Conclusion: Medicare Advantage plans can be cheaper in terms of monthly premiums, with some plans offering $0 premiums. However, costs like deductibles, copayments, and coinsurance vary by plan, so overall expenses depend on healthcare usage and plan details.

Choosing between Medicare Advantage (Part C) and Original Medicare (Parts A and B) is a significant decision facing many Americans as they become eligible for Medicare.

One of the critical factors in this decision is cost.

Understanding how the costs of Medicare Advantage plans compare with those of Original Medicare is essential for making an informed choice that aligns with your healthcare needs and financial situation.

This blog aims to demystify the costs associated with each option, helping you navigate your Medicare choices confidently.

The Costs of Original Medicare

Original Medicare comprises Part A, which covers hospital insurance, and Part B, which covers medical insurance.

While Part A is premium-free for most beneficiaries (based on work history), Part B comes with a monthly premium that most people pay.

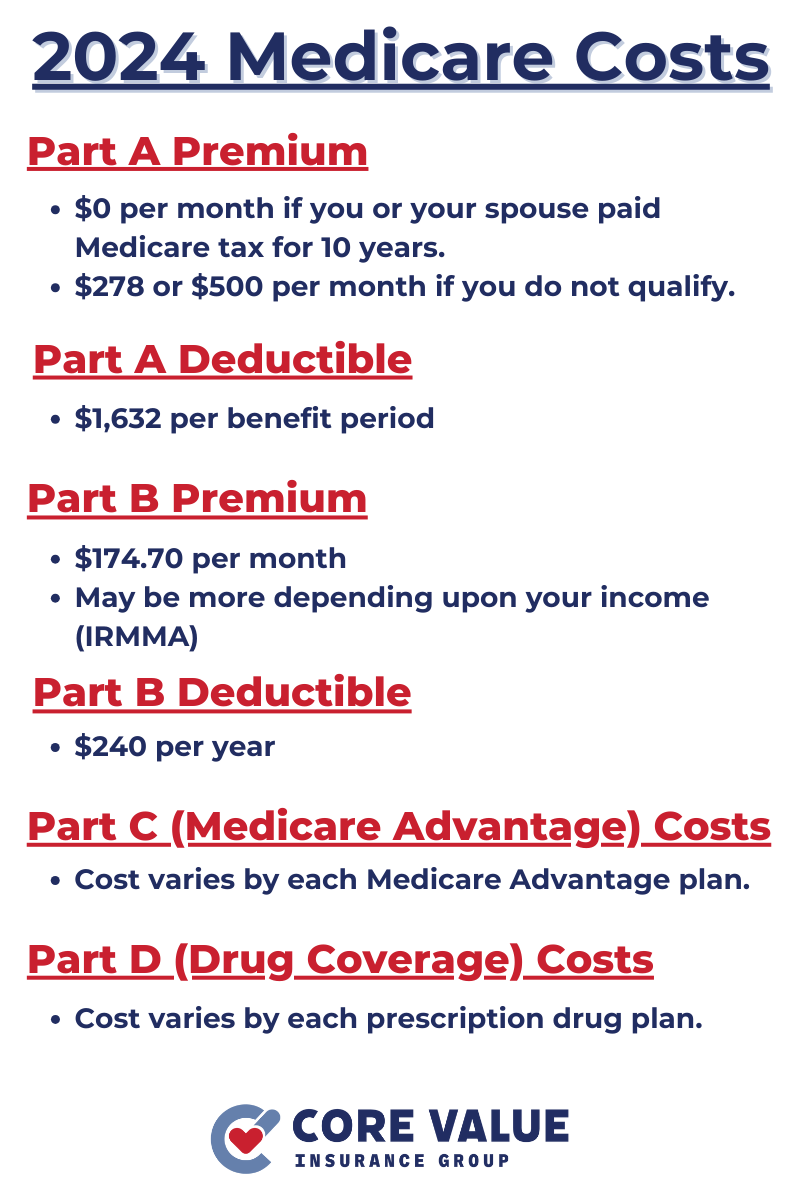

In addition to premiums, there are deductibles and copayments to consider:

- Part A costs might include a deductible for hospital stays and coinsurance for extended stays.

- Part B charges a standard monthly premium, with a deductible and typically 20% coinsurance on Medicare-approved services after meeting the deductible.

These out-of-pocket costs can add up, especially if you require frequent medical care or high-cost services, and there is no out-of-pocket maximum with Original Medicare.

The Costs of Medicare Advantage

Medicare Advantage plans, offered by private insurance companies, bundle Part A and B benefits and often include Part D (prescription drug) coverage.

The costs of Medicare Advantage plans can vary widely:

- Premiums: Some plans offer $0 monthly premiums, though you still need to pay your Part B premium.

- Deductibles and Copayments: These vary by plan. Some may have lower deductibles and copayments than Original Medicare.

- Out-of-Pocket Maximum: A key feature of Medicare Advantage is the annual out-of-pocket cost limit, protecting you from excessive expenses.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

The variation in plans means some may offer significant savings compared to Original Medicare, especially if you choose a plan that aligns closely with your healthcare needs.

Additional Benefits and Their Impact on Costs

Medicare Advantage plans often include benefits not covered by Original Medicare, such as dental, vision, and hearing care, and wellness programs.

These additional benefits can provide substantial value and potentially reduce your overall healthcare costs.

For example, preventive dental care can avoid more costly dental work later on, and fitness benefits can help maintain your overall health, potentially reducing the need for more extensive medical intervention.

Comparing Costs – Scenarios

To illustrate how Medicare Advantage and Original Medicare costs can vary, consider these hypothetical scenarios:

Healthy Individual

Rarely visits the doctor and takes no regular medications. Under Original Medicare, they pay premiums and a minimal amount in copayments.

A $0 premium Medicare Advantage plan with lower copayments and an out-of-pocket maximum could offer savings.

Moderate Healthcare Needs

Visits doctors regularly and takes several medications.

The Medicare Advantage plan may offer savings through bundled services and included Part D coverage.

High Healthcare Needs

Requires frequent specialist care and hospitalization.

Original Medicare with a Medigap policy might offer more predictable costs despite higher premiums, but a Medicare Advantage plan’s out-of-pocket maximum provides a safeguard against excessive expenses.

Making the Right Choice for Your Healthcare and Budget

Choosing between Medicare Advantage and Original Medicare involves considering your current and future healthcare needs, financial situation, and the potential for unexpected expenses.

Evaluate each plan’s costs, benefits, and coverage limitations carefully.

Remember, you have the opportunity to switch during the Open Enrollment Period if your needs change.

Conclusion

The decision between Medicare Advantage and Original Medicare is highly personal and depends on your healthcare needs, financial situation, and preference for risk.

While Medicare Advantage plans can offer cost savings and additional benefits for some, Original Medicare may be the better choice for others, especially when paired with a Medigap policy.

By carefully assessing your situation and the available options, you can make an informed decision that ensures your health and financial well-being in retirement.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!