Are you approaching the age of 65 or wondering if you qualify for Medicare due to a disability?

Understanding Medicare eligibility is crucial to accessing healthcare benefits. Medicare eligibility refers to meeting the requirements necessary to qualify for Medicare coverage.

It is important to understand these criteria in order to access the healthcare benefits provided by Medicare.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

If you are turning 65 years old, you may be eligible for Medicare based on your age.

Alternatively, if you have a disability, you may also qualify for Medicare before reaching the age of 65.

Whether you are approaching Medicare age yourself, have a disability, or are a caregiver assisting someone, understanding the key criteria and enrollment process is essential.

Meeting the Age Criteria

As you approach the age of 65, it becomes important to understand the age criteria for Medicare eligibility.

Turning 65 is a significant milestone as it makes you eligible for Medicare, which provides essential healthcare benefits.

Medicare coverage is not limited to individuals who are 65 years old or older. If you have a disability, you may qualify for Medicare before reaching the age of 65.

This allows younger individuals with disabilities to receive necessary healthcare services and support.

It’s important to learn about the specific requirements for Medicare coverage if you’re under 65 and have a disability.

Whether you’re approaching Medicare age yourself or assisting someone in their enrollment process, being aware of these age requirements will help you navigate the system more effectively.

Qualifying for Medicare with Disabilities

For individuals with disabilities, Medicare provides essential healthcare benefits.

Understanding the disability qualifications for Medicare is crucial to accessing the necessary support and services.

To qualify for Medicare based on a disability, you must meet certain requirements set by the Social Security Administration (SSA).

The SSA evaluates your medical condition and determines if it meets their definition of disability.

They consider factors such as the severity of your condition, its impact on your ability to work, and its expected duration.

Certain disabilities automatically qualify you for Medicare. These include:

- End-stage renal disease (ESRD)

- Amyotrophic lateral sclerosis (ALS)

- Permanent kidney failure requiring dialysis

- Kidney transplant

If you have any of these specific disabilities, you are eligible for Medicare regardless of your age.

By understanding the disability qualifications for Medicare, you can determine if you meet the necessary criteria and take steps to enroll in the program.

It’s important to explore all available resources and consult with professionals who can guide you through the process.

Costs and Income Considerations

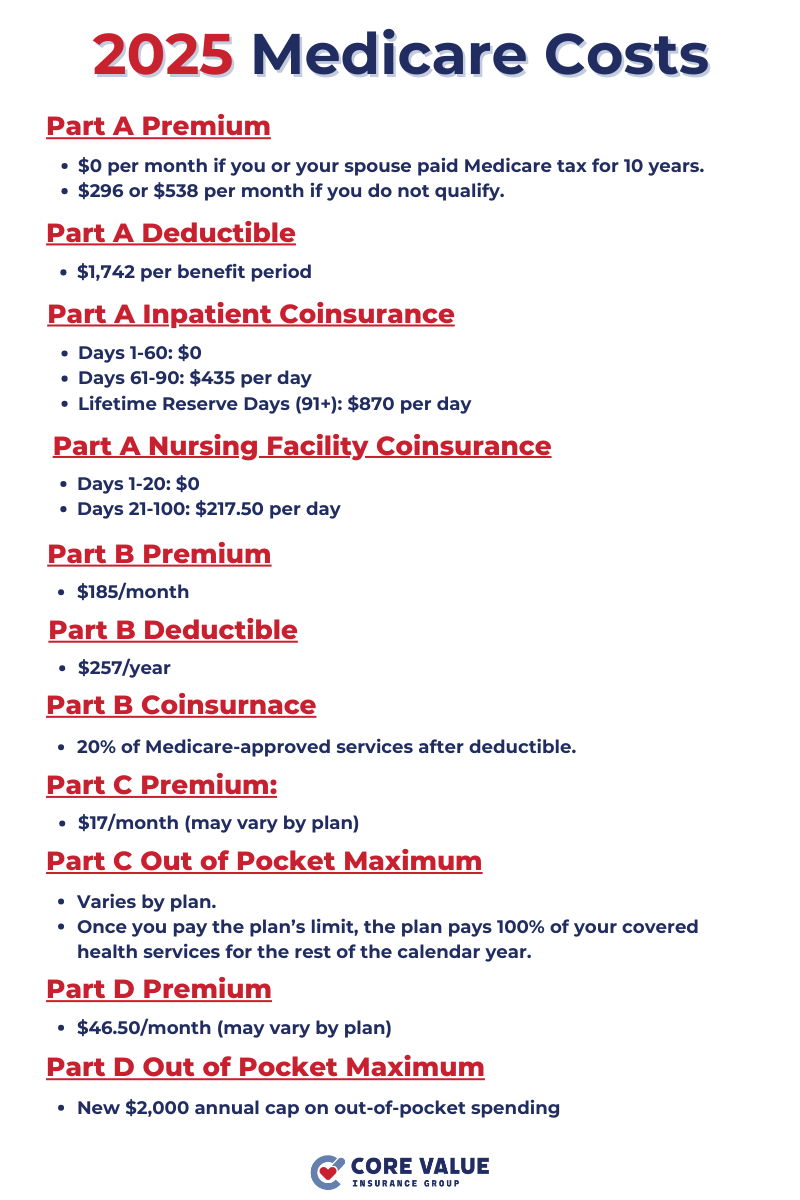

When it comes to Medicare coverage, understanding the associated costs is essential. Medicare consists of different parts, each with its own premium expenses.

Medicare premium costs vary depending on the specific part of Medicare you choose.

Part A, which covers hospital services, is generally premium-free for most individuals who have paid Medicare taxes while working.

However, Part B, which covers medical services, requires a monthly premium.

Additionally, there are premiums associated with Part C (Medicare Advantage) and Part D (prescription drug coverage).

Your income can also impact your Medicare eligibility and costs. The government assesses your income through a process known as “income-related monthly adjustment amount” (IRMAA).

If your income exceeds certain thresholds, you may be subject to higher premiums for Parts B and D.

It’s important to understand how income is assessed and the potential impact it can have on your Medicare coverage.

By understanding the different Medicare costs you can make informed decisions about your healthcare coverage.

Timely Enrollment and Avoiding Penalties

Enrolling in Medicare during the appropriate enrollment periods is crucial to avoid penalties.

Let’s explore the different enrollment periods for Medicare and understand the potential consequences of late enrollment.

Understanding the enrollment periods is essential to ensure that you sign up for Medicare at the right time.

The Initial Enrollment Period (IEP) is a seven-month window that begins three months before your 65th birthday month and ends three months after.

It’s important to enroll during this period to avoid any gaps in coverage or penalties.

In addition to the IEP, there are Special Enrollment Periods (SEP).

SEPs allow individuals who experience certain life events, such as retirement or loss of employer coverage, to enroll in Medicare outside of their IEP.

Failing to enroll in Medicare on time can result in penalties. Late enrollment penalties may apply if you don’t have creditable coverage and delay signing up for Part B or Part D.

These penalties can increase your premium costs permanently.

To avoid these penalties, it’s crucial to understand the deadlines and enroll during the appropriate periods.

Medicare Eligibility Recap

Now that you have a better understanding of the key criteria for Medicare eligibility and the enrollment process, it’s important to explore the available Medicare resources.

These resources can provide you with further information and support to make informed decisions about your healthcare coverage.

Utilizing Medicare resources allows you to expand your knowledge and ensure that you have all the necessary information at your fingertips.

You can access official Medicare websites, brochures, and publications that provide comprehensive information about various aspects of the program.

Additionally, there are helpline numbers and online tools that can assist you in navigating the complexities of Medicare.

By exploring these Medicare resources, you can enhance your understanding of eligibility requirements, premium costs, coverage options, and more.

This knowledge empowers you to make informed choices that align with your healthcare needs.

Remember, navigating the Medicare eligibility process effectively is crucial to accessing the healthcare benefits you need.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!