to travel abroad, having adequate medical coverage is essential.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Medigap Plan M provides coverage for emergency medical services during foreign travel, ensuring that you’re protected in case of unexpected medical expenses while outside the United States.

This benefit offers peace of mind and allows you to enjoy your travels without worrying about potential healthcare costs.

By choosing Medigap Plan M, individuals gain access to valuable medical benefits and comprehensive health coverage.

Whether it’s covering copayments and coinsurance or providing protection during international trips, this plan offers peace of mind and financial security.

Medicare Supplement Plan M Cost-sharing

Plan M follows a cost-sharing structure, which means that you will be responsible for sharing some of the healthcare expenses.

However, the out-of-pocket expenses are typically lower compared to other plans.

With Medicare Supplement Plan M, you’ll have coverage for copayments and coinsurance, but you’ll need to pay a portion of these costs yourself.

This shared responsibility helps keep monthly premiums lower while still providing essential coverage.

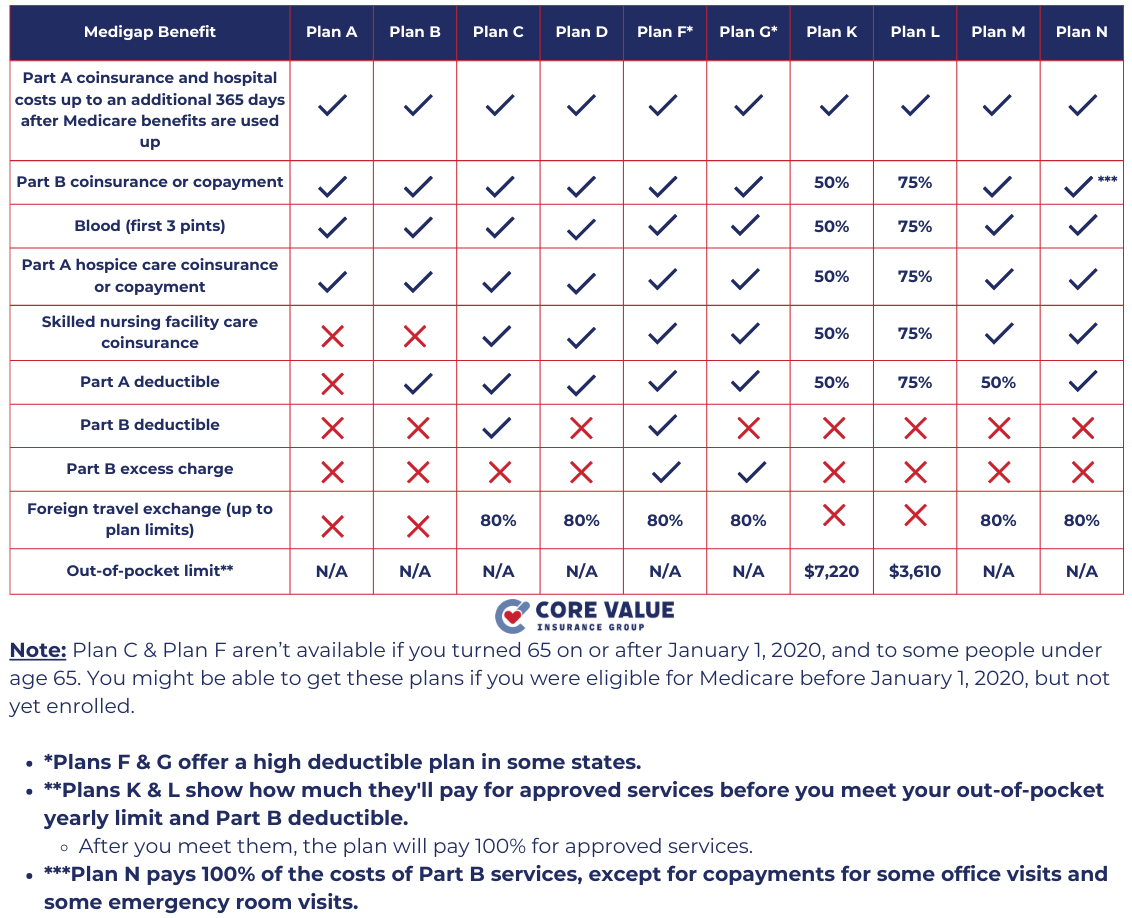

Comparing Medigap Plans

When comparing Medigap plans, it’s important to evaluate the differences in coverage and cost.

Each plan offers varying levels of benefits and has its own pricing structure.

By exploring different options, you can determine which plan best suits your needs and budget.

Consider factors such as:

- Deductibles

- Copayments

- Coinsurance rates

- Additional benefits offered by each plan

It’s crucial to carefully review the details of each Medigap plan before making a decision.

Take into account your healthcare needs and financial situation when comparing the available options.

Choosing Medicare Supplement Plan M

When it comes to finding carriers that offer Medigap Plan M, there are a few steps you can take to ensure you have access to the coverage you need.

Locating Carriers that Offer Plan M

Start by conducting an online search for insurance carriers that provide Medigap Plan M.

Visit their websites and gather information about their offerings, including coverage details and pricing.

- Contact your state’s insurance department: Reach out to your state’s insurance department or regulatory agency for a list of approved carriers in your area. They can provide valuable resources and guidance on finding reputable carriers.

- Seek recommendations: Talk to friends, family members, or healthcare professionals who have experience with Medigap plans. They may be able to recommend reliable carriers that offer Medigap Plan M.

- Consult with an insurance agent: Consider working with an insurance agency like Core Value Insurance Group, who specializes in Medicare plans. They can help navigate the options available in your area and provide personalized recommendations based on your specific needs.

By following these steps, you can locate carriers that offer Medigap Plan M and ensure you have access to the coverage you need for your healthcare expenses.

Medicare Supplement Plan M Recap

To make an informed decision about Medicare Supplement Plan M, it’s essential to evaluate the benefits and costs associated with this plan.

Consider your healthcare needs and financial situation when comparing Medicare Supplement plan options. Assess the coverage provided by Plan M, including:

- Copayments

- Coinsurance

- Foreign travel emergency care

- Blood coverage

Take into account the cost-sharing structure and compare it with other available plans.

By carefully considering these factors, you can choose the Medigap plan that best suits your requirements and provides the necessary coverage for your healthcare expenses.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!