Medicare enrollment periods, also known as enrollment windows or phases, play a crucial role for both current beneficiaries and individuals approaching Medicare eligibility.

These designated timeframes determine when individuals can enroll in or make changes to their Medicare coverage.

It is essential to enroll during the appropriate enrollment period to maximize Medicare benefits and avoid potential penalties or gaps in healthcare coverage.

By understanding the different enrollment periods, beneficiaries can make informed decisions about their healthcare needs and ensure they have the right coverage at the right time.

Three Medicare Enrollment Periods to Remember:

- Initial Enrollment Period (IEP)

- Annual Enrollment Period (AEP)

- Special Enrollment Period (SEP)

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

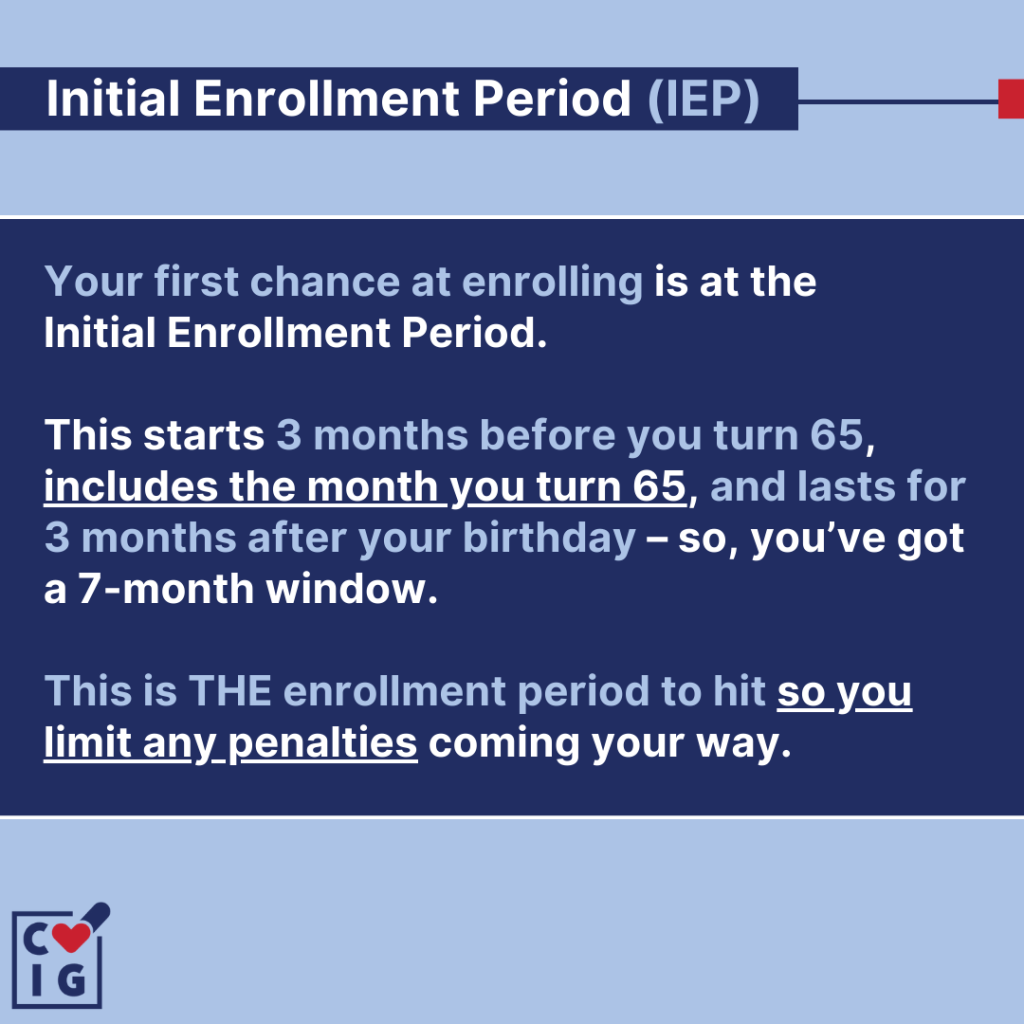

Initial Enrollment Period (IEP)

If you’re new to Medicare, you’ve likely heard about the Initial Enrollment Period (IEP), but you may not fully understand its significance.

The Initial Enrollment Period is your first opportunity to enroll in Medicare, and it’s crucial to navigate it correctly to avoid future penalties.

For those new to Medicare, the Initial Enrollment Period is a seven-month window that starts three months before the month you turn 65, includes the month you turn 65, and ends three months after the month you turn 65.

During this period, you can sign up for:

- Medicare Part A (Hospital Insurance)

- Medicare Part B (Medical Insurance)

- Medicare Part C (Medicare Advantage)

- Medicare Part D (Prescription Drug Plan)

For those who are new to Medicare, timing is everything during the Initial Enrollment Period. Missing this period could result in higher premiums or delayed coverage.

Mark the dates on your calendar and set reminders to make sure you don’t forget.

Alternatively, you can give us a call to schedule a time to discuss your plan options with our licensed agents and we’ll reach back out during your IEP!

Some individuals are automatically enrolled in Medicare Parts A and B. These include those already receiving Social Security benefits or those with certain qualifying conditions.

However, automatic enrollment doesn’t cover Parts C and D, so you’ll need to enroll in these manually if you’re interested.

Annual Enrollment Period (AEP)

The Annual Enrollment Period (AEP) is a crucial time for Medicare beneficiaries to make changes to their coverage.

It occurs from October 15th to December 7th each year, providing an opportunity to review and adjust healthcare plans.

During the Annual Enrollment Period, beneficiaries have the chance to make changes that can better meet their evolving healthcare needs.

They can switch from Original Medicare to a Medicare Advantage plan or vice versa. This allows them to explore different options and select a plan that aligns with their preferences and requirements.

To make the most of the Annual Enrollment Period, it’s important for beneficiaries to review their current healthcare needs and assess whether their existing plan still meets those needs.

They should consider factors such as:

- Prescription drug coverage

- Doctor networks

- Out-of-pocket costs

Comparing available plans can help individuals identify options that provide comprehensive coverage at an affordable price.

Beneficiaries should take advantage of resources like the Medicare Plan Finder tool or consult with trusted advisors who can provide guidance on available plans in their area.

By taking an active role in evaluating and selecting a plan during the Annual Enrollment Period, beneficiaries can ensure they have optimal coverage for the upcoming year.

Special Enrollment Period (SEP)

The Special Enrollment Period (SEP) is a valuable opportunity for individuals to enroll in Medicare outside of the standard enrollment periods.

This period allows eligible individuals to sign up for Medicare or make changes to their existing coverage when they experience qualifying life events.

Examples of qualifying events include:

- Retirement

- Loss of employer coverage

- Relocation

During the Special Enrollment Period, beneficiaries have the flexibility to select Medicare plans that align with their specific healthcare needs.

This means they can choose plans that cover their preferred doctors, medications, and medical services.

Enrolling during this period ensures continuous coverage without penalties or gaps in healthcare.

One of the key benefits of the Special Enrollment Period is that it provides individuals with additional time and options to make informed decisions about their Medicare coverage.

It allows them to explore different plan options and compare costs and benefits before making a choice.

It’s important to note that eligibility for the Special Enrollment Period is triggered by specific life events, so it’s crucial to understand the criteria for qualification.

Know your enrollment period

Understanding the rules and benefits of each enrollment period empowers individuals to make informed decisions about their Medicare plans.

By navigating the enrollment process with confidence, beneficiaries can ensure continuous and appropriate healthcare coverage that meets their specific needs.

Being knowledgeable about enrollment periods allows Medicare recipients to take control of their healthcare journey and make choices that align with their preferences and circumstances.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!