A “Peak Boomer” is anyone born between 1959 and 1964, which is the last significant wave of the baby boomer generation.

As Peak Boomers approach the traditional retirement age, they face unique challenges amidst changing economic and healthcare landscapes.

Notably, many in this group are not as financially prepared for retirement as earlier boomers.

According to “The Peak Boomer Impact Study,” a significant number of Peak Boomers will have less than $250,000 in retirement savings.

Let’s discuss the distinctive challenges faced by Peak Boomers, offering a detailed checklist to help those nearing retirement make well-informed decisions about Medicare.

The Challenge Peak Boomers Face

The demographic shift represented by Peak Boomers reaching retirement age is significant.

Their large numbers and the trend of insufficient financial planning are poised to impact the overall economy.

Industries like manufacturing and healthcare may experience workforce shortages as these workers retire, while shifts in consumer spending could affect various other sectors.

Furthermore, the reliance on Social Security by many in this cohort highlights the importance of comprehensive healthcare planning, as medical expenses are a considerable part of retirement spending.

The Basics of Medicare

Before delving into detailed preparation steps, it’s essential to understand what Medicare is and what it covers.

Medicare is a federal health insurance program primarily for people aged 65 and older, though it also covers certain younger people with disabilities and specific diseases.

Medicare is divided into four parts:

- Part A (Hospital Insurance): Covers inpatient hospital stays, care in skilled nursing facilities, hospice care, and some home health care.

- Part B (Medical Insurance): Covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Part C (Medicare Advantage Plans): Offers all Part A and Part B coverage and often includes Medicare prescription drug coverage (Part D) as part of the plan, managed by Medicare-approved private companies.

- Part D (Prescription Drug Coverage): Adds prescription drug coverage to Original Medicare.

Understanding these components is crucial for selecting the right plan that matches your health needs and financial situation.

The Importance of Early Medicare Planning

Given the financial and healthcare realities facing Peak Boomers, early Medicare planning cannot be overstated.

Proactive engagement with Medicare not only helps manage future health expenses but also secures the necessary coverage without the stress of last-minute decision-making.

Early planning allows Peak Boomers to:

- Avoid Late Enrollment Penalties: Delaying enrollment can lead to lifetime penalties, particularly for Part B and Part D, increasing out-of-pocket costs.

- Optimize Coverage Options: Understanding different Medicare parts and plans early provides an opportunity to compare and choose the best options based on personal health needs and financial situations.

This strategic approach to Medicare can significantly mitigate the financial uncertainties that come with retirement, ensuring that healthcare needs are met without compromising other retirement savings.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

5 Steps to Prepare for Medicare

Step 1: Assess Your Health Needs

Begin by evaluating your current and anticipated healthcare needs.

Consider chronic conditions, regular medications, and potential surgeries.

This assessment will guide you in choosing between Original Medicare and Medicare Advantage, as well as whether you’ll need supplementary coverage.

Step 2: Understand Your Current Insurance Coverage

Align your current health coverage, whether through an employer or private insurance, with Medicare.

This understanding will help you determine the optimal time to transition to Medicare without experiencing a lapse in coverage.

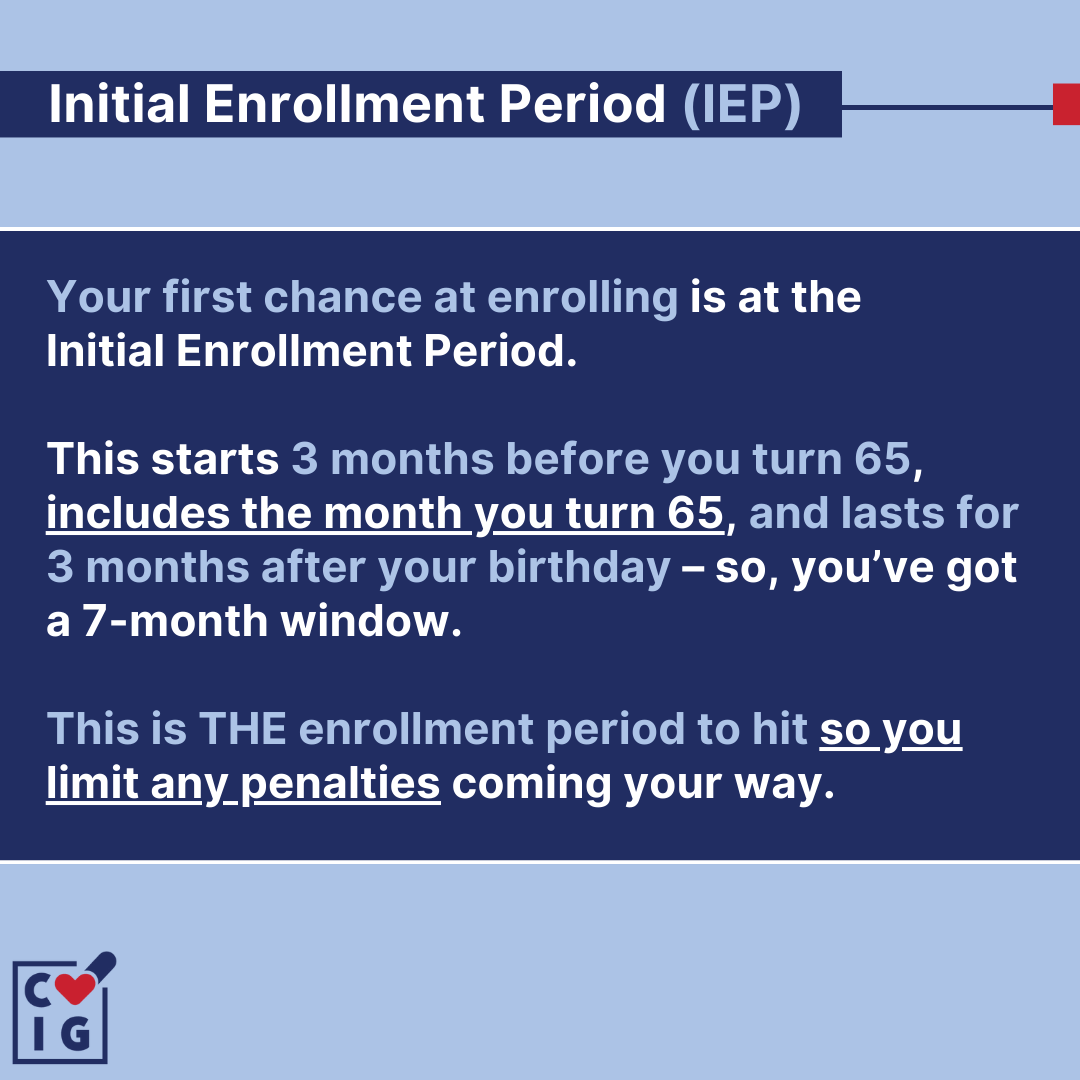

Step 3: Know the Enrollment Periods

Mark your calendar for your Initial Enrollment Period (IEP), which is the seven-month period surrounding your 65th birthday (three months before to three months after).

Missing this window can result in delayed coverage and penalties.

Step 4: Consider Your Financial Situation

Create a detailed budget that accounts for Medicare premiums, deductibles, and other out-of-pocket expenses.

Consider your retirement savings and how they align with these expected costs, especially given the financial challenges common among Peak Boomers.

Step 5: Seek Professional Advice

Navigating Medicare can be simplified by consulting with professionals, like ourselves at CVIG!

Utilize resources such as the State Health Insurance Assistance Programs (SHIP) for personalized advice and guidance through the enrollment process.

Remember This!

As a Peak Boomer, your approach to retirement, particularly healthcare, needs careful planning and proactive steps.

By following the checklist provided, you can embrace this pivotal phase of life confidently.

Remember, effective Medicare planning is not just about securing healthcare coverage but also about ensuring a financially stable and fulfilling retirement.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!