Are you approaching the age of 65 or have a disability? It’s important to understand the various Medicare coverage options available to you.

When it comes to healthcare benefits, navigating through the different Medicare plans can be overwhelming.

However, by exploring and understanding your Medicare coverage options, you can make an informed decision that suits your needs.

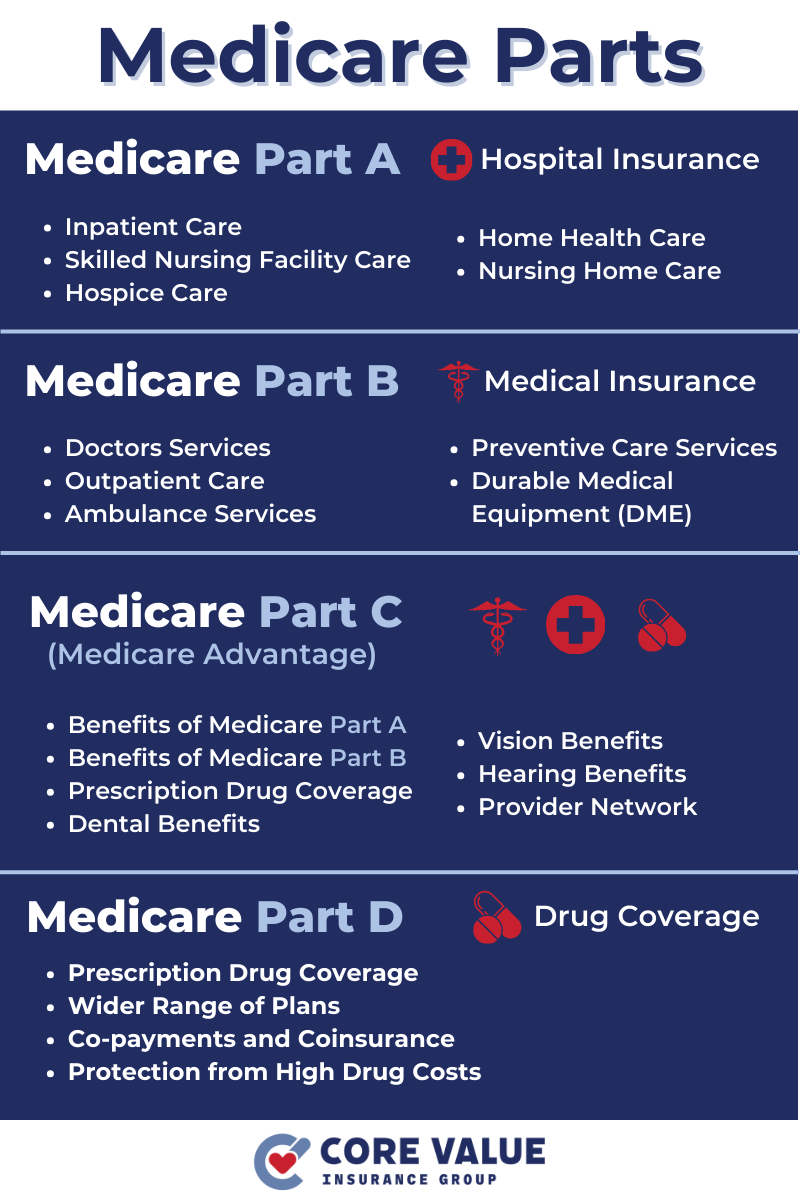

Medicare offers a range of insurance options designed to provide comprehensive coverage for seniors and individuals with disabilities. These options include:

Each option has its own benefits and eligibility requirements.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

By exploring these Medicare coverage options, you can gain a better understanding of what each plan offers and how they align with your specific healthcare needs.

This knowledge will empower you to choose the right Medicare plan that provides the necessary coverage for your medical expenses.

Understanding Original Medicare

Original Medicare, also known as Traditional Medicare, is the foundation of healthcare coverage for individuals aged 65 and older or those with certain disabilities.

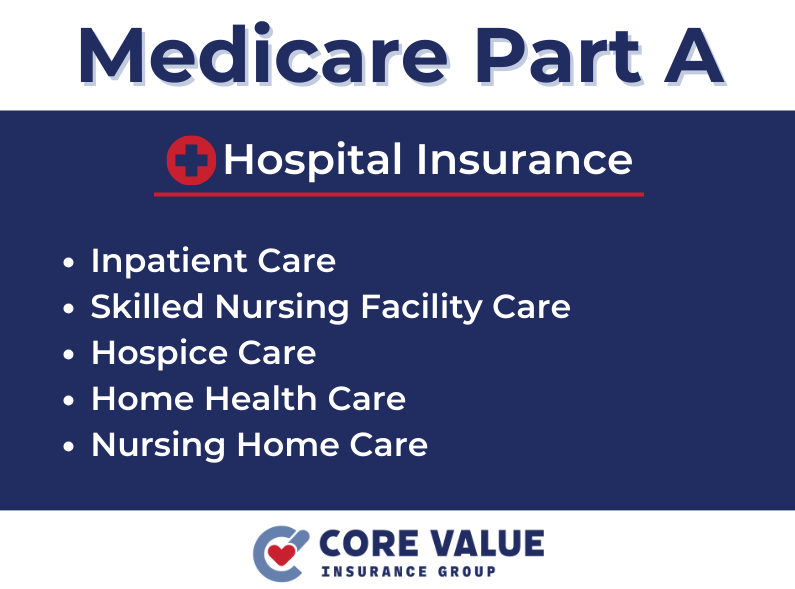

It consists of two parts: Medicare Part A and Part B.

Medicare Part A provides hospital insurance coverage. This includes inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services.

Most people do not have to pay a premium for Part A if they or their spouse paid Medicare taxes while working.

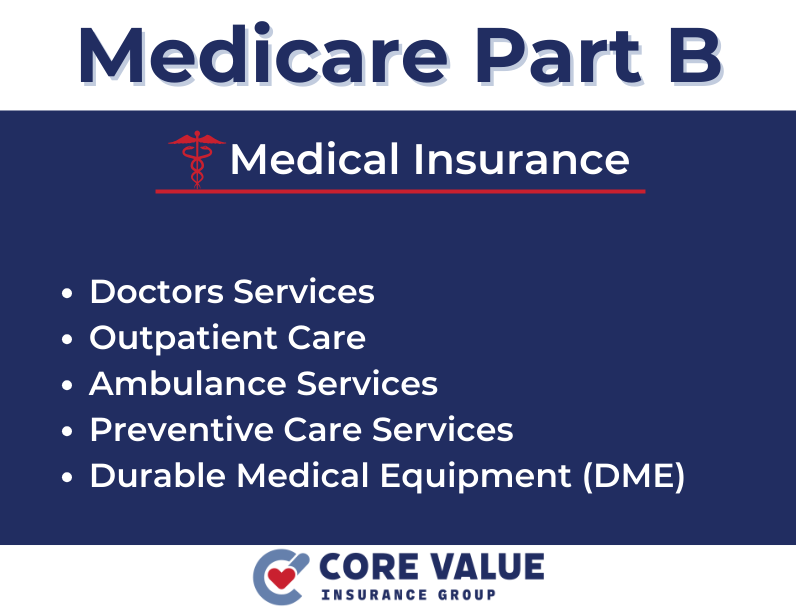

Medicare Part B covers medical services such as doctor visits, preventive care, outpatient care, and medically necessary supplies.

Medicare Part B covers medical services such as doctor visits, preventive care, outpatient care, and medically necessary supplies.

Part B requires a monthly premium based on income.

It’s important to note that both Part A and Part B have deductibles and coinsurance costs that beneficiaries are responsible for.

Benefits of Original Medicare

With Original Medicare, you have the freedom to choose any doctor or hospital that accepts Medicare assignment.

This means you can see any healthcare provider who participates in the Medicare program nationwide.

Part A covers hospital stays up to a certain number of days per benefit period. It also covers skilled nursing facility care after a qualifying hospital stay.

However, it does not cover long-term custodial care.

Part B covers medically necessary services like doctor visits, lab tests, preventive screenings, durable medical equipment (DME), and outpatient procedures.

It also includes certain preventive services like flu shots and annual wellness visits.

It’s important to understand that Original Medicare does not cover prescription drugs (except in limited circumstances) or most dental, vision, and hearing services.

To help with these additional costs, you may want to consider enrolling in a separate prescription drug plan (Part D) or a Medicare Supplement plan (Medigap).

Medicare Advantage (Part C)

Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare.

These plans are offered by private insurance companies approved by Medicare.

Medicare Advantage plans provide all the benefits of Original Medicare (Part A and Part B) and often include additional coverage, such as prescription drugs, dental, vision, and hearing services.

Enrollment in a Medicare Advantage plan is typically done during specific enrollment periods.

The Annual Enrollment Period (AEP) occurs from October 15th to December 7th each year.

There are also Special Enrollment Periods (SEPs) for individuals who experience certain qualifying events, such as moving or losing employer coverage.

Medicare Advantage Benefits and Coverage

Medicare Advantage plans offer several advantages over Original Medicare.

In addition to the basic coverage provided by Part A and Part B, these plans may include extra benefits like:

- Prescription drug coverage (Part D)

- Routine dental care

- Eyeglasses

- Hearing aids

- Fitness programs

There are different types of Medicare Advantage plans available, including:

- Health Maintenance Organization (HMO) plans

- Preferred Provider Organization (PPO) plans

- Private Fee-for-Service (PFFS) plans

- Special Needs Plans (SNPs)

Each plan has its own network of doctors and hospitals that participants must use to receive full benefits.

It’s important to carefully review the details of each plan before enrolling to ensure it meets your healthcare needs.

Consider factors such as:

- Monthly premiums

- Deductibles

- Copayments

- Coinsurance

- Provider networks

- Prescription drug formularies

What is Medicare Part D?

Medicare Part D is a prescription drug coverage program offered by private insurance companies approved by Medicare.

It helps beneficiaries pay for their prescription medications.

This coverage is available to individuals who are eligible for Medicare, whether they have Original Medicare or a Medicare Advantage plan.

Enrollment in a Medicare Part D plan is typically done during specific enrollment periods.

- The Initial Enrollment Period (IEP): occurs when you first become eligible for Medicare.

- Annual Enrollment Period (AEP): from October 15th to December 7th each year.

- Special Enrollment Periods (SEPs): for certain qualifying events, such as losing creditable prescription drug coverage.

Benefits of Medicare Part D

Medicare Part D plans have formularies, which are lists of covered drugs. These formularies categorize medications into different tiers based on cost and coverage levels.

Each plan may have its own list of covered drugs and associated costs.

The costs associated with Medicare Part D include monthly premiums, deductibles, copayments or coinsurance amounts for prescriptions.

It’s important to review the details of each plan to understand these costs and ensure that the medications you need are covered at an affordable price.

It’s worth noting that not all drugs may be covered by every plan, so it’s important to choose a plan that covers your specific medications.

If your medication needs change over time, you can switch plans during the Annual Enrollment Period to find one that better meets your needs.

What are Medicare Supplement Plans (Medigap)?

Medicare Supplement plans, also known as Medigap plans, are private insurance policies designed to work alongside Original Medicare (Part A and Part B).

These plans help cover some of the out-of-pocket costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance.

Medicare Supplement plans are offered by private insurance companies and are standardized across different states.

This means that the benefits of each plan are the same regardless of which insurance company you choose.

However, the premiums may vary between insurance providers.

When you have a Medicare Supplement plan, it helps fill the gaps in coverage left by Original Medicare.

You still need to be enrolled in both Part A and Part B of Original Medicare to be eligible for a Medicare Supplement plan.

Medicare Supplement Coverage

One of the main benefits of having a Medicare Supplement plan is that it can provide financial protection against high medical costs.

These plans can help cover expenses like:

- Hospital stays

- Skilled nursing facility care

- Doctor visits

- Other healthcare services

When choosing a Medicare Supplement plan, it’s important to consider your specific healthcare needs and budget.

There are different types of Medigap plans labeled with letters (such as Plan A, Plan B, etc.), each offering a different level of coverage.

It’s essential to review the benefits provided by each plan and select one that aligns with your individual needs.

It’s worth noting that while Medigap plans help cover out-of-pocket costs related to Original Medicare, they generally do not include prescription drug coverage.

If you require prescription drug coverage, you may need to enroll in a separate Medicare Part D plan.

Choosing the Right Medicare Coverage

When it comes to selecting the best Medicare plan, it’s crucial to understand the different types of Medicare coverage options available.

- Consider your healthcare needs and eligibility requirements before making an informed decision.

- Take into account factors such as your preferred doctors and hospitals, prescription drug needs, budget, and any additional benefits you may require.

By carefully evaluating these factors, you can choose the right Medicare plan that provides comprehensive coverage and meets your individual needs.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!