As Medicare beneficiaries or individuals approach eligibility, it is crucial to have a clear understanding of premiums, deductibles, and coinsurance for the different parts of Medicare, to effectively plan for healthcare expenses in the year to come.

These plans provide additional financial protection and peace of mind, reducing your overall Medicare financial obligations.

Additionally, we will discuss the variations in costs for Medicare Advantage plans and Medicare Prescription Drug plans, helping you compare options available in your area.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Understanding these aspects can further assist you in managing your healthcare expenses effectively.

By gaining insights into the monthly cost of Medicare and exploring various options, you can make informed decisions about your healthcare coverage while keeping your financial well-being in mind.

Medicare Premiums

Medicare premiums are the monthly payments made by beneficiaries to maintain their coverage.

These premiums contribute to the cost of Medicare coverage and vary depending on the specific part of Medicare and the individual’s income level.

It is important to note that these premiums are separate from other healthcare expenses, such as deductibles and coinsurance.

Factors Affecting Medicare Premiums

Several factors can impact the amount of Medicare premiums.

Income-related adjustments play a significant role in determining premium amounts for Medicare Part B and Part D.

Higher-income individuals may be subject to higher premium rates due to income-related monthly adjustment amounts (IRMAA). It’s essential to understand how your income level can affect your monthly Medicare payments.

Additionally, it’s worth noting that Medicare Advantage plans may have different premium structures compared to Original Medicare.

While Original Medicare typically has separate premiums for Part A and Part B, some Advantage plans may offer all-in-one coverage with a single premium payment.

By understanding the factors influencing Medicare premiums, you can better anticipate and plan for your healthcare expenses under Medicare.

It is crucial to consider these costs when comparing different parts of Medicare or evaluating whether a supplemental plan like Medigap or an Advantage plan would be more suitable for your needs.

Medicare Deductibles

Medicare deductibles are the initial out-of-pocket amounts that beneficiaries must pay before their coverage kicks in.

These deductibles serve as a form of cost-sharing, requiring individuals to contribute towards their healthcare expenses.

Different parts of Medicare have separate deductibles, such as Part A, Part B, and Part D.

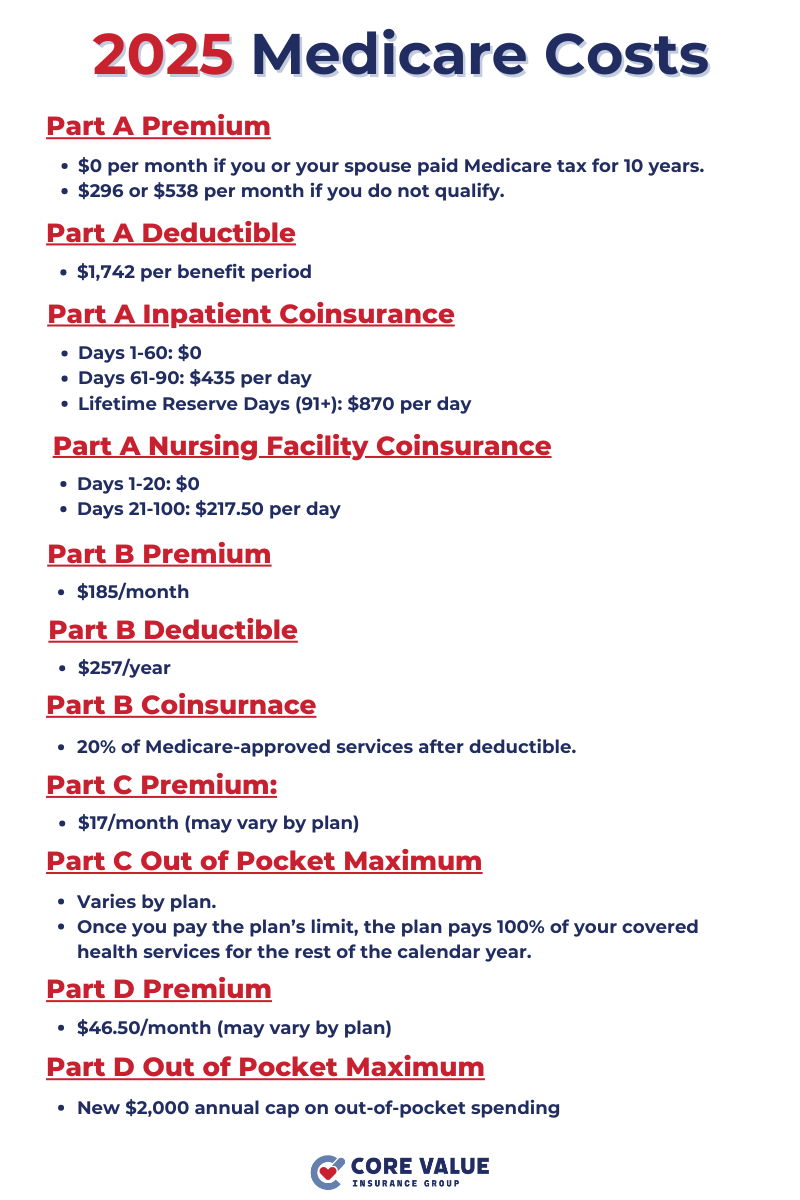

In 2025, the deductible for Medicare Part A (Hospital Insurance) is $1,742 per benefit period.

This means that beneficiaries are responsible for paying this amount before their Part A coverage begins.

Similarly, Medicare Part B (medical insurance) has an annual deductible which may change each year.

Coinsurance in Medicare

Coinsurance refers to the percentage of healthcare costs that beneficiaries are responsible for after meeting their deductibles.

Once the deductible is met, coinsurance comes into play.

For instance, if you have Medicare Part B coverage and receive a covered service or procedure that costs $100, you may be responsible for paying 20% coinsurance ($20), while Medicare covers the remaining 80%.

Understanding coinsurance rates is essential for budgeting healthcare expenses under Medicare.

By knowing how much you will need to contribute out-of-pocket after meeting your deductible, you can plan accordingly and anticipate your financial obligations.

It’s important to note that Medigap plans can help cover some or all of these out-of-pocket costs associated with deductibles and coinsurance.

These supplemental plans provide additional financial protection and peace of mind by filling the gaps left by Original Medicare.

Reduce Expenses with Medicare Supplement Plans (Medigap)

Medicare Supplement plans, also known as Medigap plans, are private insurance policies that help cover the gaps in Original Medicare.

These plans provide additional coverage for Medicare beneficiaries by paying for deductibles, coinsurance, and other out-of-pocket costs that would otherwise be the responsibility of the individual.

Medicare Supplement plans offer peace of mind and financial protection by reducing the burden of healthcare expenses.

They work alongside Original Medicare to fill in the gaps left by Part A and Part B coverage.

These plans are standardized and regulated by the government, ensuring that beneficiaries have access to consistent benefits regardless of which insurance company they choose.

Medicare Supplement Benefits

There are several benefits to enrolling in a Medicare Supplement plan. First and foremost, these plans offer flexibility in choosing healthcare providers.

Unlike some other types of Medicare coverage, Medigap plans allow beneficiaries to see any doctor or specialist who accepts Medicare patients.

Additionally, Medicare Supplement plans can help reduce overall healthcare expenses.

By covering deductibles, coinsurance, and other out-of-pocket costs, these supplemental insurance policies provide financial relief for beneficiaries.

This can be especially beneficial for individuals who require frequent medical services or have chronic health conditions that result in higher healthcare costs.

It’s important to note that while Medigap plans can help alleviate healthcare expenses, they do not typically include prescription drug coverage.

Beneficiaries may need to enroll in a separate Medicare Prescription Drug Plan (Part D) to ensure comprehensive coverage for their medication needs.

Understanding Medicare Advantage Plans

Medicare Advantage plans, also known as Part C, offer an alternative way to receive Medicare benefits.

These plans are offered by private insurance companies approved by Medicare and often provide additional benefits beyond what is covered by Original Medicare.

Some common additional benefits include:

- Prescription drug coverage

- Dental Care

- Vision care

- Wellness programs

When comparing costs, it’s important to note that Medicare Advantage plans may have different cost structures compared to Original Medicare.

While Original Medicare typically has separate premiums for Part A and Part B, some Advantage plans may offer all-in-one coverage with a single premium payment.

Medicare Prescription Drug Plans

Medicare Part D provides prescription drug coverage to beneficiaries.

These plans are offered by private insurance companies approved by Medicare and can help reduce the cost of medications.

The costs of these plans can vary depending on factors such as the specific medications needed and the plan’s formulary (list of covered drugs).

When comparing prescription drug plans, it’s crucial to consider factors like:

- Monthly premiums

- Annual deductibles

- Copayments

- Coinsurance

- Pharmacies are in-network

Evaluating these factors will help you choose a plan that best meets your medication needs while keeping your overall healthcare expenses in check.

By comparing both Medicare Advantage plans and prescription drug plans, you can make an informed decision about which type of coverage aligns with your healthcare needs and budget.

Tax Deductions for Medicare Premiums

Some individuals may be eligible for tax deductions on their Medicare premiums, providing potential tax benefits that can help reduce overall healthcare costs.

The criteria and requirements for these deductions vary, so it’s important to understand if you qualify.

In general, if you itemize your deductions on your federal income tax return, you may be able to deduct your Medicare premiums as medical expenses.

However, there are certain limitations and guidelines set by the Internal Revenue Service (IRS) that determine the deductibility of these expenses.

Consulting with a tax professional or reviewing IRS publications can provide further guidance on how to maximize your tax benefits related to Medicare costs.

Social Security Deductions for Medicare

Medicare premiums are often deducted from Social Security benefits.

If you receive Social Security retirement or disability benefits, the premium amount is typically automatically deducted from your monthly benefit payment.

It’s important to know the amount that will be deducted from your Social Security income and how it affects your monthly cash flow.

By knowing the impact of Medicare premium deductions on your monthly income, you can budget accordingly and ensure that you have sufficient funds available for other living expenses.

Navigating Medicare Costs in 2025

By understanding the intricacies of Medicare costs in 2025, beneficiaries can make informed decisions about their healthcare coverage.

Comparing premiums, deductibles, and other expenses is crucial in finding the most cost-effective options available.

Navigating Medicare costs requires careful consideration of personal healthcare needs and financial circumstances.

Managing Medicare expenses involves evaluating your individual healthcare requirements and budget constraints.

It’s important to assess factors such as:

- Anticipated medical services

- Prescription drug needs

- Potential tax deductions

- Social Security deductions

By taking these factors into account, you can make choices that align with your healthcare needs while also being mindful of your financial situation.

Remember that there are resources available to help you navigate Medicare costs effectively.

Utilize tools like the Medicare Plan Finder on the official Medicare website or consult with a licensed insurance agent who specializes in Medicare.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!