Conclusion: The four main types are Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Private Fee-for-Service (PFFS) plans, and Special Needs Plans (SNPs).

When it comes to Medicare coverage, one size certainly does not fit all.

This is where Medicare Advantage (Part C) plans come in, offering a variety of options that cater to different healthcare needs and preferences.

Medicare Advantage plans provide an alternative to Original Medicare, often including additional benefits.

Understanding the four primary types of Medicare Advantage plans is essential for anyone looking to make an informed decision about their healthcare coverage.

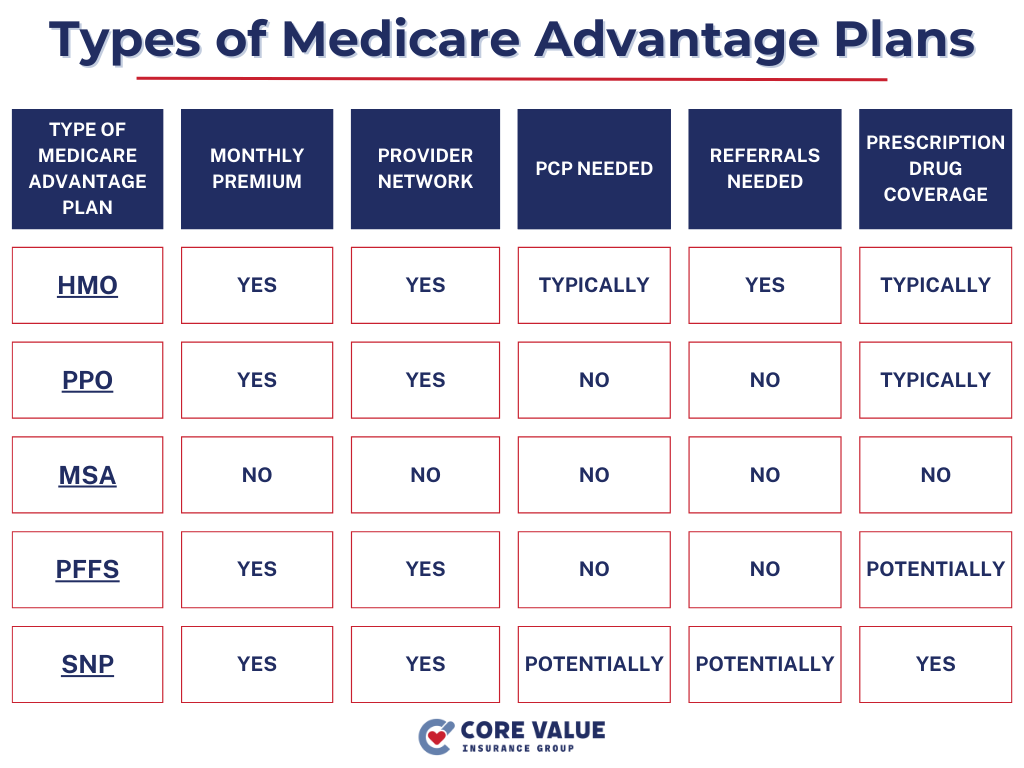

Let’s break down the 4 types of Medicare Advantage plans:

- Health Maintenance Organization (HMO) plans

- Preferred Provider Organization (PPO) plans

- Private Fee-for-Service (PFFS) plans

- Special Needs Plans (SNPs)

Health Maintenance Organization (HMO) Plans

HMO plans are known for their structured approach to healthcare.

They require members to use doctors, hospitals, and other healthcare providers within the plan’s network for their care.

These plans are designed to promote coordinated care and emphasize preventive services.

One key characteristic is the necessity for members to choose a primary care physician (PCP) who becomes their main point of contact for healthcare needs.

This PCP is responsible for referrals to specialists within the network, making the HMO plan a more managed healthcare experience.

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Primary Care Physician and Referrals

The requirement for a PCP and referrals within HMO plans ensures that care is appropriately managed and coordinated.

However, it also means less flexibility compared to other plan types.

Going outside the network without prior authorization (except in emergencies) typically results in higher out-of-pocket costs or no coverage at all.

Preferred Provider Organization (PPO) Plans

PPO plans offer more flexibility when it comes to choosing healthcare providers.

Members of a PPO plan can see any doctor or specialist without a referral, even those outside of the plan’s network, though at a higher cost.

This flexibility is attractive to those who prefer not to be limited by network restrictions and are willing to pay a bit more for that freedom.

Private Fee-for-Service (PFFS) Plans

PFFS plans provide the greatest level of flexibility, allowing members to see any Medicare-approved doctor or healthcare provider who accepts the plan’s payment terms.

There’s no need for a network, giving members the freedom to choose providers for each healthcare service they need.

Plan Determines How Much It Pays Providers

Under PFFS plans, the plan itself decides how much it will pay healthcare providers and how much members need to pay when they get care.

This can vary by service, and not all providers may accept the plan’s terms, so it’s important to confirm provider acceptance in advance.

Special Needs Plans (SNPs)

SNPs are designed to meet the needs of specific groups of people, including those:

- with certain chronic conditions

- living in institutional settings

- eligible for both Medicare and Medicaid

These plans offer tailored benefits, provider choices, and drug formularies to best serve their members’ needs.

Choosing the Right Medicare Advantage Plan

Selecting the right Medicare Advantage plan is a deeply personal decision that should take into account your healthcare needs, preferences, and financial situation.

Consider what aspects of healthcare coverage are most important to you.

Whether it’s the flexibility to choose providers, the cost of premiums and out-of-pocket expenses, or the availability of additional benefits and services.

Conclusion

The variety of Medicare Advantage plans available means that there’s likely a plan out there that fits your unique healthcare needs and lifestyle.

With this knowledge, you’re well-equipped to make a choice that supports your health and well-being, ensuring you get the most out of your Medicare coverage.

Medicare Parts

Speak with a licensed insurance agent!

Enter your Zip Code to View Medicare Plans in your Area

Speak with a licensed insurance agent!