When it comes to managing healthcare costs, especially during unexpected hospital stays, hospital indemnity insurance can be a crucial layer of protection.

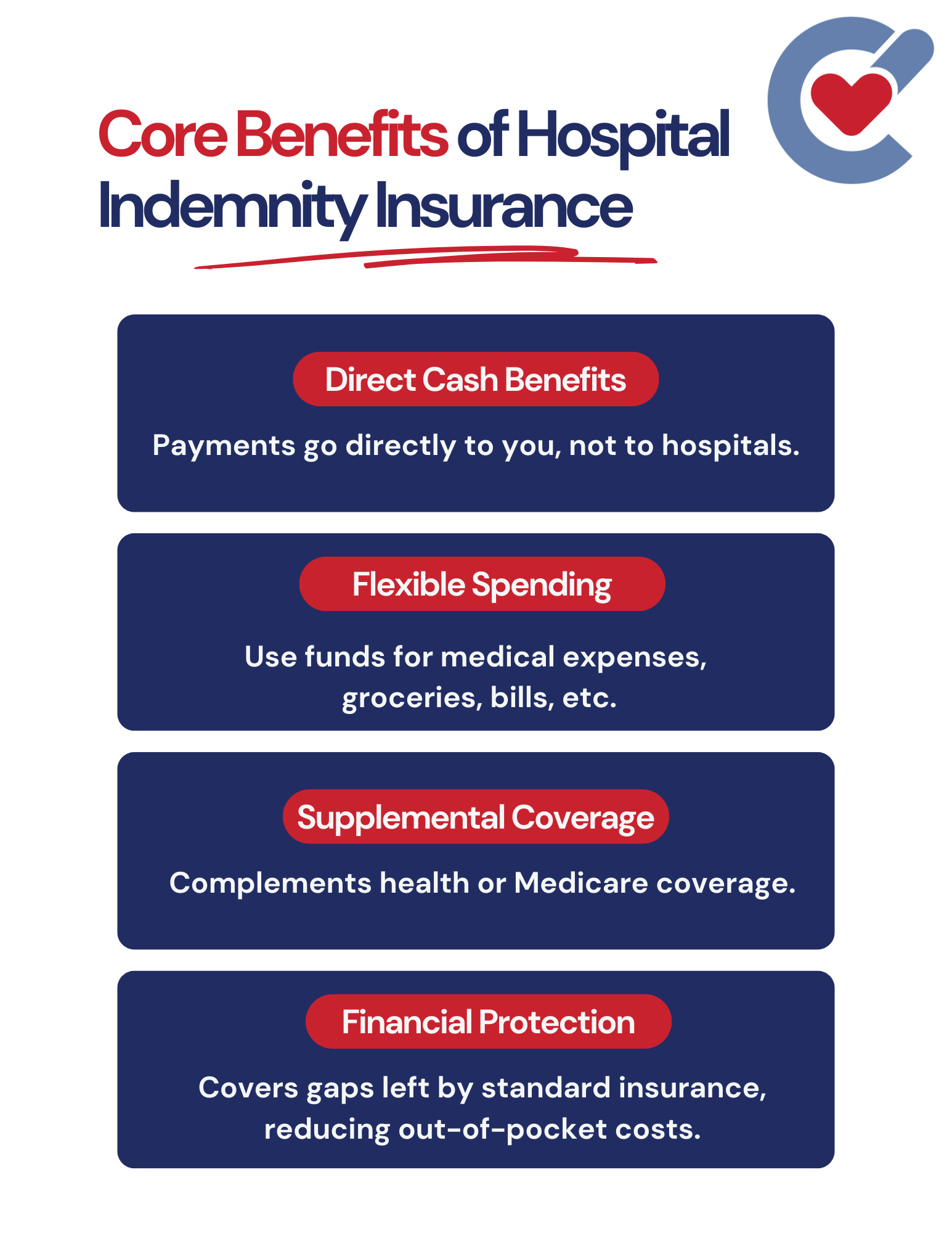

Unlike standard health insurance, which directly pays healthcare providers, hospital indemnity insurance provides you with a cash benefit that can be used in any way you see fit.

This flexibility makes it an attractive option for covering costs like deductibles, copays, transportation, or even daily expenses.

This guide will help you understand hospital indemnity insurance, its benefits, eligibility, coverage, and how it fits into the lives of Philadelphia and Bucks County residents.

What is Hospital Indemnity Insurance?

Hospital indemnity insurance is supplemental coverage designed to pay a cash benefit directly to you or your family in the event of a covered hospitalization.

Unlike traditional health insurance, this coverage allows you to spend the funds on anything that may arise during your hospital stay or recovery period.

Key Features of Hospital Indemnity Insurance:

- Direct Cash Payouts: Receive a set cash amount when hospitalized, regardless of other insurance.

- Flexible Use: You decide how to use the funds—whether for medical bills, transportation, family lodging, or household expenses.

- Gaps in Health Insurance: This type of coverage is designed to help fill the financial gaps left by health insurance policies, especially high deductibles and copays.

What Does Hospital Indemnity Insurance Cover?

Different plans offer different types of coverage, so it’s important to review specific policy details.

Typical benefits include:

- Hospital Admission Benefit: A lump sum is paid upon admission to a hospital due to a covered illness or injury.

- Daily Hospital Confinement Benefit: Receive a daily cash benefit for each day you’re hospitalized.

- Intensive Care Unit (ICU) Coverage: Additional payments are available for ICU stays, reflecting the higher level of care and associated costs.

- Emergency Room Coverage: Benefits for emergency room visits that lead to hospital admission.

- Outpatient Surgery Benefit: Provides coverage for surgeries performed on an outpatient basis, without requiring an overnight hospital stay.

Each of these benefits can be used to cover expenses that traditional health insurance might not fully address, such as transportation, in-home care, groceries, or other daily expenses.

Who Qualifies for Hospital Indemnity Insurance?

Hospital indemnity insurance is generally accessible to a wide range of individuals, but specific eligibility criteria may vary by provider. Typically:

- Age Range: Policies are available for people aged 18 to 90.

- Medical Underwriting: Many hospital indemnity policies have guaranteed acceptance, meaning you may not need to undergo a medical exam. However, some plans include waiting periods for pre-existing conditions.

- Employment Status: In some cases, you may need to be working part-time or full-time to qualify.

This insurance can be especially valuable for seniors on Medicare, as it helps cover out-of-pocket expenses not fully covered by Medicare Parts A and B.

Why Philadelphia and Bucks County Residents Choose Hospital Indemnity Insurance

Hospital indemnity insurance is especially relevant in Pennsylvania, where medical costs can be substantial.

Residents of Philadelphia, Bucks County, and nearby areas often face high out-of-pocket expenses during hospitalizations, even with traditional health insurance.

By adding a hospital indemnity plan, locals can protect themselves from unexpected costs and maintain financial stability during hospital stays.

Local insurance providers like Core Value Insurance Group specialize in helping Philadelphia and Bucks County residents find the right policies for their needs, ensuring coverage aligns with local healthcare costs and insurance requirements.

Frequently Asked Questions About Hospital Indemnity Insurance

- How does hospital indemnity insurance differ from standard health insurance?

- Standard health insurance covers medical bills directly, whereas hospital indemnity insurance pays a cash benefit directly to you. You can use this cash to cover medical or non-medical expenses.

- Can I have hospital indemnity insurance if I’m already on Medicare?

- Yes! Hospital indemnity insurance is a popular option for Medicare beneficiaries, as it helps cover out-of-pocket expenses not fully covered by Medicare.

- Are there restrictions on how I can use the benefits?

- No, the cash benefits from hospital indemnity insurance are yours to use as you wish, whether for healthcare costs or daily expenses.

- Will my premium rates increase as I age?

- Premium rates vary by policy and provider, but many plans offer fixed rates that do not increase with age. Review policy terms to understand how rates may change.

Advantages of Hospital Indemnity Insurance

Adding hospital indemnity insurance to your coverage provides several key advantages:

Financial Security for Unexpected Costs

Medical emergencies can create a significant financial burden, especially if you’re facing high copays and deductibles.

Hospital indemnity insurance helps cover these gaps, so you don’t have to worry about dipping into savings or accruing debt.

Flexibility in Coverage

Unlike other insurance policies that pay specific providers, hospital indemnity insurance benefits go directly to you.

Use the cash for whatever you need, from covering medical bills to helping with everyday costs while you’re hospitalized.

Portability

Many policies allow you to keep your coverage even if you change jobs or move, making this type of insurance a portable option that stays with you through life’s transitions.

Selecting the Right Hospital Indemnity Policy

Choosing the right policy depends on several factors. Here are some things to consider:

- Coverage Limits: Look at the maximum payout amounts for different types of benefits, like daily hospital stays or ICU coverage.

- Benefit Triggers: Be clear on what circumstances will trigger a benefit payment, such as hospital admission, certain surgeries, or ICU admission.

- Exclusions and Waiting Periods: Understand any policy exclusions, including those related to pre-existing conditions, and if there are waiting periods before coverage kicks in.

- Premium Costs: Balance premium costs with potential benefits. While a low premium might be appealing, ensure it provides adequate coverage.

Hospital Indemnity Insurance in Philadelphia & Bucks County

At Core Value Insurance Group, we help residents of Philadelphia, Bucks County, and surrounding areas explore hospital indemnity insurance options tailored to their needs.

Our licensed agents are experts in Medicare and supplemental insurance, and we’re here to answer your questions and guide you in finding a plan that fits your health and financial goals.

Take the Next Step

Hospital indemnity insurance offers peace of mind, helping you stay financially stable during hospital stays and recoveries.

Core Value Insurance Group specializes in helping local residents find the best policies for their specific needs.

Schedule a call with us today for a personalized consultation, and let us guide you in selecting a hospital indemnity plan that meets your needs and budget.

Medicare Parts

Speak with a licensed insurance agent!