As we transition into 2025, Medicare costs and benefits have seen important changes that every beneficiary should be aware of.

For those in Philadelphia, Bucks County, and nearby areas, understanding these updates is essential to making informed Medicare choices that support health and financial goals.

Let’s break down each part of Medicare, what it covers, associated costs for 2025, and the differences compared to 2024.

For personal, one on one guidance to explore Medicare plans in your area, don’t hesitate to book a consultation with one of our local agents!

Medicare Part A (Hospital Insurance)

Medicare Part A provides coverage for inpatient hospital care, skilled nursing facility care, hospice care, and limited home healthcare.

Part A is often referred to as “hospital insurance” because it primarily covers inpatient services, which are essential for managing serious health issues that require a hospital stay or specialized care.

Key Benefits of Part A

- Hospital Coverage: Part A covers a semi-private room, meals, and general nursing care during hospital stays. This is beneficial for anyone facing significant health issues.

- Skilled Nursing Facility: After a qualifying hospital stay, Part A helps cover short-term care in a skilled nursing facility, which is essential for recovery.

- Hospice and Home Healthcare: For those in end-of-life care or who require short-term home healthcare, Part A provides valuable coverage.

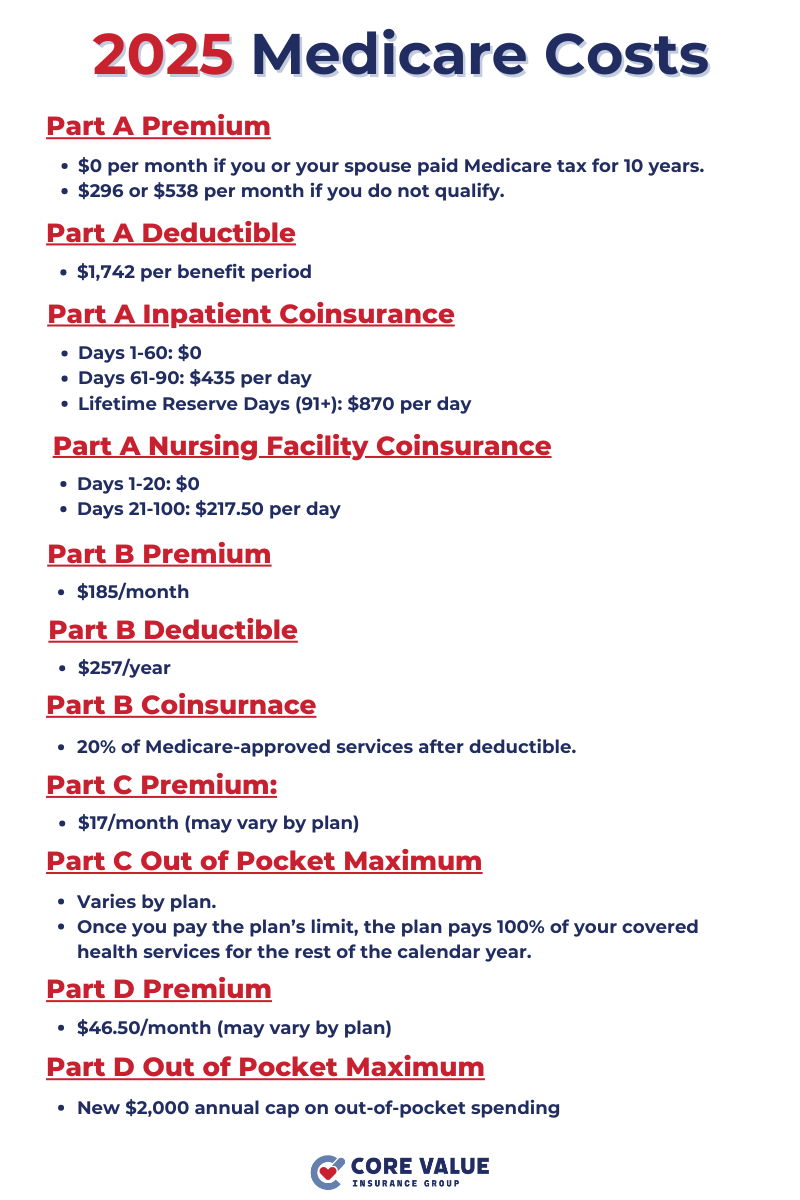

2025 Medicare Part A Costs

Monthly Premiums: Most people pay $0 if they’ve worked 10+ years (40 quarters).

- 2025: $296/month for individuals with 30-39 quarters, and $538/month for those with fewer than 30 quarters.

- 2024 Comparison: $278/month and $505/month, respectively, showing a modest increase in 2025.

Inpatient Hospital Deductible:

- 2025: $1,742 per benefit period (up from $1,632 in 2024).

Coinsurance for Inpatient Hospital Stay:

- Days 1-60: $0 (no change)

- Days 61-90: $435 per day in 2025 (up from $408 in 2024)

- Lifetime Reserve Days (91+): $870 per day in 2025 (up from $816 in 2024)

Skilled Nursing Facility Coinsurance:

- Days 1-20: $0

- Days 21-100: $217.50 per day (an increase from $204 in 2024)

Why It’s Important

Medicare Part A provides crucial coverage for high-cost services like hospital stays and skilled nursing care.

For those with serious health conditions or who need rehabilitative care, Part A ensures that unexpected medical events don’t lead to overwhelming expenses.

Understanding the details of Part A can help you anticipate any out-of-pocket costs for hospital or skilled nursing care.

Medicare Part B (Medical Insurance)

Medicare Part B covers outpatient and preventive services, such as doctor visits, diagnostic tests, and some preventive services (like vaccinations and screenings).

This makes Medicare Part B essential for managing regular healthcare needs and maintaining overall health.

Key Benefits of Medicare Part B:

- Doctor Visits and Outpatient Care: Part B covers visits to primary care providers and specialists, so you don’t have to worry about high out-of-pocket costs for routine care.

- Preventive Services: From cancer screenings to vaccines, Part B helps cover preventive services that detect and address health issues early on.

- Durable Medical Equipment (DME): Part B also covers necessary medical equipment like walkers and oxygen tanks.

2025 Medicare Part B Costs:

- Monthly Premium:

- 2025: $185 (increased from $174.70 in 2024).

- Annual Deductible:

- 2025: $257 (up from $240 in 2024).

- Coinsurance:

- After meeting the deductible, Part B generally covers 80% of approved services, leaving the beneficiary responsible for 20%.

Having Part B coverage ensures you can access outpatient care, preventive services, and durable medical equipment without overwhelming out-of-pocket costs.

It’s especially valuable for those with chronic conditions or regular healthcare needs.

Medicare Part D (Prescription Drug Coverage)

Medicare Part D offers coverage for prescription medications, making it vital for individuals who rely on daily medications for chronic conditions.

Different Part D plans are available, each with its own formulary (list of covered drugs) and cost-sharing structure.

Key Benefits of Medicare Part D:

- Affordable Access to Prescription Drugs: With Part D, you have access to necessary medications at predictable costs.

- Coverage for a Wide Range of Medications: Each plan has a formulary that includes common prescriptions for various conditions.

- Protection from High Drug Costs: Part D provides a safety net for costly medications, particularly with the new 2025 out-of-pocket cap.

2025 Medicare Part D Costs:

- Average Monthly Premium:

- 2025: $46.50 (down from $53.95 in 2024).

- Out-of-Pocket Maximum:

- 2025: New $2,000 cap on annual out-of-pocket costs for prescriptions (no such cap existed in 2024).

Part D ensures you won’t face prohibitive costs for prescription medications, particularly for high-cost drugs.

The new $2,000 cap in 2025 provides even greater financial protection.

Take Action

Prescription drug costs can vary widely, so it’s essential to choose a Part D plan that covers your medications affordably.

Schedule a call with us to explore Part D plans that best meet your needs.

Medicare Advantage (Part C)

Medicare Advantage plans (also called Medicare Part C) combine Part A and Part B, often with additional benefits like prescription drug coverage, dental, vision, and fitness programs.

Many choose Medicare Advantage for its all-in-one convenience and extra benefits.

Key Benefits of Medicare Advantage:

- Comprehensive Coverage: Medicare Advantage includes Parts A and B, often bundled with Part D and other perks.

- Additional Services: Some plans cover extra services not offered by Original Medicare, like dental, vision, and hearing.

- Predictable Costs: With maximum out-of-pocket limits, Advantage plans provide predictable expenses.

2025 Medicare Advantage Costs:

- Average Monthly Premium:

- 2025: $17 (slightly down from $18.23 in 2024).

- Out-of-Pocket Maximum:

- 2024: Capped at $8,850 for in-network services.

- 2025: Varies by plan. Once you pay the plan’s limit, the plan pays 100% of your covered health services for the rest of the calendar year.

Medicare Advantage plans are ideal for those seeking all-in-one coverage with predictable costs.

They offer flexibility for people who want extra services not included in Original Medicare.

Local Medicare Advantage Plans

Medicare Advantage plans vary widely, so choosing one that fits your needs is essential.

Schedule a consultation today to find the right Medicare Advantage plan in Philadelphia, Bucks County or surrounding counties state-wide!

Medicare Supplement (Medigap) Plans

Medigap (Medicare Supplement) plans help cover out-of-pocket costs left by Original Medicare, like copayments, coinsurance, and deductibles.

With several Medigap plans available, beneficiaries can choose the level of coverage that fits their needs.

Key Benefits of Medigap:

- Reduced Out-of-Pocket Costs: Medigap helps cover costs like copays and deductibles, making healthcare expenses more predictable.

- Flexibility with Providers: Medigap works with any provider that accepts Medicare, allowing beneficiaries to access care nationwide.

- Different Plan Options: With options from Plan A to Plan N, Medigap allows for flexibility in coverage and premium levels.

2025 Medigap Costs:

- Premiums: Premiums vary widely based on the plan type, insurer, and location.

Medigap is ideal for those who want to minimize out-of-pocket expenses and have predictable healthcare costs.

It’s a good option for people who travel or see multiple healthcare providers.

Find a Medicare Supplement Plan

If you’re considering Medigap, schedule an appointment to explore plans and find a plan that provides the best value for your healthcare needs.

Why Review Your Medicare Options?

Medicare beneficiaries in Philadelphia, Bucks County, and nearby areas face unique healthcare needs, and annual Medicare updates significantly impact coverage choices.

Reviewing your Medicare coverage regularly helps you stay informed and prepared for any changes.

With adjustments like those for 2025, it’s critical to ensure you have a plan that meets your health needs and budget.

Schedule Your Medicare Consultation Today

Our local Medicare agents at Core Value Insurance Group are here to help you understand and adapt to these changes.

Book an appointment to review your Medicare options, compare plans, and find the best fit for you.

Don’t wait – schedule a consultation today!

Medicare Parts

Speak with a licensed insurance agent!