When retiring in Philadelphia, avoiding Medicare mistakes is crucial to ensure your healthcare needs are met.

By understanding and avoiding common pitfalls, you can make informed decisions and enjoy your retirement with peace of mind.

Top 5 Mistakes:

- Missing your Initial Enrollment Period (IEP).

- Assuming Medicare covers all healthcare costs.

- Not enrolling in Medicare Part D on time.

- Not taking advantage of Special Enrollment Periods (SEPs).

- Missed opportunities for better coverage or savings.

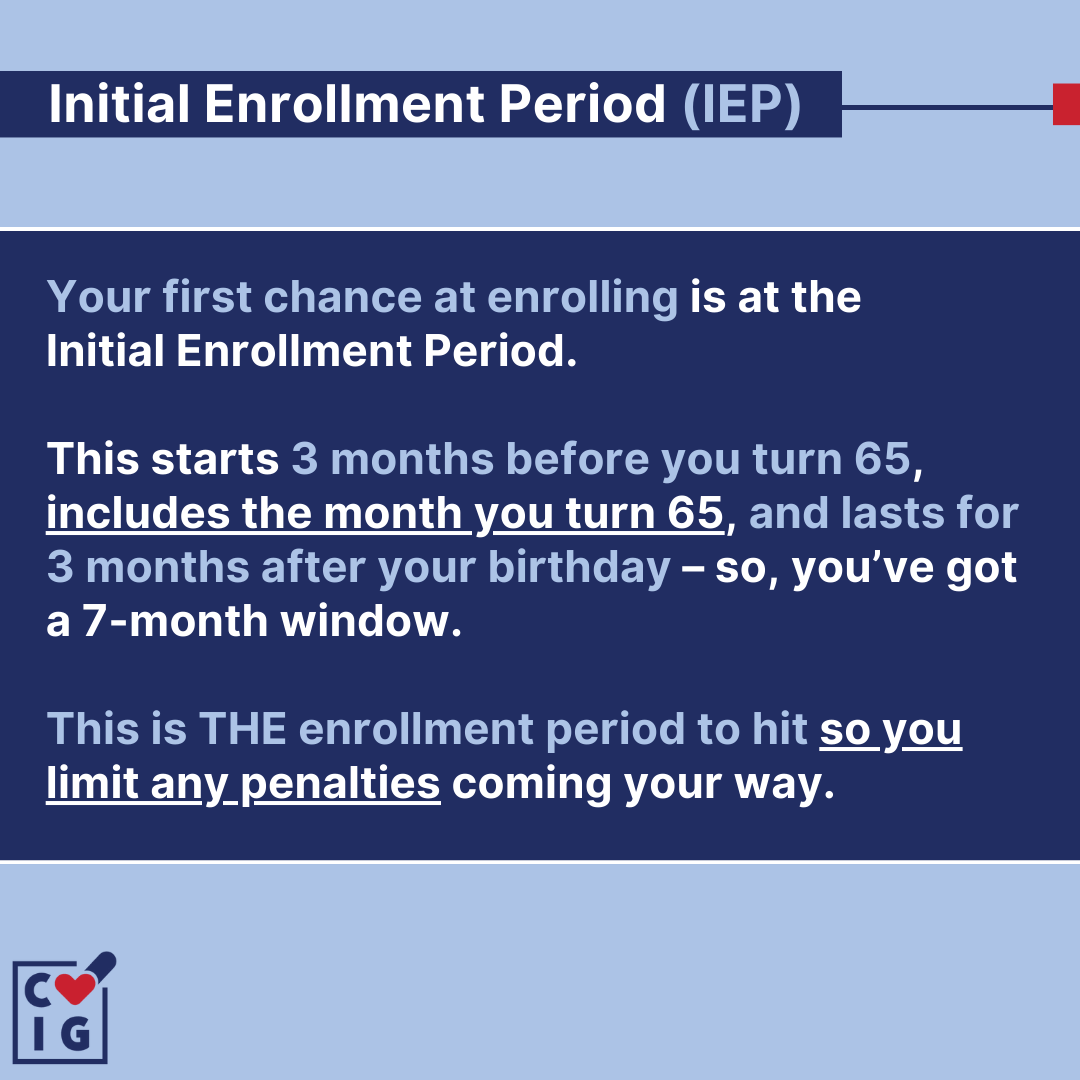

Mistake #1: Missing the Initial Enrollment Period (IEP)

Your Initial Enrollment Period (IEP) is a crucial 7-month window. It starts three months before the month you turn 65, includes your birthday month, and ends three months after.

If you miss this period, you may face late enrollment penalties and delayed coverage.

How to Avoid It

Start researching Medicare options at least six months before your 65th birthday.

Enroll in Medicare Part A and Part B through the Social Security Administration during your IEP.

Mark your calendar to avoid missing these important dates. Philadelphia residents can use local resources and counseling services to guide them through this process.

Why This Matters

Medicare is essential for covering your healthcare needs as you age. Missing your IEP can result in gaps in coverage and higher costs.

By enrolling on time, you ensure seamless coverage and avoid unnecessary penalties.

Mistake #2: Underestimating the Costs of Medicare

Many people assume Medicare covers all healthcare expenses, but that’s not true.

Original Medicare (Part A and Part B) covers many services but leaves out key areas like prescription drugs, dental, vision, and hearing aids.

These omissions can lead to high out-of-pocket costs.

How to Avoid It

Plan for additional costs by considering Medicare Supplement Insurance (Medigap) or a Medicare Advantage Plan (Part C).

These plans offer broader coverage and can help fill the gaps left by Original Medicare.

Philadelphia residents should compare plans available in their area to find the best fit for their health needs and financial situation.

Why This Matters

Without proper planning, you could face significant healthcare expenses.

By understanding what Medicare does and does not cover, you can choose a plan that protects you from unexpected costs.

Mistake #3: Ignoring Medicare Part D

Medicare Part D provides prescription drug coverage, which is not included in Original Medicare.

Ignoring Part D can result in higher out-of-pocket costs for medications and late enrollment penalties.

How to Avoid It

Even if you don’t take many medications now, enroll in a Medicare Part D plan when you first become eligible.

Review the drug formularies of different Part D plans available in Philadelphia to ensure your medications are covered.

Why This Matters

Prescription drugs can be a significant expense, especially as you age.

By enrolling in Part D, you protect yourself from high medication costs and avoid penalties.

Mistake #4: Overlooking Special Enrollment Periods (SEPs)

Special Enrollment Periods (SEPs) allow you to enroll in Medicare without penalties if you have other health coverage when you turn 65.

Not utilizing SEPs can lead to gaps in coverage and higher costs.

How to Avoid It

If you or your spouse are still working and have health coverage through an employer, you may qualify for an SEP.

This allows you to enroll in Medicare without penalties once that coverage ends.

Philadelphia workers should confirm their eligibility for SEPs and keep track of their employment health coverage status.

Why This Matters

SEPs provide flexibility and can save you from penalties and coverage gaps.

By knowing your SEP eligibility, you can transition smoothly to Medicare when your current coverage ends.

Mistake #5: Not Reviewing Medicare Plans Annually

Your healthcare needs and Medicare plans can change yearly.

Not reviewing your plan during the Annual Enrollment Period (AEP) can mean missed opportunities for improved coverage or cost savings.

How to Avoid It

From October 15 to December 7 each year, review and make changes to your Medicare plans.

Philadelphia residents should compare their current plans with new options, check for changes in coverage or costs, and switch plans if a better option is available.

Utilize local resources and Medicare counseling services to assist with this review.

Why This Matters

Regularly reviewing your plan ensures it continues to meet your needs and can save you money.

By staying informed about your options, you can make the best choices for your healthcare.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Missing the Initial Enrollment Period (IEP)

Your Initial Enrollment Period (IEP) is the first opportunity to enroll in Medicare for Philadelphia residents.

Missing this window can have significant consequences.

The IEP Timeline:

- Starts: Three months before your 65th birthday month

- Includes: Your birthday month

- Ends: Three months after your birthday month

Enrolling during your IEP ensures your coverage starts on time and helps you avoid late enrollment penalties.

These penalties can increase your Part B premiums by 10% for each 12-month period you were eligible but did not enroll.

Steps to Avoid Missing the IEP:

- Set Reminders: Use calendars, alarms, or reminder apps to keep track of your IEP.

- Gather Information Early: Start researching Medicare plans six months before you turn 65.

- Use Local Resources: Philadelphia offers resources and services to help you navigate the enrollment process, like us at CVIG!

- Enroll Online: You can enroll in Medicare Part A and Part B through the Social Security Administration’s website.

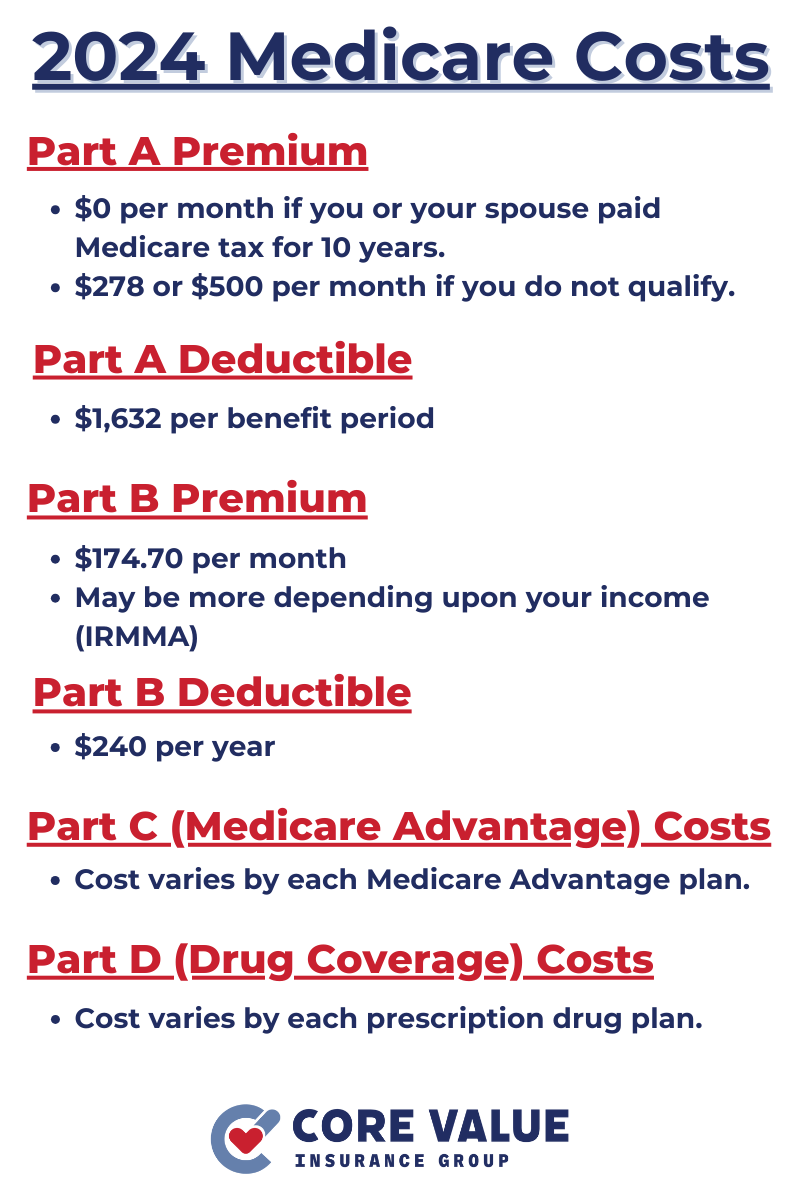

Underestimating the Costs of Medicare

Medicare does not cover all healthcare costs, and it’s essential to understand what is and isn’t covered.

What’s Covered by Original Medicare:

- Part A: Inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Part B: Certain doctors’ services, outpatient care, medical supplies, and preventive services.

What’s Not Covered:

- Prescription drugs (covered by Part D)

- Dental, vision, and hearing services

- Long-term care

- Cosmetic surgery

- Most chiropractic services

How to Plan for Additional Costs:

- Consider Medigap: Medigap policies help pay some of the healthcare costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles.

- Look at Medicare Advantage Plans: These plans, offered by private companies, often include additional benefits like dental, vision, and hearing coverage.

- Budget for Out-of-Pocket Costs: Estimate your annual healthcare expenses and create a budget to cover these costs.

Ignoring Medicare Part D

Prescription drug coverage is an essential part of your healthcare plan in Philadelphia. Ignoring Part D can lead to high medication costs and penalties.

Medicare Part D helps cover the cost of prescription drugs.

Not having this coverage can result in significant out-of-pocket expenses.

Penalties for Late Enrollment

If you don’t enroll in a Medicare Part D plan when you’re first eligible, you may have to pay a late enrollment penalty.

This penalty is added to your monthly Part D premium and continues for as long as you have Medicare drug coverage.

How to Choose a Part D Plan:

- Review Drug Formularies: Check the list of covered drugs for each Part D plan available in Philadelphia.

- Compare Costs: Look at the monthly premiums, deductibles, and copayments for each plan.

- Check Pharmacy Networks: Ensure your preferred pharmacy is in the plan’s network.

- Consider Your Medications: Choose a plan that covers your current medications and has a broad formulary for future needs.

Overlooking Special Enrollment Periods (SEPs)

Special Enrollment Periods (SEPs) allow you to enroll in Medicare without penalties if you have other health coverage when you turn 65.

You qualify for a SEP if you or your spouse are still working and covered by a group health plan through an employer.

SEPs also apply if you lose this coverage.

Benefits of SEPs

SEPs provide flexibility in enrolling in Medicare without facing late penalties.

This is especially important if you delay enrolling in Part B because you have other coverage.

- Track Your Coverage: Keep detailed records of your health coverage and employment status.

- Know the SEP Rules: Understand the conditions under which you can use a SEP.

- Act Quickly: Once your employment coverage ends, enroll in Medicare during the SEP to avoid penalties.

Not Reviewing Medicare Plans Annually

Your healthcare needs and Medicare plans can change each year.

Failing to review your plan annually can mean missed opportunities for better coverage or cost savings.

Annual Enrollment Period (AEP): From October 15 to December 7 each year, you can review and make changes to your Medicare plans.

Why Annual Review is Important

Plans can change their coverage, costs, and provider networks. Your health needs may also change, requiring different coverage.

Steps for Annual Review:

- Compare Plans: Use the Medicare Plan Finder tool to compare available plans in Philadelphia.

- Check for Changes: Look for any changes in your current plan’s coverage or costs.

- Consider Your Health Needs: Assess your health needs and whether your current plan meets them.

- Seek Help: Use local resources and counseling services to get assistance in reviewing and choosing plans.

Conclusion

Avoiding these common Medicare mistakes will help ensure your healthcare needs are met as you retire in Philadelphia.

By understanding your Initial Enrollment Period, planning for additional costs, enrolling in Part D, leveraging Special Enrollment Periods, and reviewing your plans annually, you can make informed decisions.

Take action early, seek local guidance, and empower yourself with the knowledge to make the most of your Medicare coverage in Philadelphia.

By avoiding these mistakes, you can enjoy a smoother transition into retirement with the peace of mind that your healthcare needs are covered.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!