Medicare Supplement plans, also known as Medigap, provide additional coverage to help fill the gaps in Original Medicare.

To ensure your Medicare Supplement eligibility, you need to meet certain requirements.

This section will guide you through the eligibility criteria for Medicare Supplement plans and explain how they can help cover out-of-pocket costs.

By understanding the eligibility requirements for Medigap, you can determine if you qualify and explore your options for obtaining additional coverage.

Eligibility at Age 65 and Older

As you reach the age of 65, understanding the eligibility criteria for becomes crucial.

It is important to enroll in both Medicare Part A and Part B to be eligible for Medigap coverage.

Your eligibility for a Medicare Supplement plan may vary depending on your enrollment in Medicare Part A and Part B.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

To be eligible for Medicare Supplement Plans at age 65 and older, you must meet certain criteria. These include:

- Being enrolled in both Medicare Part A

- Being enrolled in both Medicare Part B

- Residing within the plan’s service area

Enrolling in Part A and Part B is essential because Medigap plans are designed to supplement these original Medicare benefits.

Determining Your Medicare Supplement Eligibility

To determine your eligibility for a Medicare Supplement plan, you can check with your local Social Security office or use the online resources provided by the Centers for Medicare & Medicaid Services (CMS).

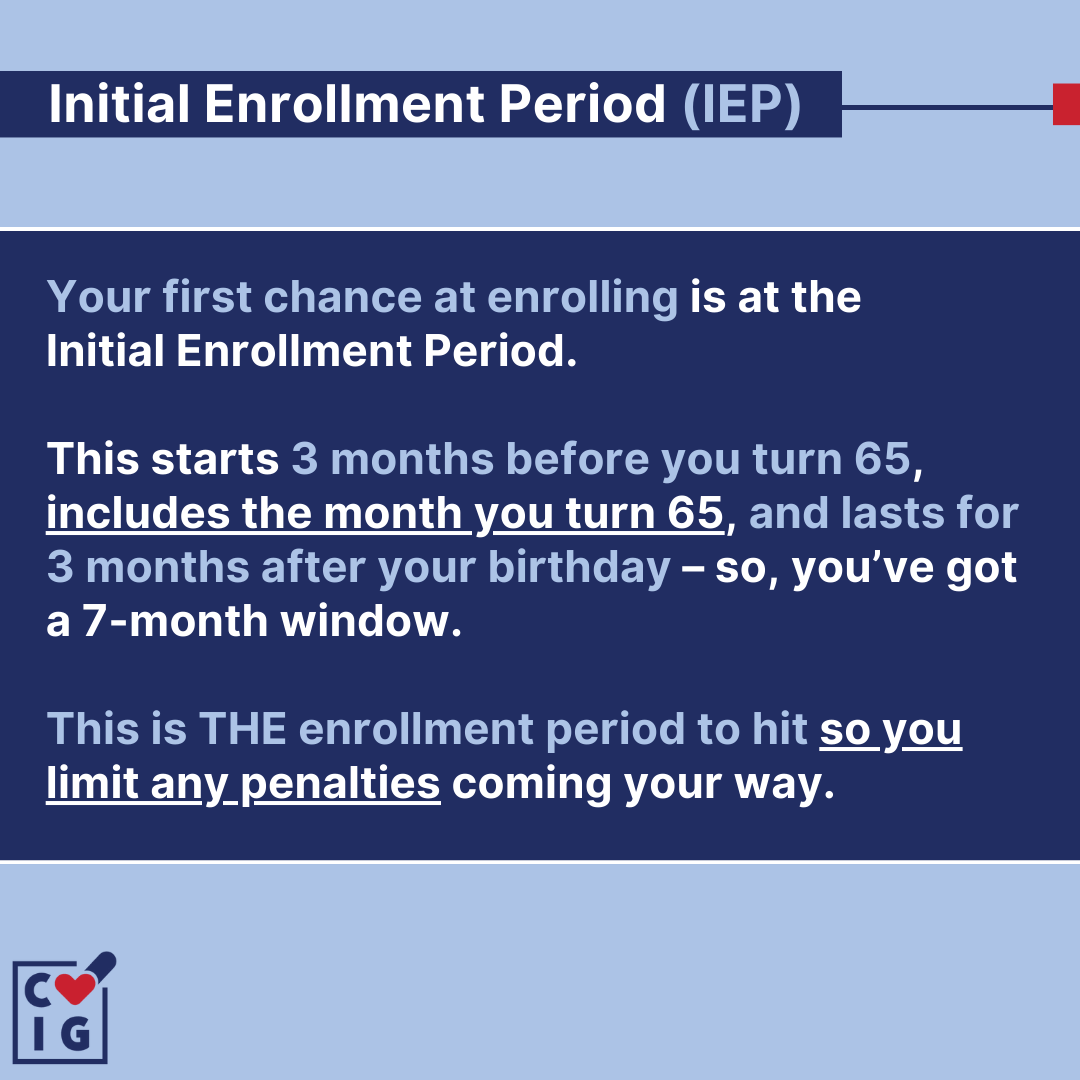

It is important to be aware of the Initial Enrollment Period (IEP), which starts six months from when you turn 65 or enroll in Part B—whichever comes later.

Missing the Initial Enrollment Period may limit your options, but there are still alternatives available if you find yourself outside of this timeframe.

Remember that understanding your eligibility requirements is essential when considering Medicare Supplement.

By enrolling in both Medicare Part A and Part B at age 65 or older, you can explore various Medigap options that best suit your healthcare needs.

Medigap Options for Those Under 65

While Medicare Supplement plans are typically designed for individuals who are 65 and older, there are also options available for those under 65.

In this section, we will explore the eligibility criteria for individuals under 65 and discuss the circumstances under which they may be eligible for Medigap coverage.

Medicare Supplement Eligibility for Those Under 65

The eligibility criteria for Medicare Supplement differ slightly for individuals under 65.

Generally, those who qualify include individuals with certain disabilities or medical conditions.

It is important to understand the specific eligibility requirements set by insurance providers in your state. By meeting these criteria, you can explore the availability of plans tailored to your needs.

Alternative Coverage Options for Those Under 65

If you are not eligible for Medicare Supplement, there are alternative healthcare coverage options to consider.

One such option is Medicaid, a joint federal and state program that provides healthcare coverage to low-income individuals and families.

Medicaid offers comprehensive benefits that can help cover medical expenses.

Additionally, it is essential to navigate through other healthcare options if you do not meet the eligibility criteria for Medicare Supplement or Medicaid.

This may involve exploring private health insurance plans or seeking assistance from local healthcare resources.

Remember that while Medicare Supplement primarily caters to those aged 65 and older, there are options available for individuals under 65 as well.

Medicare Supplement Enrollment Periods

When it comes to enrolling in Medigap, it’s important to understand the different enrollment periods available and how to make changes to your coverage during these periods.

Understanding Medicare Supplement Enrollment Periods

There are specific enrollment periods that allow you to sign up for or make changes to your Medicare Supplement plan.

The Initial Enrollment Period (IEP) is a crucial time when you first become eligible for Medicare.

During this period, you have guaranteed issue rights, meaning insurance companies cannot deny you coverage or charge higher premiums based on pre-existing conditions.

It’s important to take advantage of this period to secure the Medigap plan that best suits your needs.

Additionally, there is an Open Enrollment Period where you can make changes to your Medicare Supplement plan each year.

This period typically lasts for six months and begins on the first day of the month in which you turn 65 or enroll in Part B.

During this time, you have the opportunity to switch plans or providers without medical underwriting.

Medigap Special Enrollment Periods

In certain situations, you may qualify for a Special Enrollment Period (SEP) outside of the other enrollment periods. These circumstances include:

- Losing employer-sponsored health coverage

- Moving out of your plan’s service area

- Other specific qualifying events

Special enrollment periods provide time-limited opportunities for individuals to enroll in or make changes to their Medicare Supplement plan.

By staying informed about these opportunities, you can ensure that you have access to the Medigap coverage that meets your healthcare needs.

Key Takeaways

Understanding the eligibility requirements for Medicare Supplement is crucial when considering additional coverage options.

To be eligible for Medigap, it is important to enroll in:

- Medicare Part A

- Medicare Part B

By meeting these requirements, you can explore various Medicare Supplement Plans that best suit your healthcare needs.

This will provide a solid foundation for accessing additional benefits and reducing out-of-pocket costs.

When exploring your options, make informed decisions based on your eligibility and healthcare needs.

Take into account factors such as cost, coverage, and provider networks to find the right Medicare Supplement plan that aligns with your specific requirements.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!