Medicare premiums are a significant concern for many seniors in Philadelphia, Bucks County, and surrounding areas.

With 2025 approaching, understanding the upcoming increases is crucial for managing your healthcare budget effectively.

Let’s explore the changes to Medicare premiums for 2025 by CMS and how you can prepare.

How much will Medicare premiums increase?

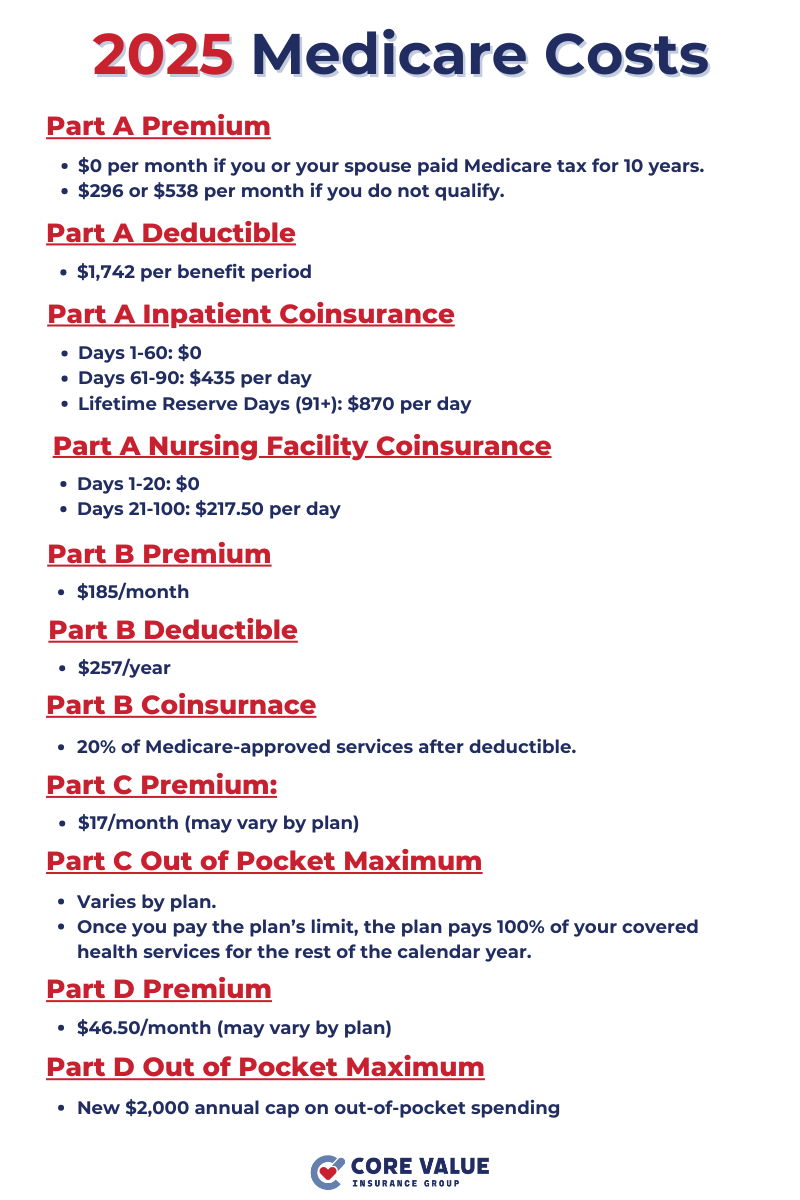

The Centers for Medicare & Medicaid Services (CMS) have announced the following updates for 2025 Medicare premiums:

Medicare Part A Premium

$0 for most people (because they or a spouse paid Medicare taxes long enough while working – generally at least 10 years).

If you get Medicare earlier than age 65, you won’t pay a Medicare Part A premium. This is sometimes called “premium-free Part A.”

If you don’t qualify a $0 Medicare Part A Premium, in 2025 you’ll pay either $285 or $518 each month for Medicare Part A. Which premium you will pay depends on how long you or your spouse worked and paid Medicare taxes.

The Medicare Part A premium has increased from $278 or $505 in 2024 to $285 or $518 in 2025.

Medicare Part B Premium

The standard Medicare Part B premium will be $185 per month in 2025, an increase of $10.30 from $174.70 per month in 2024.

These adjustments reflect the ongoing costs associated with providing comprehensive healthcare coverage to Medicare beneficiaries.

Why Are Medicare Premiums Increasing in 2025?

The increase in the 2025 Medicare Part B standard premium and deductible is mainly due to projected price changes and assumed increases in usage.

This adjustment is consistent with historical experience and reflects rising healthcare costs, inflation, and the demand for services.

Key contributing factors include:

- Higher healthcare inflation: As the cost of medical services and treatments rises, Medicare premiums follow suit.

- Increased utilization: An aging population often requires more frequent and advanced healthcare services.

- Legislative impacts: Programs and changes like the Inflation Reduction Act may influence certain cost structures.

How to Budget for Medicare Premiums Increasing in 2025

Review Your Current Medicare Coverage

Take the time to assess your current Medicare plan. Knowing your premiums, deductibles, and out-of-pocket costs will help you see how these changes may impact your budget.

Find Medicare Supplement Options

If you have Original Medicare, think about getting a Medigap (Medicare Supplement) policy. It can help pay for extra costs not covered by your Original Medicare plan.

Consider Medicare Advantage Plans

Medicare Advantage plans often include added benefits like dental, vision, and hearing coverage.

However, it’s important to ensure your preferred doctors and hospitals are in-network.

Stay Updated on Medicare Changes

CMS typically announces official updates to Medicare costs in the fall.

Make it a habit to review these updates annually, or work with an agent at CVIG and we will make you aware of these changes during our annual plan review prior to your upcoming enrollment period.

How We Can Help You

As a trusted local Medicare agency, CVIG assists seniors in Philadelphia, Bucks County, and surrounding counties in understanding Medicare changes.

We provide one on one support, ensuring you’re prepared for premium adjustments and remain on the best plan for your health and financial situation.

Our annual Medicare reviews are designed to ensure your coverage meets your needs and that you’re minimizing unnecessary expenses.

Stay Ahead of 2025 Medicare Changes

Medicare can be confusing, but you don’t have to face it alone. If you’re in Bucks County or the greater Philadelphia area, CVIG is here to help you.

Our local Medicare agents at Core Value Insurance Group are here to help you understand and adapt to these changes.

Book an appointment to review your Medicare options, compare plans, and find the best fit for you.

Don’t wait – schedule a consultation today!

Medicare Parts

Speak with a licensed insurance agent!