Original Medicare, also known as Traditional Medicare, provides essential healthcare coverage for individuals who qualify. It consists of two main parts: Medicare Part A and Part B.

Medicare Part A offers coverage for hospital stays, skilled nursing facilities, and some home healthcare services.

On the other hand, Medicare Part B covers doctor visits, outpatient care, preventive services, and medical supplies. Together, these two parts form the foundation of Original Medicare.

By understanding the coverage, enrollment process, and healthcare benefits of Original Medicare, you can make informed decisions about your healthcare options.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

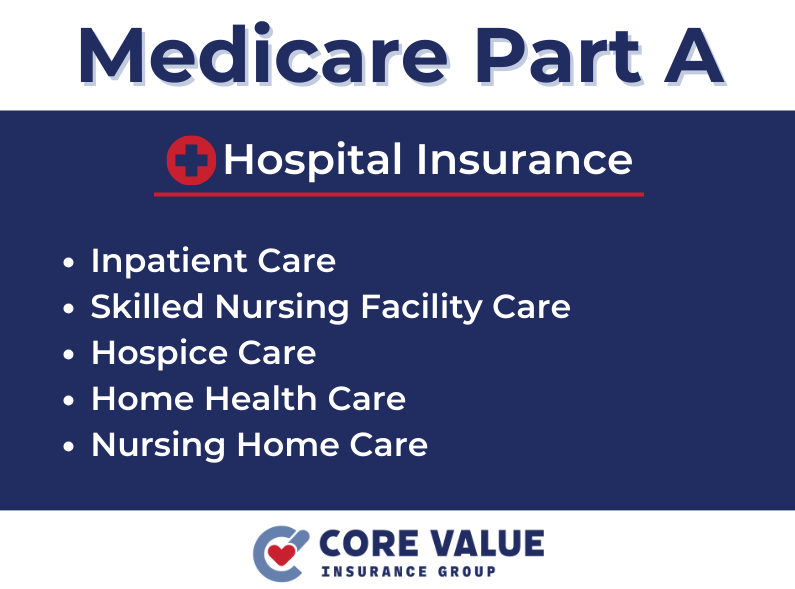

Medicare Part A

Medicare Part A is an essential component of Original Medicare, providing coverage for hospital stays, skilled nursing facilities, and some home healthcare services.

Understanding the details of Medicare Part A is crucial to ensure you can access the necessary care when needed.

Understanding Medicare Part A

Medicare Part A, also known as Hospital Insurance, covers inpatient hospital care, including critical access hospitals and long-term care hospitals.

It also includes skilled nursing facility care, hospice care, and limited home healthcare services. This coverage is vital for individuals who require hospitalization or specialized nursing care.

To be eligible for Medicare Part A, you must meet certain criteria. Most people qualify for premium-free Part A if they or their spouse have paid Medicare taxes while working.

If you don’t meet this requirement, you may still be able to enroll in Part A by paying a monthly premium.

Part A Enrollment and Eligibility

Enrolling in Medicare Part A is typically automatic if you’re already receiving Social Security benefits or Railroad Retirement Board benefits.

However, if you aren’t receiving these benefits yet, you’ll need to sign up for Medicare during your Initial Enrollment Period (IEP).

Your IEP begins three months before your 65th birthday month and ends three months after that month. During this period, you should take steps to enroll in Medicare Part A to avoid any potential delays or penalties.

It’s important to note that delaying enrollment in Medicare Part A could result in higher premiums when you do decide to sign up.

Therefore, it’s advisable to understand the enrollment process and eligibility requirements beforehand so that you can make informed decisions about your healthcare coverage.

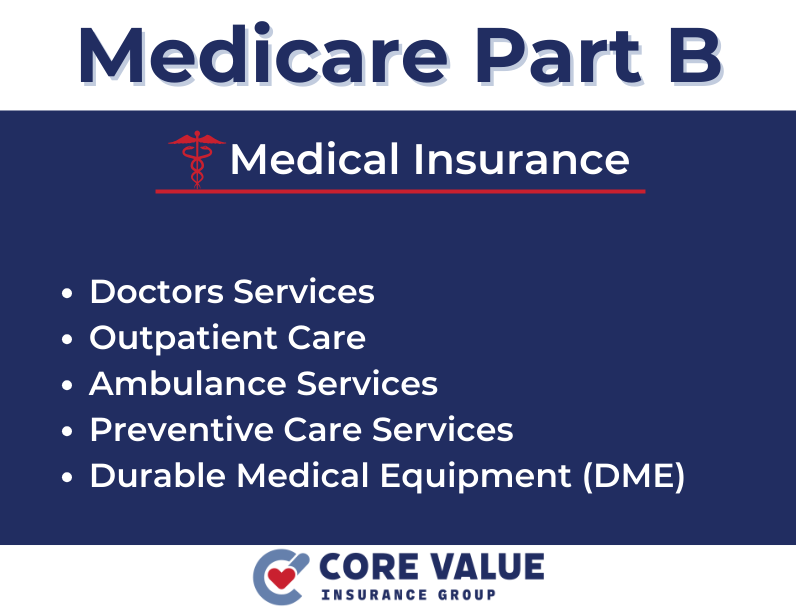

Medicare Part B

Medicare Part B, also known as Medical Insurance, is an important component of Original Medicare that covers doctor visits, outpatient care, preventive services, and medical supplies.

It provides essential healthcare coverage to ensure you have access to necessary medical services.

Part B Coverage and Benefits

Medicare Part B offers a wide range of coverage options to support your healthcare needs. It includes coverage for:

- Doctor visits

- In-person and telehealth appointments

- Outpatient procedures and surgeries

- Laboratory tests

- Durable medical equipment (such as wheelchairs or walkers)

- Preventive services (like vaccinations and screenings)

- Certain medications administered in a clinical setting

Understanding the benefits and services provided under Medicare Part B is crucial for making informed decisions about your healthcare.

By taking advantage of these coverage options, you can receive the necessary care to maintain your health and well-being.

Part B Enrollment and Costs

Enrolling in Medicare Part B requires understanding the enrollment process and associated costs.

Most individuals are automatically enrolled in Part B if they’re already receiving Social Security benefits.

However, if you aren’t receiving these benefits yet or need to sign up separately for Part B, it’s important to follow the enrollment guidelines.

There may be costs associated with Medicare Part B coverage, including a monthly premium based on your income level.

Additionally, late enrollment penalties may apply if you don’t sign up during your Initial Enrollment Period (IEP) or if you delay enrollment without qualifying for a Special Enrollment Period (SEP).

To avoid late enrollment penalties under Medicare Part B, it’s essential to understand the enrollment process, associated costs, and any applicable deadlines.

Comprehensive Healthcare Coverage

When it comes to healthcare coverage, Original Medicare provides a solid foundation.

However, there are additional coverage options available that can supplement and enhance your healthcare benefits.

Additional Coverage Options

One option to consider is Medicare Advantage, also known as Medicare Part C.

These plans are offered by private insurance companies approved by Medicare and provide comprehensive healthcare coverage beyond what Original Medicare offers.

Medicare Advantage plans often include prescription drug coverage (Medicare Part D) and may offer additional benefits such as dental, vision, and hearing services.

Another option is Medigap, also known as Medicare Supplement Insurance.

Medigap plans are designed to fill the gaps in Original Medicare coverage by helping pay for out-of-pocket costs like deductibles, copayments, and coinsurance.

These plans are sold by private insurance companies and work alongside your Original Medicare benefits.

Understanding the benefits and considerations of these additional coverage options is essential in making informed decisions about your healthcare.

The Confusion of Medicare

Navigating the Medicare system can sometimes be complex, but with the right knowledge and resources, you can make the most of your healthcare coverage.

One aspect of navigating the system involves finding healthcare providers who accept Medicare.

This ensures that you receive care from providers who participate in the Medicare program.

Understanding how Medicare billing works is also crucial to avoid any surprises or confusion regarding costs.

Familiarize yourself with terms like “Medicare-approved amount” and “out-of-pocket maximum” to gain clarity on your financial responsibilities.

To maximize your healthcare coverage under Original Medicare or any supplement plan, consider seeking guidance from licensed professionals, like ourselves, specializing in senior health insurance.

Original Medicare Recap

Whether you are approaching Medicare age or a caregiver assisting someone in their journey, you now have the knowledge to navigate the complexities of Original Medicare.

With this information, you can make informed decisions about your healthcare coverage.

Remember that there are additional coverage options available, such as Medicare Advantage or Medigap plans, to supplement your benefits.

By staying informed and exploring all available options, you can ensure that you have comprehensive healthcare coverage tailored to your needs.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!